Global Raw Hazelnut Market Outlook For Bulk Traders

Key Highlights

- In bulk trade, hazelnuts stop being a fancy retail nut pretty quickly — they're bought and sold like any other raw material, where volumes and dependable supply matter more than branding.

- Supply is still heavily tied to Türkiye, so one bad crop or strange weather season there can quietly move global prices overnight. Origin risk is real here.

- Europe remains the heartbeat of demand, mostly because chocolate and confectionery factories keep buying year after year, not just when prices look attractive.

- Buyers don't obsess over “premium look.” They care about practical things — clean lots, even kernels, low moisture — basically anything that keeps their processing lines running smoothly.

- More origins like the US, Italy, Chile and Azerbaijan are stepping in, not to replace Türkiye, but to give importers options and a little breathing room during negotiations.

Introduction:

Few agricultural products make the transition from “premium food” to “industrial input” as seamlessly as hazelnuts. Botanically a true nut and commercially a specialty dry fruit, they command premium positioning at retail. But in B2B trade when you want to export hazelnuts in bulk the conversation shifts quickly — toward tonnage, kernel yield, and who can deliver consistently at scale.

And by that yardstick, hazelnuts have quietly become one of the most structured and predictable segments in the tree nut business.

Keep reading this informative piece of blog, as it will provide you a complete market overview of the bulk hazelnuts trade market globally.

Production Remains Concentrated — and That Still Defines Everything

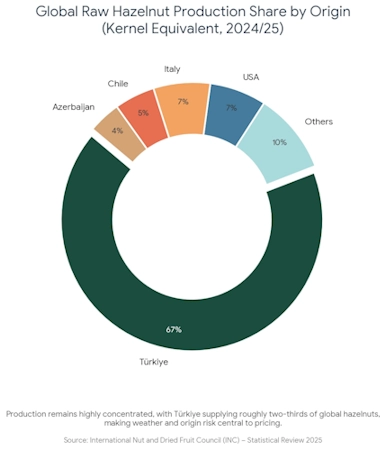

Hazelnuts may be traded globally, but production is geographically tight. A handful of origins carry most of the world's supply as top hazelnuts exporters, and that concentration continues to shape pricing power and risk.

Recent data show global output touching roughly 1.25 million metric tons in-shell (about 587,410 MT kernel equivalent) in 2024/25, before easing slightly in the following season.

Türkiye alone accounts for around two-thirds of global production — roughly 67%

For buyers, that concentration has implications.

- Weather in one country can influence global prices

- Crop estimates quickly move futures and contracts

- Diversification into the USA, Italy, Chile, or Azerbaijan is becoming strategic

- Procurement planning increasingly starts with origin risk analysis

In hazelnuts, geography is never a footnote. It's the headline.

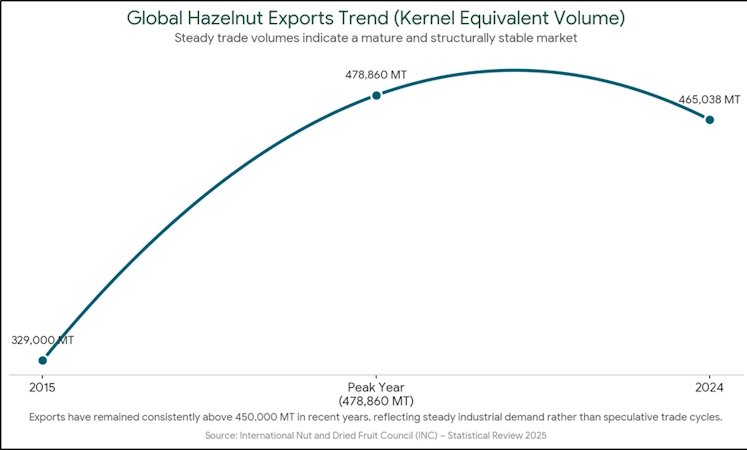

Trade Volumes Show a Market That Has Matured

What stands out over the past decade isn't volatility — it's steady scale.

Global hazelnut exports climbed from just over 329,000 metric tons in 2015 to a peak near 478,860 MT, and have since stayed comfortably above the 450,000 MT threshold, with 465,038 MT shipped in 2024 (kernel equivalent) .

That kind of consistency tells you something.

Hazelnuts might be a niche confectionery input. They move in bulk like industrial ingredients.

- Large, repeat contracts dominate

- Shipments follow scheduled procurement cycles

- Buyers expect year-round availability

- Price swings tend to be supply-driven, not speculative

Once a commodity crosses half a million tonnes of annual trade, it stops being opportunistic. It becomes structural.

Europe Still Sets the Tone for Demand

If production has a center of gravity, so does consumption — and it sits firmly in Europe.

The region absorbs roughly 67% of in-shell exports and nearly 80% of shelled shipments.

Germany remains among the top hazelnuts buyers, while Italy functions as a major processing hub.

This matters because processing hubs create stable, long-term demand rather than sporadic buying.

- Chocolate and confectionery manufacturers lock in annual supply/li>

- Processing plants require uniform quality and predictable volumes

- Imports tend to be systematic rather than seasonal

- Long-term contracts reduce speculative trading

In other words, Europe buys to run factories, not to test markets. That stability keeps the trade disciplined.

Processing Is Where the Real Value Sits

Raw hazelnuts may leave origin as an agricultural product, but they arrive at destination as an industrial input.

A significant share moves directly into roasting, grinding, paste, spreads, and chocolate lines. That shifts how importers think about quality.

They're not chasing “premium.” They're chasing “consistency.”

- Kernel size uniformity matters for automated sorting

- Moisture stability impacts shelf life and storage

- Low defect rates protect processing yield

- Clean, graded lots reduce downstream losses

For B2B buyers, every extra broken kernel or excess moisture percentage is measured against processing efficiency. Quality isn't aesthetic — it's arithmetic.

Supply Chains Are Quietly Expanding Beyond Türkiye

Even though Türkiye still dominates as a top hazelnuts exporter , other producers are gaining incremental ground.

The USA and Italy each hold roughly 7% shares, while Chile and Azerbaijan contribute around 4-5% each .

That may look small on paper, but for buyers, secondary origins provide something invaluable: leverage.

- Multiple origins reduce concentration risk

- Alternate crops stabilize pricing negotiations

- Buyers can hedge weather shocks

- Freight routes diversify

In procurement meetings, this isn't framed as diversification. It's simply called insurance.

What the Numbers Quietly Suggest for 2026 and Beyond

When you step back, the hazelnut market doesn't feel speculative. It feels settled — almost methodical.

Production stays above the million-tonne mark. Exports hover around half a million tonnes. Europe continues to absorb most of it. And processing demand remains steady.

Nothing dramatic. Just steady expansion.

And steady markets are often the most investable ones.

- Predictable trade flows attract long-term contracts

- Processing demand creates recurring purchases

- Established logistics reduce volatility

- Reliable volumes make hedging easier for traders

In commodities, predictability is often more valuable than rapid growth.

Final Take

Hazelnuts won't grab headlines the way almonds or pistachios sometimes do. They don't need to. The trade runs on quieter strengths — stable origins, disciplined buyers, consistent processing demand.

For exporters and importers alike, that's the sweet spot.

Because in the bulk food trade, the best markets aren't the loud ones.

They're the ones that simply keep moving — container after container, season after season — with fewer surprises and clearer margins.

And right now, raw hazelnuts look exactly like that kind of business.