The U.S. decision to withdraw the 50 percent reciprocal tariff on Indian tea, coffee, spices and select agricultural items reflects a pragmatic adjustment in policy. It is a reminder that global commodity flows ultimately align with supply reliability, competitiveness and long-established sourcing patterns. India’s position in the Global spice trade and Agricultural Export ecosystem has been shaped by consistency, agro-climatic advantages, processing capabilities and a long history of trade.

From Tariff Dispute to Market Constraint

What began as a tariff-driven confrontation has, within weeks, reverted to the economic fundamentals driving procurement. Rising food inflation in the U.S., pressure from processors and retailers, and the limited substitutability of certain ingredients led to this reversal. The change is not a concession; it is a recognition that essential commodity sourcing responds to market-driven constraints rather than political signalling.

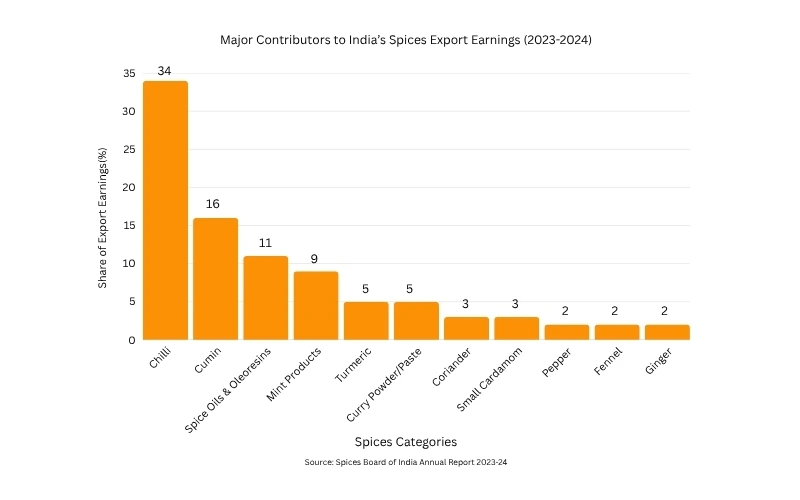

The Spice Basket: What the Numbers Indicate

The Spices Board of India’s 2023–24 export composition highlights the structure of the sector. Chilli constitutes 34 percent of export value, forming the largest segment. Cumin contributes 16 percent, while spice oils and oleoresins account for 11 percent and mint products for 9 percent. Together, these categories represent more than 70 percent of total value.

This concentration has direct implications for business planning:

- Chilli’s large share reflects both depth of demand and sensitivity to crop performance.

- Cumin’s position underscores its consistent utilisation in processing and blended spice applications.

- Spice oils and oleoresins illustrate the shift toward value-added categories where margins are comparatively stronger.

These figures function as indicators of risk and opportunity for exporters, processors and procurement teams.

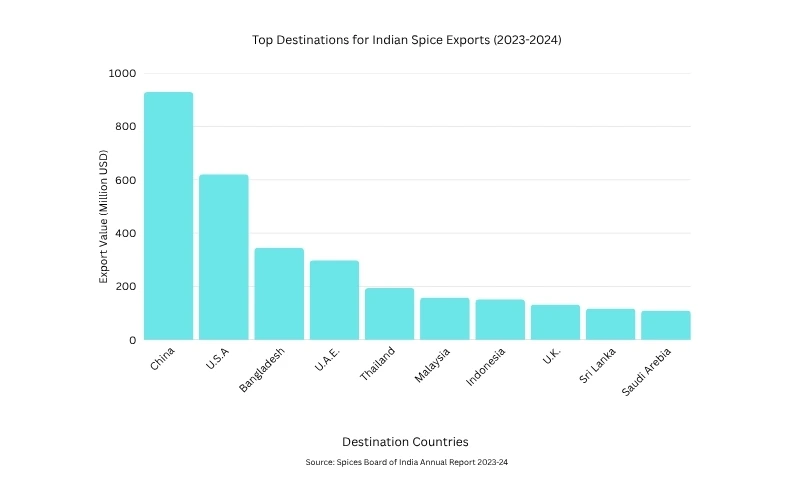

Market Geography: The U.S. as a Significant Destination

India’s spice exports span a wide global footprint. China accounts for 21 percent of value, while the U.S. represents 14 percent — a substantial market particularly for specialised and processed categories. Other destinations such as Bangladesh, the UAE, Thailand, Malaysia and multiple regions across Europe, East Asia and Africa reflect India’s diversified presence.

For U.S. buyers, a 14 percent share signifies meaningful reliance on Indian supply chains. For Indian exporters, the tariff withdrawal opens additional scope, especially for businesses already integrated with North American processing and formulation industries.

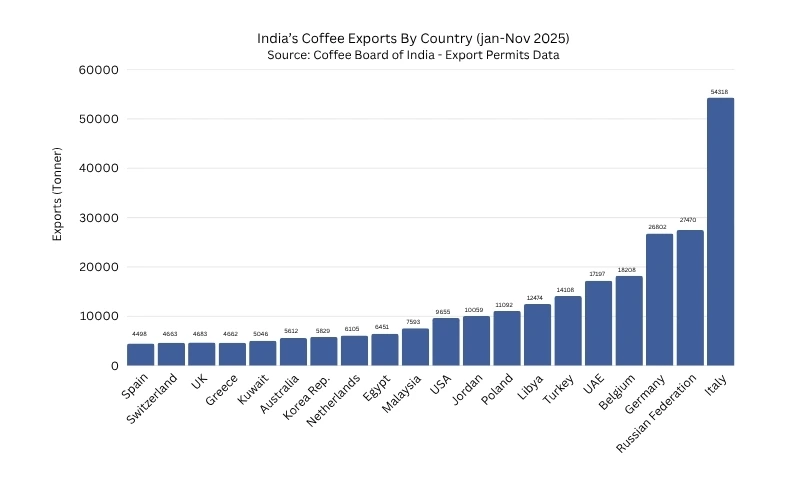

Coffee Exports: Structure, Markets and U.S. Reliance

The coffee segment mirrors a similar structural dynamic. Between January and mid-November 2025, India exported approximately 336,000 tonnes of coffee (GBE), supported largely by robust instant coffee shipments, which alone accounted for over 129,000 tonnes. Europe remained the anchor market with Italy, Germany and Belgium among the largest destinations, while the U.S. absorbed close to 9,600 tonnes.

Although the U.S. is not the largest volume buyer, its reliance on Indian instant and processed coffee remains commercially significant, especially for North American formulators and private-label manufacturers who depend on India’s consistent specifications and scalable processing capacity.

For Coffee Exporters, the data highlights a stable demand base across roasted, green and instant formats, reinforcing the relevance of India’s diversified processing ecosystem within global coffee supply chains.

Value-Chain Considerations: Where Competitive Advantage Is Built

The data indicates areas where India performs strongly and where further focus is warranted:

- Raw vs value-added balance: The dominance of chilli and cumin shows the strength of raw commodity exports. The expansion of spice oils and oleoresins highlights the potential of higher-value segments.

- Quality and compliance: Access to the U.S. market increasingly depends on residue management, traceability and consistent specifications. Tariff relief does not replace the need for stringent compliance.

- Supply predictability: With a few crops contributing most of the value, structured farming and diversification strategies can reduce volatility for both suppliers and buyers.

Strategic Takeaways for Exporters and Traders

- Leverage the policy window: The tariff rollback offers Indian exporters a fresh commercial opening. Those already linked with U.S. processors and flavour manufacturers can use this period to strengthen engagement, renegotiate terms, and secure longer-duration supply commitments while the momentum is favourable.

- Focus on value addition: Expand capacities in oleoresins, essential oils and formulated seasoning products where margins are stronger.

- Strengthen compliance: Invest in residue testing, traceability and certifications aligned with U.S. buyer expectations.

- Manage concentration risk: Chilli’s 34 percent share is both a strength and a vulnerability. Diversifying crop portfolios and destination markets can stabilise long-term business.

- Position Indian origin effectively: Highlight quality, consistency and traceability to appeal to buyers who prioritise reliable sourcing and provenance.

Conclusion: A Window for Strengthened Trade

The rollback of tariffs offers a clear commercial opening but does not negate the ongoing requirements of scale, quality, compliance and value-addition. For the U.S., the move reflects a practical reliance on Indian agricultural inputs. For Indian exporters, the priority now is to convert this policy shift into sustained growth by enhancing capabilities across the value chain.

India continues to supply a category of agricultural products that global markets depend on. The U.S. may lead in technology, but its food industry continues to draw significantly from India’s expertise and capacity in core agricultural ingredients.

-(1).webp)