The India–EU Free Trade Agreement has been under discussion for so long that many exporters had stopped following it.

Talks started, stalled, restarted. Committees changed. Priorities shifted. For years, it felt like one of those deals that would always stay “under negotiation.”

Now that it’s finally concluded, the reaction in the agriculture trade isn’t dramatic or celebratory. It’s more practical.

People are simply asking: Which products benefit? And which don’t?

Because that’s what matters in the end.

The Trade Base Was Already There

India and the European Union weren’t starting from zero.

Two-way trade between the two sides already sits above $130 billion annually, making the EU one of India’s largest trading partners. Food and agri products form a smaller slice of that, but still meaningful. Indian seafood, spices, coffee, tea, rice products, and processed foods have been moving steadily into Europe for years. At the same time, Europe exports specialty foods, ingredients, and beverages into India.

So this isn’t about creating a relationship from scratch.

It’s more about removing a few cost barriers that have quietly limited volumes.

Tariffs, in many cases, were the real bottleneck. Not demand.

Where the Door Actually Opens

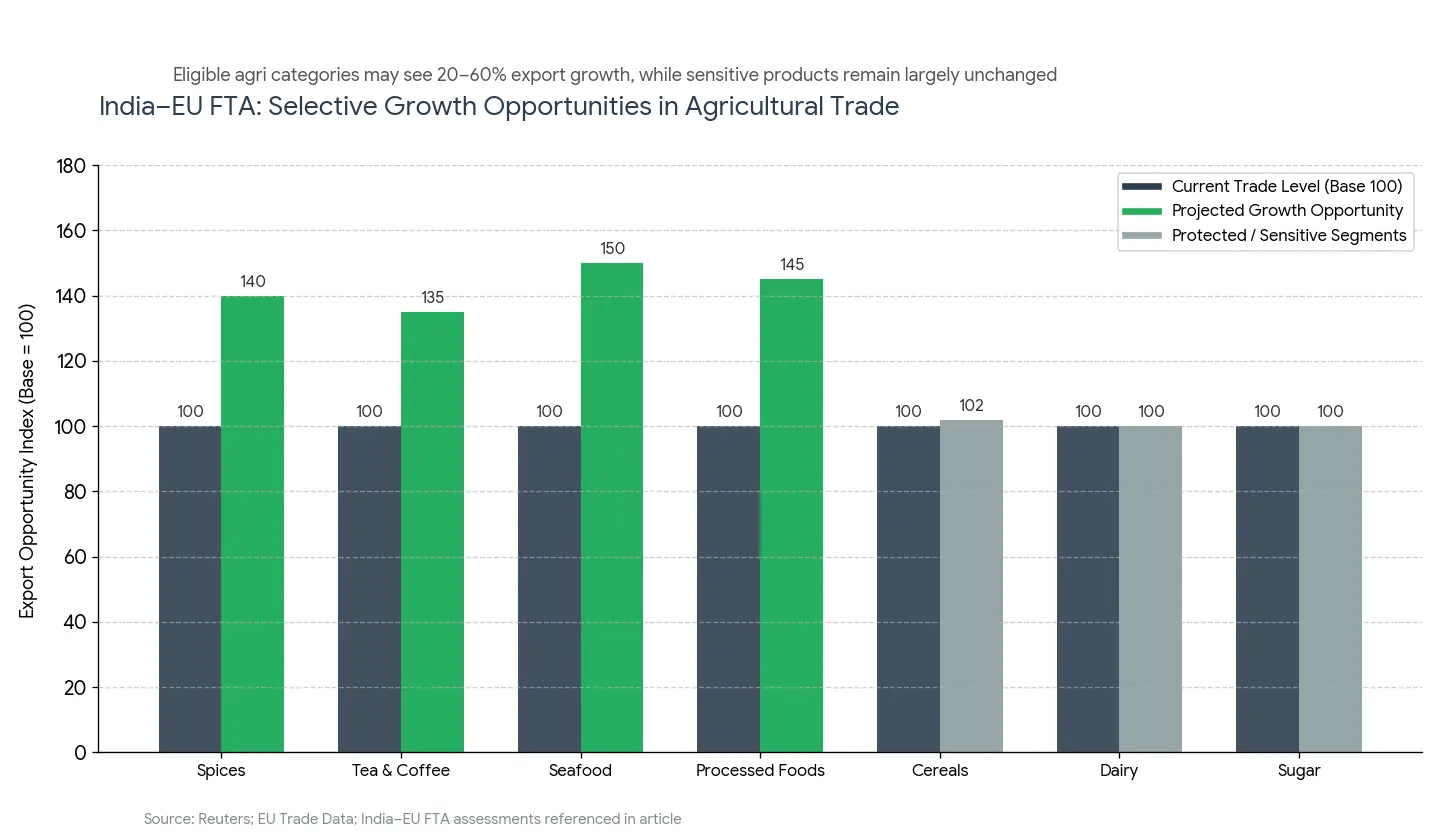

The benefits aren’t spread evenly. And that’s important to understand early.

Non-sensitive categories are where the real upside sits.

Products like:

- spices

- tea and coffee

- seafood

- processed and value-added foods

- certain fruits and horticulture items

These are expected to see lower duties or easier access into the EU market.

For exporters in these segments, pricing suddenly looks more competitive. A few percentage points of tariff reduction can change the math quickly, especially in bulk shipments.

In practical terms, this means Indian suppliers who were previously just “alternative sources” may now start competing more directly with established suppliers inside Europe or Southeast Asia.

Nothing dramatic overnight. But steady growth.

The kind that builds quietly year after year.

Where Nothing Really Changes

At the same time, some big-ticket agricultural categories remain protected.

- Cereals.

- Dairy.

- Sugar.

- Certain fruits and vegetables.

- Beef.

These sit under exclusions, quotas, or tighter safeguards.

And honestly, that’s not surprising.

Both India and the EU protect their farm sectors quite carefully. Food security and rural incomes are political issues everywhere, not just here.

So if someone expects a flood of Indian wheat or dairy into Europe because of this deal, that’s probably wishful thinking.

For these segments, business will look more or less the same as before.

The Opportunity Is Real — But Not Automatic

Trade agreements often sound bigger than they actually are.

They don’t create demand by themselves. They just make it easier to serve existing demand.

For Indian agri exporters, the next phase is less about celebration and more about homework.

European buyers are particular. Standards are strict. Paperwork is detailed. Traceability isn’t optional.

If shipments don’t meet SPS norms or labeling requirements, lower tariffs won’t help much.

In conversations with exporters, the same points keep coming up:

- better testing and certification

- tighter quality control

- proper documentation

- full traceability from farm to port

These aren’t new ideas. But now they matter more because access is opening up.

If exporters get these basics right, growth of 20–60% over the next five to ten years in eligible categories doesn’t sound unrealistic.

If they don’t, the opportunity will simply pass to someone else.

Why This Matters for Agriculture Specifically

For India’s agriculture sector, this deal is less about headline numbers and more about diversification.

Traditionally, many exporters depend heavily on the Middle East, Southeast Asia, or a handful of large buyers. Europe offers something different — a stable, premium market that values quality and consistency.

That tends to mean better margins.

Even moderate volumes into the EU can sometimes earn more than larger volumes elsewhere.

So for spice processors, seafood exporters, coffee growers, or ready-to-eat food manufacturers, this isn’t just another market. It’s a higher-value one.

And that changes planning.

Investments in packaging, compliance, and branding suddenly start making sense.

A Few Practical Takeaways

- Tariff reductions mainly benefit non-sensitive products like spices, tea, coffee, seafood, and processed foods

- Large staples such as cereals and dairy remain protected

- India–EU trade already exceeds $130 billion annually, so the base demand exists

- Compliance with EU standards will decide who actually benefits

- Growth is likely gradual, not explosive

Final Word

This FTA isn’t the kind of deal that transforms agriculture overnight.

There won’t be a sudden spike in shipments next month.

Instead, it feels more like a slow shift in the background — fewer cost hurdles, slightly better margins, a bit more confidence in long-term contracts.

For exporters who are prepared, that’s enough.

Sometimes trade doesn’t change with a bang. It just tilts quietly in one direction.

And over time, that tilt makes all the difference.

.webp)