Buy Emata Rice in Bulk From the Best Global Suppliers

What is EMATA Rice?

EMATA rice variety isn't a rice variety in the usual sense. It's a trade name, mainly used in West African markets, for imported Parboiled, long-grain, non-basmati rice.

In trade, EMATA stands for rice that moves in bulk and volume. It's not bought for branding or origin stories. It's bought because it cooks consistently, handles storage well, and fits into large food distribution systems.

That's why EMATA rice keeps moving. It works at scale, stays affordable, and does exactly what buyers in mass-consumption markets need it to do.

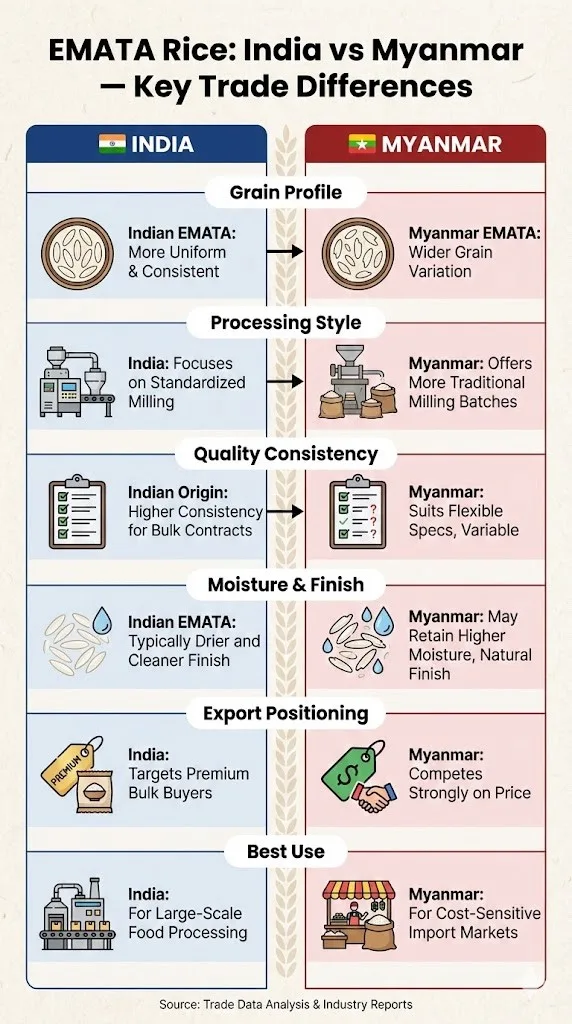

How is Indian EMATA Rice Different from Myanmar EMATA Rice?

- Supply scale is the first separator.

Indian EMATA rice is available in much larger volumes. India's parboiling capacity and export infrastructure allow suppliers to handle big, repeat shipments more easily.

- Consistency across shipments.

Indian EMATA is generally preferred when buyers want the same broken %, parboiling depth, and grain behaviour across multiple lots. Myanmar EMATA can vary more from shipment to shipment.

- Price positioning differs.

Myanmar EMATA often comes in at a lower price point, especially in spot trades. Indian EMATA tends to trade slightly higher, backed by consistency and reliability.

- Parboiling and handling.

Indian EMATA usually shows more uniform parboiling and better grain strength, which helps during long storage and transit. Myanmar EMATA may be softer, depending on processing.

- Buyer preference depends on use

Buyers focused purely on cost often look at Myanmar. Buyers running large programs or long contracts usually lean toward Indian EMATA.

Emata Rice Specifications

| Moisture |

14% Max |

| Broken |

25% Max |

| Size Of Broken |

0.75 mm |

| Paddy |

4 Grains Max |

| Damage |

2% Max |

| Foreign Matter |

1% Max |

| Red And Red Streaked Kernel |

3% Max |

| Chalky Kernel |

8% Max |

| Milling Standard |

Reasonably Well Milled |

Types, Grades & Variants - Emata Rice

Emata rice variety is a commercial trade designation, not a botanical variety. It is widely used in West African import markets to describe parboiled, long-grain, non-basmati rice positioned for everyday consumption. Trade specifications are driven primarily by broken percentage, grain profile, and parboiling intensity, rather than origin branding.

By Broken Percentage

- 5% broken - premium quality, preferred for branded retail and government-linked supply.

- 10% broken - most commonly traded grade for mass consumption

- 15-25% broken - widely used in open markets and redistribution

- 25-50% broken - price-driven segment for processing and institutional use

By Grain Type

- Emata Long Grain Rice (dominant format in Emata trade and a type of long grain rice in non-basmati category)

- Medium Grain (select markets)

- Short grain (limited demand, niche usage)

By Parboiling Intensity

- Light parboiled - softer texture, quicker cooking

- Medium parboiled - balance of firmness and yield (most common)

- Heavy / double parboiled firmer grain, higher post-cooking separation

By Origin

- India

- Thailand

- Myanmar

- Vietnam

- Brazil / Guyana (select markets)

Most Emata rice imports revolve around long-grain parboiled rice which is Emata Long Grain Rice with 10-15% broken, while 5% broken grades are reserved for premium retail programs and institutional tenders.

Applications & End-Use Mapping

Demand for EMATA rice sits firmly inside supply systems rather than consumer branding. It is chosen because it works reliably at scale, not because it carries a label.

- Public food supply programs use EMATA rice for its predictable yield and cooking consistency across large batches

- Institutional kitchens and mass caterers prefer it because it cooks evenly and holds texture during repeated preparation

- Food processors and wholesalers use EMATA rice for redistribution, blending, and repacking into local market formats.

- Bulk traders value its ability to withstand long shipping cycles and extended storage in warm, humid climates.

- Most EMATA rice demand is export-oriented, especially in regions where rice is a daily staple and food security takes priority over presentation.

Supply & Demand Countries - Emata Rice

Emata rice trade is shaped by a clear exporter-importer divide. Supply originates mainly from Asian bulk rice exporters, while demand is concentrated in West and Central African consumption markets, where Emata is positioned as a reliable, everyday staple.

Major Supplying Countries

- India - Largest and most consistent supplier; wide flexibility in broken %, parboiling depth, and price bands

- Thailand - for cleaner milling and stable quality, typically positioned slightly premium

- Vietnam Competitive pricing, strong presence in 10-25% broken segments.

- Myanmar - Emata rice from Myanmar is price-driven supply for bulk and redistribution markets

- Brazil - ENiche supplier with preference in select West African ports

- Guyana - Limited but steady exports to specific African buyers

Suppliers compete primarily on price consistency, shipment reliability, and ability to customize broken percentage, rather than branding

Major Importing / Demand Countries

- Nigeria - Largest Emata market; strong demand across 10-25% broken categories

- Benin - Key transit and redistribution hub for regional trade

- Togo - Import-driven consumption market

- Ghana - Demand for better-milled and mid-range broken grades

- Cameroon - Growing imports for urban consumption

- Senegal - Preference for parboiled rice with consistent cooking quality

- Côte d'Ivoire - Stable importer with mixed grade demand

Demand is consumption-led rather than seasonal, making Emata rice a steady-volume import commodity

Trade Pattern Insight

- Emata rice flows predominantly from Asia → West Africa

- Contracts are finalized on technical specifications (broken %, grain length, parboiling level) rather than origin branding

- 10-15% broken long-grain parboiled rice forms the backbone of most tenders

- Higher broken grades gain traction during price-sensitive periods

Global Market Overview

The global parboiled rice market is already a sizable one. In 2023, it was estimated at roughly USD 16.5 billion, and most projections point to a gradual rise toward USD 23 billion by the early 2030s. This isn't growth driven by hype or speculation — it's the kind that comes from steady, everyday consumption.

To put that in context, total global rice exports were valued at close to USD 39 billion in 2024, which means parboiled rice — and by extension EMATA rice — sits comfortably inside a deep, active global trade system rather than on the fringes.

Key Demand Drivers

- Everyday demand: Emata is daily-use rice in West Africa, which keeps imports regular and predictable

- Easy on pricing: Multiple broken options help buyers manage costs without disrupting supply.

- Reliable supply base: Large exporters in India, Vietnam and Thailand keep volumes flowing year-round.

- Spec-led buying: Deals are closed on specs, not stories—broken %, parboiling and grain length decide the trade.

Production & Supply Dynamics - Emata Rice

- Exporter-led supply base

Emata rice is mainly supplied by parboiled long-grain exporters, led by India, which accounts for 60%+ of global parboiled rice exports, followed by Thailand, Vietnam, and Myanmar. Emata rice from Myanmar is slightly more cost competitive and has higher variations in sizes and polishing.

- Climate & policy sensitivity

Monsoon swings, El Niño conditions, and export policy changes—especially from India—can quickly tighten availability or move prices for Emata-grade parboiled rice.

- High origin concentration risk

Heavy reliance on a single origin exposes buyers to sudden duty revisions, minimum export prices, or shipment controls—making origin diversification a commercial necessity.

- Emerging origins & hedging

Brazil and Guyana cater to niche West African demand, while Southeast Asia acts as a secondary hedge against India-centric risk.

EMATA Rice Price & Bulk Cost Indicators

Indicative bulk export price:

- USD 420-650 per metric tonne (FOB)

Pricing varies by:

- Broken percentage

- Origin

- Packaging type

- Certification requirements

- Freight and shipment conditions

EMATA rice price per metric tonne is purely indicative for reference and remains subject to market movement, crop conditions, and trade policies.

HS Code & Classification - EMATA Rice

EMATA Rice is typically classified under HS Code 1006, covering semi-milled, wholly milled, and parboiled rice.

In bulk export trade, it is most commonly declared under HS 100630 for parboiled rice, subject to destination-specific customs interpretation

Buyer Expectations & Trade Requirements - EMATA Rice

Importers typically prioritize

- Consistent broken percentages

- Moisture compliance within agreed limits

- Independent pre-shipment inspection

- Uniform grain appearance

- Reliable shipment execution across contracts

In EMATA Rice trade, consistency usually matters more than small price savings.

LOGISTICS, PACKAGING & INCOTERMS

Packaging: EMATA rice is usually packed in 25 kg or 50 kg bags, most commonly PP bags suitable for bulk handling

Storage & shelf life: When kept dry and well ventilated, it generally holds quality for 12-24 months, even across long supply cycles.

Incoterms: Trades are commonly done on FOB or CIF terms, with EXW used in select cases depending on buyer preference.

Export documentation: Shipments typically move with a Certificate of Origin, phytosanitary certificate, and inspection report, along with standard shipping documents.

Certifications & Compliance

- At a basic level, EMATA rice shipments move with the usual essentials — a phytosanitary certificate and export-side food safety clearance. Nothing fancy, just what customs expects.

- Some buyers ask for extra comfort. Things like ISO or HACCP come up more often with institutional or repeat orders, especially when volumes get larger.

- Requirements can shift by destination. A document that's fine for one African port may need an extra check somewhere else, so most exporters confirm country-specific rules before locking the shipment.

Future Outlook & Opportunities

- Demand is expected to stay firm rather than spike. West Africa continues to import large volumes of parboiled rice, with regional rice imports running into multiple million tonnes annually, driven mainly by population growth and food security needs.

- India's role remains central. Indian parboiled rice already supplies a significant share of West African consumption, and exporters with stable specs are likely to see repeat demand rather than one-off orders.

- Price sensitivity will keep EMATA relevant. Even small price shifts matter in EMATA trade. When Indian parboiled prices eased by 30-35% year-on-year in recent cycles, buying activity responded quickly.

- Opportunities lie in consistency, not premiumisation. Buyers are more likely to lock longer contracts with suppliers who can deliver the same broken percentage, moisture, and packing across shipments.

- Logistics and timing will matter more. Freight volatility and port congestion are shaping purchase decisions, creating space for exporters who can plan shipments better and align with buyer inventory cycles.

Why Buy EMATA Rice Through Tradologie?

- Sourcing starts with specs, not listings

EMATA trade runs on broken %, parboiling level, packing, and shipment terms. Tradologie lets you start with those details, not generic product pages.

- Direct access to verified Emata rice suppliers

You negotiate straight with exporters who are already active in EMATA trade. No middle layers, no diluted communication.

- Real price discovery

Multiple suppliers quote against the same requirement. That helps buyers see the true market level instead of relying on a single offer.

- Built for volume trade

EMATA moves in large shipments. Tradologie is designed around bulk negotiation, not small-order retail workflows

- Transparency through the process

Offers, negotiations, and revisions stay visible. What's discussed is what gets executed.

- Support without interference

Coordination is available when needed, but decisions stay between buyer and seller. Clean, professional, and practical.

Transparency & Disclaimer

All prices, specifications, and trade data are indicative and subject to change based on season, origin, compliance requirements, and logistics. Buyers and sellers should verify details prior to contracting.