What is Parboiled Rice?

- Parboiled rice is processed before milling by the parboiling process, at the paddy stage. That early treatment influences how the grain holds up later, particularly during storage and movement.

- In the food trade, it is handled as a bulk food commodity. Visual appearance plays a smaller role here; consistency and yield tend to matter more.

- It's large volumes move through institutional supply chains, public distribution systems, and wholesale channels built around scale rather than branding.

- When buyers look for parboiled rice online, the conversation usually stays practical — specifications, repeatability, and whether quantities can move smoothly from origin to destination.

- The same feasibility keeps parboiled rice exports flowing steadily into import-dependent markets across Africa, the Middle East, and parts of Asia.

Difference Between Parboiled and Boiled Rice

In trade conversations, the distinction usually comes up only when volume, storage, or handling enters the picture. That's where the difference between parboiled and boiled rice comes in.

- Processing timing

The parboiled rice process of manufacturing is handled before milling, while the grain is still intact. Boiled rice enters the picture much later, closer to actual consumption.

- Behaviour during milling and movement

Parboiled rice holds together better through milling and transport. Boiled rice isn’t designed for that stage of the supply chain.

- Role in bulk trade

Parboiled rice moves internationally in large volumes and shows up in export tenders. Boiled rice almost never does.

- Storage and climate tolerance

Parboiled rice manages longer storage cycles, especially in warmer regions. Boiled rice is meant to be used, not stored.

At scale, the difference becomes practical rather than technical. One fits into trade systems. The other stays closer to the kitchen.

Product Specifications

| Parameter |

Typical Trade Range |

| Product Type |

Parboiled Rice |

| Grain Length |

Short (≤ 5.50 mm) Medium (5.51 - 6.60 mm) Long ( ≥ 6.61 mm) |

| Broken Content |

5% - 25% |

| Moisture |

Max 14% |

| Purity |

Min 99% |

| Foreign Matter |

Max 0.1% |

| Milling |

Well-milled |

| Processing |

Soaking → Steaming → Drying |

| Standards |

Codex, FSSAI, BIS |

| Inspection |

SGS / BV / Intertek |

| Basis |

Trade & regulatory norms |

Types, Grades & Variants

Parboiled rice is traded across several commercial grades, shaped more by end-use than by origin branding. Buyers typically define requirements around breakage, grain length, and processing intensity to ensure the product matches specific culinary or industrial needs.

By Broken Percentage

The percentage of "broken" is the primary factor in determining the market price and intended consumer base.

- 5% broken: This is the premium standard, characterised by uniform grain appearance. It is preferred for retail-linked institutional supply, high-end catering, and markets where visual presentation is paramount.

- 10% broken: Known as the standard for mass consumption markets, this grade offers a balance between quality and affordability.

- 15-25% broken: These grades contain a higher volume of broken grains. They are common in processing and redistribution channels.

By Grain Type

The physical dimension of the grain dictates the texture and cooking performance.

- Long grain: The most traded globally. Because of its ease of cooking, it is a preferred choice for Western and Middle Eastern cuisines.

- Medium grain: Becomes slightly hydrated and more tender than long grain; often used in specific regional dishes or industrial food applications.

- Short grain: Has a limited regional demand and a stickier texture; rarely parboiled compared to long-grain varieties.

Most global tenders revolve around long grain parboiled rice with 10-15% broken, while premium export contracts lean toward 5-10% broken to satisfy stricter quality controls.

Variant Summary Table

| Variant |

Typical Use |

Buyer Profile |

Price Sensitivity |

| 5% Broken |

Institutional / retail-linked |

Importers, agencies |

High (Quality focus) |

| 10% Broken |

Bulk distribution |

Wholesalers, Large distributors |

Medium (Value focus) |

| 25% Broken |

Processing / Value-tier |

Food processors, Discount brands |

Low (Volume focus) |

Applications & End-Use Mapping

Public Distribution Systems (PDS) & Government Reserves

Parboiled rice is essential for food security in West Africa, South Asia, and parts of South East Asia.

- Yield Efficiency: The parboiling process gelatinises the starch, which makes the grain tougher. This leads to a significantly lower "broken percentage" during milling. Governments get more edible rice per ton of paddy compared to raw milling.

- Shelf Life: The heat treatment during parboiling kills insect eggs and larvae within the grain. This allows PDS warehouses to store it for longer periods without massive spoilage.

Institutional Kitchens

These environments value forgiveness in the cooking process.

- Overcooking Resistance: Unlike raw white rice, which turns soupy if left in water too long, parboiled rice maintains its grain separation. This is critical for industrial steamers and large vats where precise timing is difficult.

- Holding Time: It stays fluffy and individual even after sitting in a "warm" tray for hours, making it the standard for buffet-style service and military mess halls.

Food Processing & Industrial Blending

Parboiled rice acts as a "functional ingredient" rather than just a side dish.

- Pre-cooked & Retort Meals: Because it is already partially cooked, it is the preferred choice for "90-second" microwave pouches and canned soups. It retains its texture even after the high-heat sterilisation (retort) process.

Bulk Export & Global Logistics

Parboiled rice is the "heavy-duty" version of the commodity.

- Shipping Resilience: Long-haul maritime transport involves heat and pressure. Parboiled rice is physically harder and less prone to "chalkiness," ensuring it arrives at the destination port in the same grade it was loaded.

- Niche Market Dominance: In markets like Saudi Arabia (for Mandi/Kabsa) and Nigeria, parboiled is not an alternative—it is the requirement. Branding is secondary to the "Degree of Parboiling," which dictates the colour and smell specific to regional tastes.

Major Importing / Demand Countries

Major Supplying Countries

- India

- Thailand

- Vietnam

- Pakistan

- Myanmar

Major Importing Regions

- Sub-Saharan Africa

- Middle East

- Southeast Asia

- South Asiau

India's Strategic Role

- Market Dominance: India supplies approximately 40% of the global rice trade.

- Grade Diversity: Offers a full spectrum from high-end Basmati to affordable non-Basmati white, parboiled, and broken rice.

- Supply Stability: Massive central pool stocks—totalling over 63 million metric tons as of early 2026—allow India to act as a critical global safety net and "food security provider".

Global Market Overview

Parboiled rice sits within the broader processed rice trade, which typically moves 50-55 million metric tons annually across global markets.

While exact segmentation varies by source, parboiled rice accounts for a significant share of bulk institutional and government-linked procurement. Forecasts usually span five to ten years, with growth assumptions tied closely to population trends and public food programs.

Projections should be read as directional rather than fixed, reflecting policy stability more than consumer preference.

Key Demand Drivers

Parboiled rice demand tends to stay steady rather than surge. In most importing markets, it functions as part of the food supply system, not as a discretionary choice. That’s why volumes move quietly and consistently.

- Public food distribution dependence Government-led procurement programs continue to absorb large quantities of parboiled rice, largely because yields, cooking behaviour, and scale economics remain predictable over long supply cycles.

- Operational efficiency for bulk buyers Higher milling recovery and cooking yield reduce losses across processing, storage, and institutional kitchens. These practical parboiled rice benefits tend to matter more than grain appearance in large-volume procurement.

- Storage resilience in warm climates Parboiled rice handles longer storage periods with fewer quality issues, making it suitable for regions managing extended supply chains and buffer stocks.

- Relative price stability Compared to premium white rice, the parboiled rice price tends to remain more stable, keeping it positioned as a dependable option when global rice markets turn volatile.

These parboiled rice explain why demand holds even when markets soften.

Production & Supply Dynamics - South & Southeast Asian Rice

- South and Southeast Asia dominate the map Global rice supply is anchored in this region, with India acting as the heavyweight producer. The sheer scale of cultivation in India, Thailand, and Vietnam means that any shift in their domestic output dictates the direction of global price indices.

- Monsoon cycles are the ultimate supply pivot Since a vast portion of the crop is rain-fed, the timing and intensity of the South Asian monsoon are the primary determinants of yield. A "normal" monsoon ensures surplus for export, while a deficit can trigger immediate supply tightening and price hikes.

- Policy signals dictate market flow Supply is frequently "managed" rather than free-flowing. Millions of tonnes can be removed from the global market overnight by Minimum Export Prices (MEP), export restrictions on non-basmati varieties, or modifications to duty structures, especially from India. This would force buyers to look for alternatives.

- Limited scalability in "New Origins" While regions like South America (Brazil, Uruguay) and parts of Africa are emerge as producers, they lack massive infrastructure and acreage to challenge the Asian dominance. They serve as niche or local alternatives, but cannot yet absorb the demand shock if an Asian giant retreats from the market.

The Asian rice supply chain is a high-volume, high-sensitivity machine. It functions with remarkable efficiency under normal conditions, but its heavy reliance on predictable weather and stable trade policy makes it prone to rapid, sharp corrections.

Global Trade Flows & Regional Trends

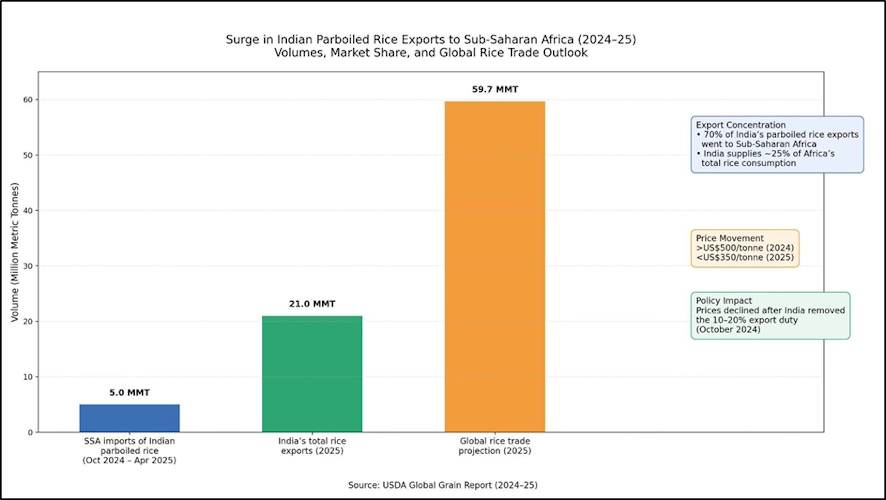

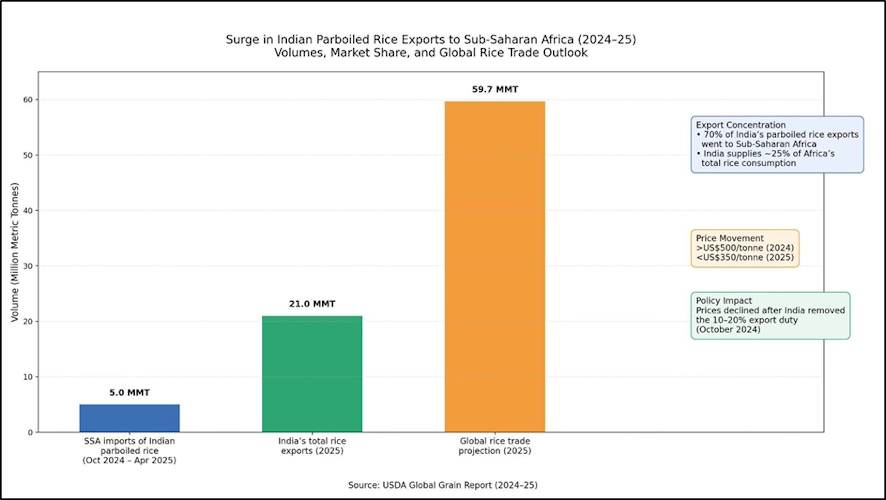

- Sub-Saharan Africa (SSA) changes course back to India Africa continues to be the most important and price-sensitive market for Indian parboiled rice, according to the most recent trade cycle. SSA markets experienced a high-speed intake of about 5 million tonnes after the 20% export duty was lifted in late 2024. This surge was driven by a need to replenish depleted stocks after a year of restricted access and record-high prices.

- Market share dominance Indian supply has reached a critical threshold, now covering over 25% of total rice consumption across the African continent. In West Africa, the reliance is even more pronounced; Indian parboiled rice has become the "price floor" for the region, dictating the affordability of the primary caloric staple for millions of households.

- The $350 Threshold Pricing underwent a dramatic "reset." After peaking above US$500 per tonne during the restrictive period of 2023-24, Indian parboiled quotes plunged to between US$350 and $380 per tonne by mid-2025. This 30%+ correction essentially "re-opened" the market for lower-income buyers who had been priced out for nearly 18 months.

- Bangladesh: The South Asian Wildcard Africa wasn't the only continent experiencing buying pressure. During the same window, Bangladesh intervened vigorously, bringing in about 925,000 tonnes. The Bangladeshi government and private traders used the recently opened road routes (such as Petrapole-Benapole) to import Indian parboiled rice at competitive prices in response to domestic crop concerns brought on by unpredictable monsoons.

- Lifting the Global Ceiling With India's total rice exports (Basmati and Non-Basmati) tracking near 21-22 million tonnes for the 2024-25 marketing year, the global trade outlook has shifted from "scarcity" to "surplus." This return of volume has forced other major exporters, like Thailand and Vietnam, to adjust their pricing strategies to stay relevant in the parboiled segment.

The 2025 cycle demonstrates that when India "sneezes," the global rice market catches a cold—but when India "opens the gates," it can single-handedly lower food inflation across two continents.

Parboiled Rice Price & Bulk Cost Indicators

Indicative Bulk Export Price

- Current Market Range: USD 350-650 per metric ton (FOB).

Pricing Variables

- Broken Percentage: The most critical quality determinant.

- Standard: 5% broken is the industry benchmark for "premium" bulk.

- Discounted: Prices drop significantly for 25% or 100% broken grades, often used for industrial processing or lower-cost food programs.

- Origin & Milling Degree:

- Origin: Indian and Pakistani origins are currently the global price anchors.

- Milling: "Well-milled" and "Double Polished/Sortex" rice fetch higher prices than "Reasonably well-milled" grades because they ensure a cleaner appearance and fewer impurities.

- Packaging & Branding:

- Bulk Standard: Quotes are usually based on 50kg Single PP (Polypropylene) bags.

- Retail Ready: Smaller packaging (1kg, 2kg, 5kg) or premium materials (BOPP, Non-woven, or Jute) can add USD 20–50 per MT to the cost.

- Certification & Compliance:

- Standard: Phyto-sanitary and Fumigation certificates are baseline.

- Premium: Third-party inspections (SGS/Intertek), Pesticide-Residue-Free (PRF) certifications, and Organic labels significantly increase the base price.

- Freight & Logistics Conditions:

- FOB vs. CNF: While export quotes are often FOB (Free on Board), the actual cost to the buyer is heavily influenced by volatile ocean freight rates, particularly for Sub-Saharan African and Middle Eastern routes.

- Inland Costs: Recent spikes in truck union rates and port congestion (e.g., at Mundra or Kandla) can create hidden "cost-push" pressures on the FOB price.

Market Sentiment (January 2026)

Note: Global parboiled prices are currently under pressure due to aggressive competition between India, Thailand, and Vietnam to clear surplus inventories. However, geopolitical tensions in the Middle East and shipping disruptions in the Red Sea have introduced "spot demand" volatility, making prices subject to weekly movement.

HS Code & Tax Classification

Parboiled rice is classified under HS Code 1006, with sub-classification determined by milling and processing level. Accurate classification is essential for customs clearance and duty assessment.

Buyer Expectations & Trade Requirements

Importers typically focus on:

- Consistent breakage levels

- Moisture compliance

- Independent inspection reports

- Uniform grain appearance

- Shipment reliability across contracts

Consistency tends to outweigh marginal price advantages.

Logistics, Packaging & Incoterms

- Packaging: 25 kg / 50 kg PP bags

- Shelf life: 12-24 months under dry storage

- Common Incoterms: FOB, CIF

- Documentation includes CO, phytosanitary certificate, and inspection reports

Certifications & Compliance

Mandatory

- Phytosanitary Certificate

- FSSAI (India)

Market-driven

- ISO

- HACCP

- Organic certification (limited volumes)

Future Outlook & Opportunities

Growth is expected to remain steady rather than explosive. Opportunities lie in institutional procurement, long-term supply contracts, traceable sourcing, and value-added processing rather than consumer branding.

The trade is moving slowly toward higher compliance, not higher margins.

Transparency & Disclaimer

All prices, specifications, and trade data are indicative and subject to change based on season, origin, compliance requirements, and logistics. Buyers and sellers should verify details before contracting.