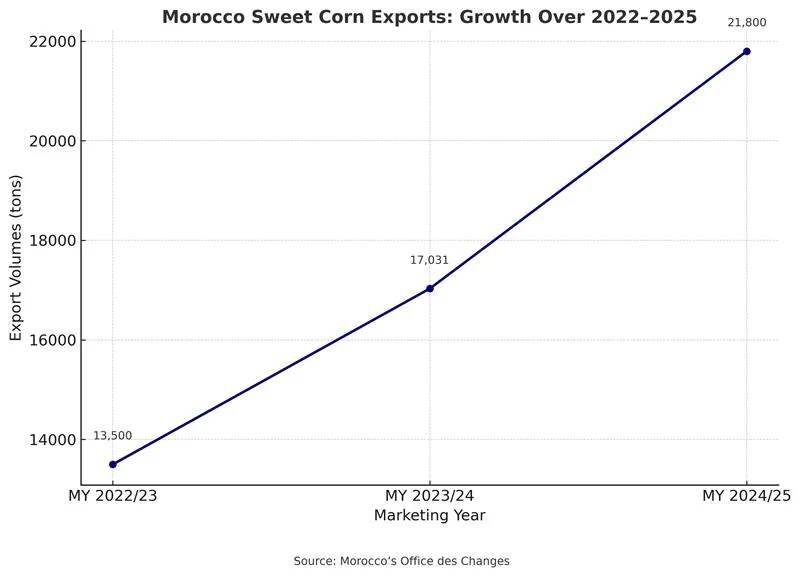

In the 2024/25 marketing year, Morocco asserted itself as a formidable player in the European sweet corn market. Exports reached 21,800 tons, surpassing the 20,000-ton milestone for the first time and generating over USD 20 million in revenue, according to EastFruit and Global Trade Tracker via Morocco’s Office des Changes. Beyond the headline figures lies a narrative of strategic agility, market foresight, and the subtle recalibration of regional trade flows.

When Opportunity Meets Preparedness

Sweet corn exports from Morocco follow a well-defined seasonal rhythm: autumn harvests from October to December, and spring from April to June, with the latter driving peak export volumes. But 2025 was different. Heavy rainfall in Spanish growing regions led to significant crop losses, sending ripples of concern across European markets. Spain, historically a competitor, suddenly became a client in need.

Morocco's agricultural sector responded with remarkable speed. Corn exporters capitalized on available capacity and logistics readiness, transforming what could have been a transient market gap into a record-breaking export performance. It was a demonstration of resilience: not merely reacting to circumstance, but strategically navigating it.

Spain: From Rival to Clien

The most telling outcome of this season was Spain's sudden pivot. For the first time since 2015, it overtook the United Kingdom as Morocco's largest importer, with imports climbing 67% year-on-year. Germany followed with a 52% increase, France 30%, and Switzerland 14%. Even the 15% decline in exports to the Netherlands was a minor counterpoint to a broader trend: Morocco is now cementing its role as a reliable European supplier.

This shift carries significance beyond commerce. It represents a subtle rebalancing of Euro-Mediterranean agricultural dependencies. Spain's reliance on Moroccan sweet corn underlines the growing value of predictable supply chains—a reminder to exporters that preparedness and credibility are as crucial as production capacity.

Economic Reverberations at Home

The USD 20 million in export revenue is more than a headline figure. It directly benefits farmers, processors, logistics providers, and a host of allied sectors. This performance strengthens the case for Morocco's continued investment in specialty crops, complementing its traditional exports of citrus, tomatoes, and olives.

For global corn exporters, Morocco's model offers lessons in operational excellence: scaling production to meet unexpected demand, navigating institutional frameworks efficiently, and maintaining supply quality to win repeat contracts in competitive markets.

Strategic Implications for the Global Market

While sweet corn occupies a niche relative to field corn, it is a growing segment within Europe's fresh and processed food ecosystem. Morocco's record performance highlights several enduring market realities:

- Climate-linked disruptions are reshaping traditional supply hierarchies; reliability now carries premium value.

- Buyer flexibility is increasing; European importers will pivot rapidly toward suppliers who can deliver on short notice.

- Agricultural exports as strategic instruments: Morocco's timely shipments to Spain embed interdependence, subtly enhancing its influence in regional trade discussions.

Diversification as a Pillar of Strategy

Sweet corn is not an isolated success. Morocco's asparagus exports have now grown for five consecutive years, signaling a deliberate diversification strategy. For corn exporters worldwide, the lesson is clear: building a resilient, high-value export portfolio strengthens bargaining power and mitigates commodity-specific volatility.

A Market Narrative in Motion

The 21,800 tons milestone represents more than volume—it is a statement of intent. Morocco has demonstrated that mid-sized producers, equipped with foresight and operational agility, can navigate market turbulence effectively, capturing share while competitors grapple with supply shocks.

For the wider global corn market, the Moroccan story is a template: trust, consistency, and strategic readiness increasingly define competitiveness. When opportunity aligns with preparedness, the consequences extend far beyond a single season, reshaping sourcing strategies and cementing relationships with long-term buyers.

Looking Ahead

As climate variability and shifting trade preferences continue to influence Europe's agricultural imports, Morocco's rise underscores the strategic value of operational resilience. Corn exporters observing this market will recognize a fundamental truth: in an interconnected, climate-sensitive trade environment, adaptability is as crucial as production volume. Morocco's 2024/25 season is a case in point—a carefully orchestrated confluence of preparation, opportunity, and market insight that may well redefine the contours of European sweet corn sourcing for years to come.