For years, the European Union was seen as a stable, high-consumption bloc in global food trade. Strong on standards, yes, but not exactly aggressive on export volumes across the board. That perception is quietly changing. And if you export agro commodities from India, it’s worth paying attention. Closely.

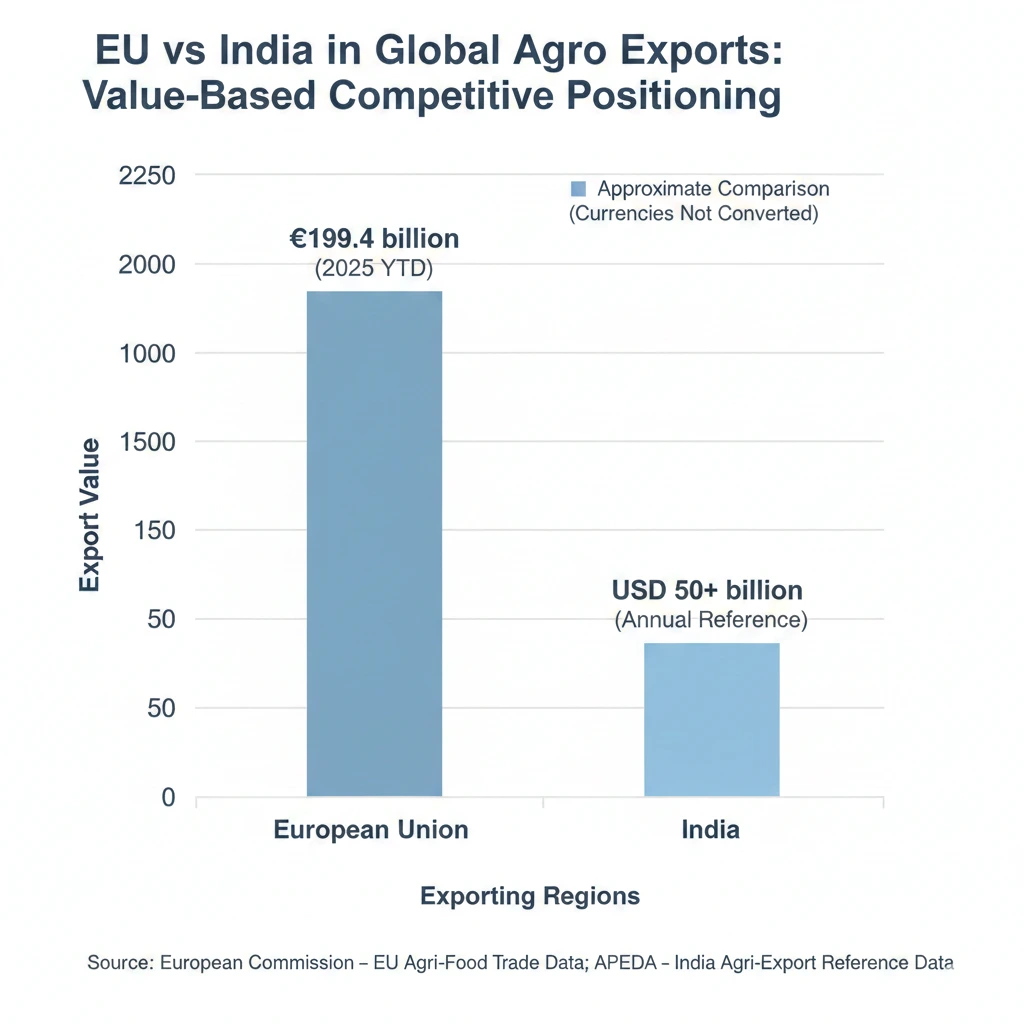

In October 2025 alone, the EU posted an agri-food trade surplus of €6.4 billion, up 18% month-on-month and nearly 19% higher than October last year. That’s not a seasonal blip. That’s a signal. By October, EU agri-food exports had touched €199.4 billion for the year — a 2% rise year-on-year, while imports, though still growing cumulatively, softened on a monthly basis.

In plain terms? Europe is producing more than it needs, pricing it well, and pushing it outward. That has consequences for global agriculture trade — and especially for India.

Why This Matters to Indian Agro Exporters

India has built its export strength on scale, cost competitiveness, and consistency. Rice, wheat, maize, sugar, spices, oilseeds, processed foods — the list is long. According to APEDA, India’s agri-exports have consistently hovered above USD 50 billion annually, with staples like rice alone accounting for over 40% of global rice trade in strong years.

But here’s the catch. India doesn’t export into a vacuum. It exports into markets where buyers compare origins, not flags. And that’s where the EU’s growing surplus starts to pinch.

Europe is not competing with India on the same terms. It’s competing on value, predictability, and compliance-heavy segments — exactly the areas many global buyers are shifting toward.

| Commodity / Segment | EU Export Position (Surplus Impact) | India’s Export Position | Why Competition Is Increasing |

| Wheat & Cereals | Strong supplier to North Africa, West Asia; benefits from predictable quality and improving logistics | Competitive during surplus years, price-driven | When EU prices soften, Indian wheat faces tighter margins in overlapping markets |

| Barley & Feed Grains |

Established supplier for feed and brewing industries |

Limited but growing presence | EU’s consistency and contract stability appeal to institutional buyers |

| Processed Foods | Expanding exports of value-added foods (bakery inputs, cocoa-based products, ready-to-use ingredients) | Still moving up the value chain | EU locks long-term buyers early, narrowing entry for Indian processors |

| Oilseeds & Derivatives | Strong compliance-led exports, traceability advantage | Cost-competitive bulk supplier | Buyers increasingly value certification and residue assurance |

| Dairy & Protein-linked Products | Rising role as importer and re-exporter; integrated supply chains | Niche exporter, regulatory constraints | Bundled tenders favor multi-category EU suppliers |

| Rice (Non-Basmati) | Limited direct competition | Global leader in volume and affordability | India retains dominance, but scrutiny on quality remains |

| Spices | Minor overlap | Global powerhouse | India’s stronghold remains intact |

The Commodity Overlap: Where Competition Gets Real

Let’s be clear: the EU is not going to replace India in basmati rice or spice blends overnight. But the overlap is wider than it looks.

Take cereal. While EU cereal exports dipped in volume recently, Europe remains a strong supplier of wheat and barley to North Africa, West Asia, and parts of Sub-Saharan Africa — markets India also courts during surplus years. When EU grain prices soften or logistics improve, Indian wheat suddenly has less breathing room.

Then there’s processed foods and value-added agro products. The EU’s export growth in cocoa-based products and coffee may not sound like India’s turf, but it matters. These categories occupy premium shelf space and institutional procurement budgets. When European suppliers lock in buyers with stable pricing and long contracts, it narrows the window for alternative origins, including Indian suppliers trying to move up the value chain.

Meat, Dairy, and the Silent Pressure

One data point that deserves more attention: EU imports of beef and veal rose 28% year-on-year in value, driven by both higher volumes and prices. This strengthens Europe’s position as a global protein hub — both as an importer and re-exporter.

Why should Indian exporters care? Because many emerging markets don’t compartmentalise food imports neatly. Government buyers, food processors, and large distributors often bundle tenders. A supplier strong in meat, dairy, and cereals becomes a preferred long-term partner — making it harder for single-commodity exporters to break in.

Price Isn’t Everything Anymore — And That’s the Problem

India still wins on price in many categories. No argument there. But global food trade is tilting, slowly but surely, toward reliability over raw cost. EU exporters benefit from integrated logistics, policy stability, and buyer trust built over decades.

When European exporters quote, buyers assume compliance is a given. With Indian exporters, buyers often still ask — certification, residue levels, inspection protocols. It’s improving, yes. But perception lags progress.

Where India Still Holds the Line

This isn’t a doom story. India remains unbeatable in several export agro commodities — rice, spices, certain oilseeds, and cost-sensitive processed foods. India’s ability to supply bulk volumes at short notice is something the EU simply cannot replicate across all categories.

Markets in Africa, parts of Southeast Asia, and West Asia still rely on Indian supply to manage food security. And in global agriculture trade, food security always trumps finesse.

The Real Shift: Competition Is Moving Up the Chain

What’s changing is the battlefield. The EU’s surplus means it can afford to be selective, strategic, and patient. India, meanwhile, must accelerate its move toward value-added exports, better branding, and tighter compliance — not because it’s fashionable, but because competition is getting sharper.

Global buyers are no longer asking just who can supply, but who can supply without friction.

The Bottom Line

Europe’s rising agri surplus isn’t a headline to skim past. It’s a reminder that the global food trade is evolving. India isn’t losing ground — but it can’t afford to stand still either.

In export agro commodities, scale opened doors for India. In the next phase of global agriculture trade, sophistication will decide who stays in the room.

-(1).webp)