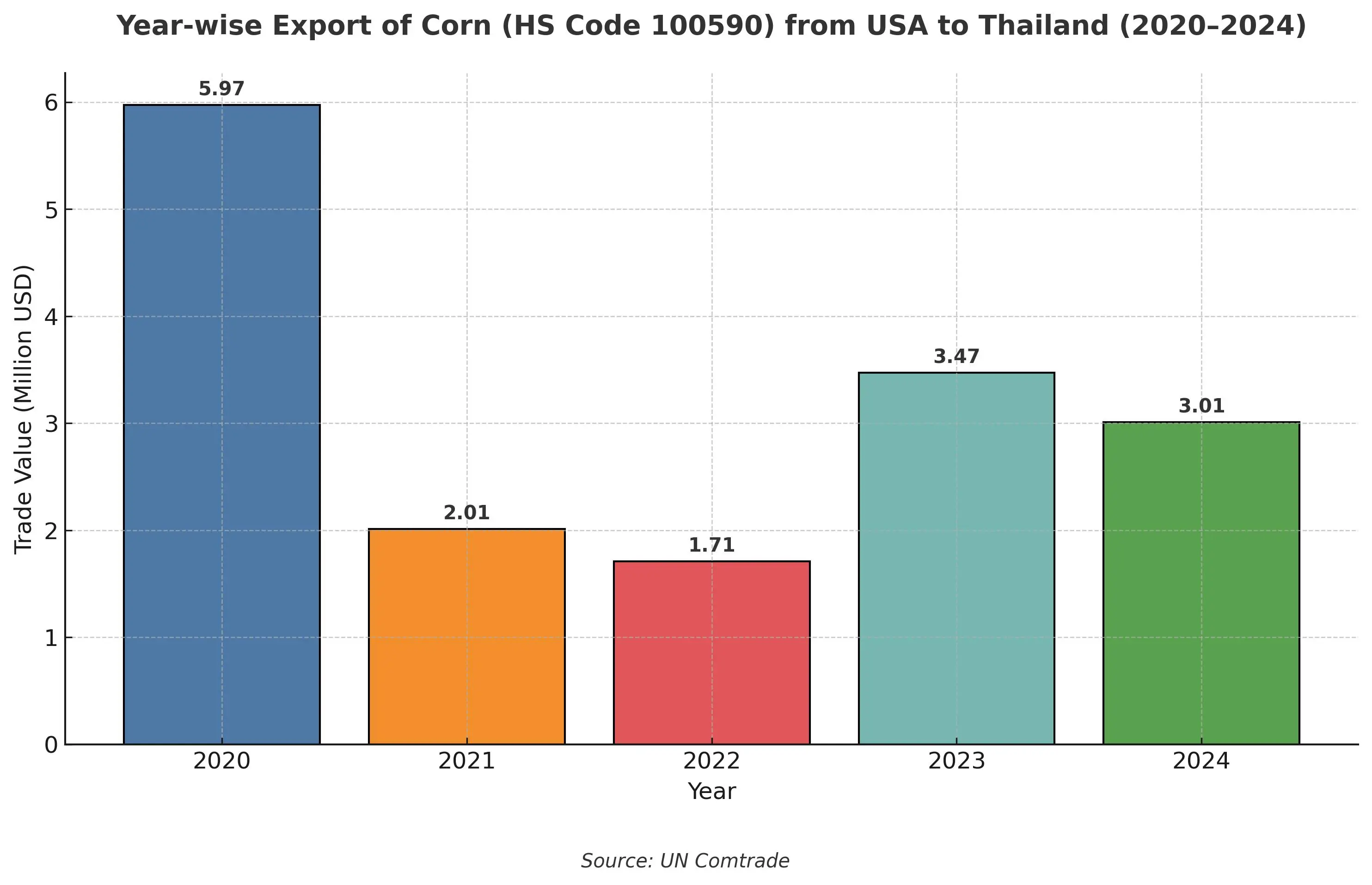

As Thailand’s Cabinet approves a landmark decision to expand duty-free imports of U.S. corn, the numbers tell a story that has been building for years. The latest UN Comtrade data (as reflected in the attached chart) showcases a steady yet uneven pattern in U.S. corn exports (HS Code 100590) to Thailand — from a high of $5.97 million in 2020, dipping to $1.71 million in 2022, and gradually recovering to $3.01 million in 2024.

This five-year snapshot is more than just a reflection of market activity; it is a mirror of evolving trade policy, fluctuating feed demand, and the strategic balancing act between local production and import dependency.

From Tariff Barriers to Reciprocal Access

Thailand’s recent approval to permit duty-free imports of up to one million tonnes of U.S. feed corn between September 2025 and June 2026 marks a notable liberalization. This is a decisive leap from the previous 54,700-tonne quota that carried a 20% tariff, signaling Bangkok’s readiness to strengthen agricultural engagement with Washington.

For U.S. bulk corn exporters, this means renewed access and greater predictability in a market that has historically been cautious toward high-volume imports. For Thai corn importers, it represents a chance to stabilize domestic feed costs amid a recovering industrial and animal feed economy.

A Historical Perspective on Trade Dependence

Corn trade between the U.S. and Thailand has long been influenced by feed demand cycles and regional competition. Thailand, a key agro-processing hub in Southeast Asia, relies heavily on feed ingredients for its poultry, swine, and aquaculture industries — sectors that support its export-driven food economy.

While local production has remained a government priority, periodic shortfalls and price fluctuations often push feed manufacturers to seek cost-effective imports. The attached chart shows that 2020 marked an exceptional year for U.S. bulk corn suppliers, possibly due to disruptions in alternative supply routes and high demand for feed ingredients during early post-pandemic recovery phases.

However, the subsequent decline in 2021 and 2022 reflected a cautious policy environment — one that has now decisively shifted with this new quota expansion.

B2B Impact: Opportunity for Exporters and Importers

The expanded duty-free window provides a clear opportunity for U.S. bulk corn exporters looking to reestablish consistent trade volumes with Thai corn importers and feed manufacturers. The reciprocal framework also highlights a broader U.S.-Thailand alignment aimed at reinforcing supply chain resilience and reducing input cost volatility in Asia’s feed industry.

For corn importers, however, the government’s 3:1 local purchase condition — requiring the purchase of three units of domestic corn for every imported unit — remains a critical variable. It ensures domestic farmers remain protected, yet it challenges buyers to balance procurement portfolios efficiently.

A Broader Trade Signal

Thailand’s move aligns with its growing Manufacturing Production Index (up 1.47% in Q2 2025), reflecting renewed industrial energy after a period of contraction. Export growth for 14 consecutive months underscores a nation regaining trade momentum — and in that context, liberalized corn imports appear as a tactical lever to maintain competitiveness across feed-dependent sectors.

From a B2B trade standpoint, this policy could act as a stabilizer — cushioning cost pressures on manufacturers while creating predictable trade flows for U.S. suppliers. It also reaffirms Thailand’s position as one of the most strategically open yet carefully balanced economies in Asia when it comes to agricultural imports.

Looking Ahead

While the UN Comtrade data illustrates recovery in recent years, the next phase will likely determine whether this rebound evolves into sustained growth. Much will depend on how exporters and corn importers navigate the dual challenge of regulatory compliance and market pricing.

Tradologie is the perfect b2b platform for bulk corn trade globally with more than millions of verified traders.

Visit www.tradologie.com today.