Minimum Order Quantity : 26 MT

Available Bag Size

Available Bag Type

Shelf life : 12-24 months under dry storage

Common Incoterms : FOB, CIF

Documentation : includes CO, phytosanitary certificate, and inspection reports

Facilitated by Tradologie.com

Offered By : Parboiled Rice Exporters

This is a Vegetarian product.

Know the Parboiled Rice Price Online, Trade Uses, Market Dynamics & Export Overview

In trade conversations, the distinction usually comes up only when volume, storage, or handling enter the picture. That's where the difference between parboiled and boiled rice comes in

At scale, the difference becomes practical rather than technical. One fits into trade systems. The other stays closer to the kitchen.

| Product Type | Parboiled Rice |

|---|---|

| Grain Length | Short (≤ 5.50 mm) Medium (5.51 - 6.60 mm) Long ( ≥ 6.61 mm) |

| Broken Content | 5% - 25% |

| Moisture | Max 14% |

| Purity | Min 99% |

| Foreign Matter | Max 0.1% |

| Milling | Well-milled |

| Processing | Soaking → Steaming → Drying |

| Standards | Codex, FSSAI, BIS |

| Inspection | SGS / BV / Intertek |

| Basis | Trade & regulatory norms |

Parboiled rice is traded across several commercial grades, shaped more by end-use than by origin branding. Buyers typically define requirements around breakage, grain length, and processing intensity.

By Broken Percentage

By Grain Type

By Origin

Most global tenders revolve around long grain parboiled rice with 10-15% broken, while premium export contracts lean toward 5-10% broken.

| Variant | Typical Use | Buyer Profile | Price Sensitivity |

|---|---|---|---|

| 5% Broken | Institutional / retail-linked | Importers, agencies | High |

| 10% Broken | Bulk distribution | Wholesalers | Medium |

| 25% Broken | Processing | Food processors | Low |

Demand for parboiled rice is tied to systems, not branding. Its applications are practical and volume-driven.

Most of this demand is export-oriented, particularly in regions where rice is a food security staple.

Production remains concentrated, while consumption is spread across regions with limited domestic milling capacity.

Major producing countries

Major importing regions

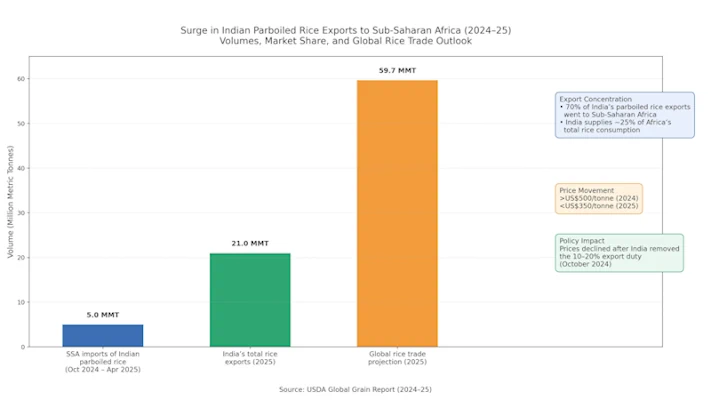

India continues to anchor global supply, largely because it can deliver volume across multiple grades without long lead times.

Parboiled rice sits within the broader processed rice trade, which typically moves 50-55 million metric tons annually across global markets.

While exact segmentation varies by source, parboiled rice accounts for a significant share of bulk institutional and government-linked procurement. Forecasts usually span five to ten years, with growth assumptions tied closely to population trends and public food programs.

Projections should be read as directional rather than fixed, reflecting policy stability more than consumer preference.

Parboiled rice demand tends to stay steady rather than surge. In most importing markets, it functions as part of the food supply system, not as a discretionary choice. That's why volumes move quietly and consistently.

These parboiled rice explain why demand holds even when markets soften.

South and Southeast Asia dominate production, with India contributing a substantial share of global output. Supply conditions are closely linked to monsoon cycles, energy costs for steaming, and export policy signals.

Risks are familiar rather than exceptional — weather variability, freight disruption, and policy intervention. New origins are emerging, but scale remains limited outside Asia.

Indicative bulk export price: USD 420-650 per metric ton (FOB)

Pricing varies by:

Parboiled rice price remains indicative and subject to market movement.

Parboiled rice is classified under HS Code 1006, with sub-classification determined by milling and processing level. Accurate classification is essential for customs clearance and duty assessment

Importers typically focus on:

Consistency tends to outweigh marginal price advantages.

Mandatory

Market-driven

Growth is expected to remain steady rather than explosive. Opportunities lie in institutional procurement, long-term supply contracts, traceable sourcing, and value-added processing rather than consumer branding.

The trade is moving slowly toward higher compliance, not higher margins.

All prices, specifications, and trade data are indicative and subject to change based on season, origin, compliance requirements, and logistics. Buyers and sellers should verify details prior to contracting.

Get in Touch

Parboiled rice online prices vary with grade, origin, volume, and shipping terms, so they don’t sit at a single fixed level. Buyers generally compare current market conditions by discussing their requirements with the Trade Facilitation team.

Bulk imports are typically discussed once quantity, grade, and destination are broadly defined. From there, conversations remain flexible, shaped by market availability and what aligns practically with the shipment.

Parboiled rice usually finds its way into markets that rely heavily on imports rather than domestic production. You’ll see steady demand across parts of Africa, the Middle East, South Asia, and pockets of Southeast Asia.

Yes, parboiled rice can be sourced online through Tradologie.com. Buyers typically share their requirements on the platform and complete the verified buyer registration, after which sourcing conversations move forward in line with bulk trade practices and compliance norms.

Most buyers keep clarity on preferred grade, broken percentage, approximate volume, and destination port. Having these points aligned helps discussions stay focused.

Exporters usually share details around available grades, volumes, and certifications. Interest tends to build around offers that match buyer requirements and shipment readiness.

Parboiled rice trade is generally volume-oriented. Most shipments move at container level or higher, though quantities can vary depending on market conditions.

Long-grain parboiled rice with 5% to 15% broken is frequently requested across many export markets. Preferences shift depending on price sensitivity and end use.

Common expectations include a phytosanitary certificate, inspection report, and standard shipping documents. Additional requirements may apply depending on the destination market.

Enquiries generally arise when specifications and volumes align. From there, discussions continue with trade facilitation support helping coordination stay on track.