Key Highlights (HS Code 0904 – Chillies & Capsicum):

- India still leads the global red chilli trade under HS Code 0904, with exports crossing USD 1.5 billion in 2023–24. That position hasn’t vanished — but it’s no longer taken for granted.

- China has started showing up more often in chilli conversations, quietly expanding cultivation and processing capacity, especially where buyers are watching prices closely.

- Volumes moved up in 2024–25, but earnings didn’t follow the same path. Global prices stayed under pressure, and that showed up clearly in export realisations.

- Back home, chilli acreage has been thinning in key producing states. It’s not dramatic yet, but it’s enough to make long-term supply planners uneasy.

- Where this competition lands next won’t be decided by who ships more containers. It will come down to consistency, processing capability, and how closely exporters stay aligned with buyer requirements.

- The global agro trade is no longer forgiving. Much like technology or manufacturing, agriculture exports today operate in a competitive, fast-adjusting environment. Red chillies are no exception.

India has led the global red chilli trade for decades. But leadership in commodities is not a static position. It has to be defended, recalibrated, and re-earned as markets evolve. China’s growing presence in chilli cultivation, processing, and export is now forcing that recalibration.

This is not a story of decline. It is a story of pressure—and what that pressure reveals about where the red chilli trade is headed.

India& Red Chilli Export Base: Still Strong, Increasingly Tested

According to the report “Trading Aromas: The Rise of the Spice Economy” (May 2025), chilli was India’s largest exported spice by value in FY 2023–24, with exports touching USD 1.51 billion. It ranked ahead of cumin and spice oils, underlining how central chillies remain to India’s spice economy.

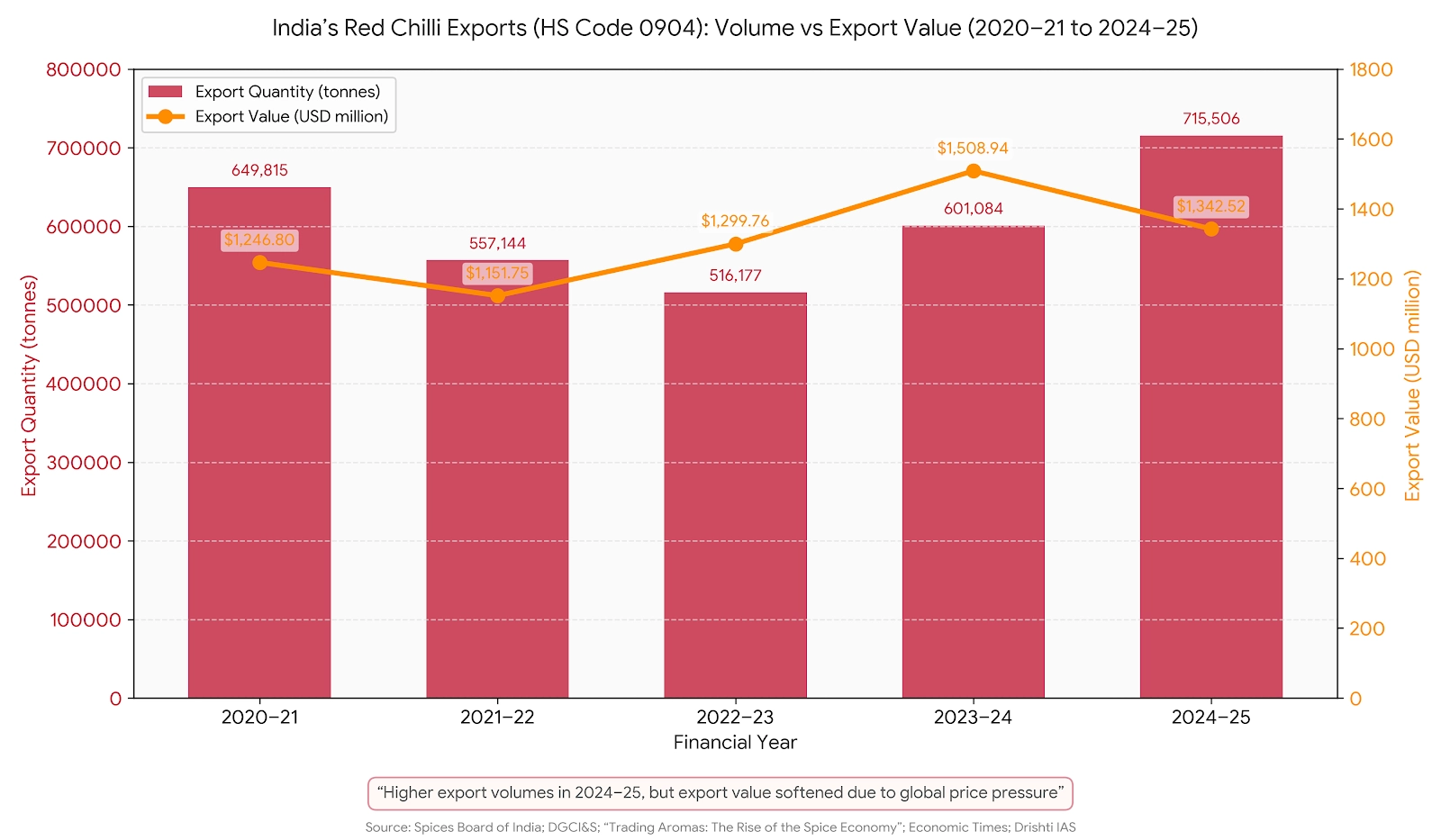

Spices Board of India and DGCI&S data further confirms India’s dominance. Over the last five years, chilli exports have consistently crossed half a million tonnes annually, peaking again in 2024–25 at over 715,000 tonnes.

Volumes are not the problem. Value, however, is where the pressure is visible.

When Higher Volumes Don’t Translate Into Higher Earnings

In 2024–25, India’s chilli exports grew sharply. Total volumes rose by 19%, and chilli powder exports jumped 35% to around 80.6 million kg, according to industry estimates cited by Economic Times.

Yet export earnings declined by 11% in the same period.

That gap between volume and value is telling. It reflects a global market where buyers are pushing back on price, and alternative supply options are beginning to matter more than before.

This is the context in which China’s role becomes relevant.

China’s Entry Is About Structure, Not Headlines

China is not trying to replicate India’s chilli ecosystem overnight. Its strategy is narrower and more tactical.

Trade reports show China focusing on specific, high-demand chilli categories—particularly paprika, used for colour extraction, and Teja chilli, valued for pungency and pharmaceutical applications. These are segments where processing depth often matters more than origin reputation.

More significantly, China is importing raw chillies, processing them domestically, and re-exporting finished products to third-country markets. This shifts the value capture away from farming and toward processing and logistics—an area where China traditionally excels.

For global buyers, especially food processors and ingredient manufacturers, this matters. Many of them are less concerned about where a chilli is grown and more concerned about consistency, specifications, and delivered cost.

India’s Internal Constraints Add Another Layer of Risk

While competition is rising externally, India is also facing pressure at home.

According to Drishti IAS and Economic Times, chilli acreage in Andhra Pradesh, Telangana, and Karnataka has fallen by nearly 35%. Cumin acreage has declined by 7–8%. Weather-related crop losses and sustained low export prices have discouraged farmers, particularly during the kharif season.

This has implications beyond one season. Reduced acreage today narrows supply flexibility tomorrow. It also limits how aggressively India can respond if global demand tightens or shifts suddenly.

China, by contrast, is expanding acreage under a more centrally coordinated system, with cost structures that allow faster adjustment.

What Global Red Chilli Buyers Are Really Optimising For

The global red chilli market has matured. Buyers are no longer chasing novelty or origin stories. They are optimising supply chains.

Across West Asia, Europe, and the Americas, buyers are increasingly focused on measurable parameters—Scoville heat units, ASTA colour value, residue compliance, and processing readiness. Reliability matters more than branding. Documentation matters more than packaging.

India still enjoys an advantage in varietal diversity and long-standing trade relationships. But buyers are now comfortable sourcing from multiple origins to manage risk and pricing volatility.

This is where China’s presence becomes less about displacement and more about leverage.

What Indian Exporters Need to Read Correctly

Exporters who live off spot demand and price calls usually feel the squeeze first. The ones who tend to hold their ground are those who already know where their chillies end up — in food processing lines, oleoresin units, or pharmaceutical blends — and plan production around that reality.

At this stage, exporting red chillies in bulk isn’t just about moving tonnage. It’s about acting like a supply partner who understands repeat use, not a seller chasing the next deal. In practice, consistency, processing capability, and market awareness matter more than how many acres were planted.

A Market Raising Its Standards, Not Shrinking

Even with all the noise, red chillies remain one of the steadier pillars of global agro trade. Demand doesn’t sit in one corner. It comes from food manufacturers, pharma buyers, colour extractors, and processors — often at the same time.

China’s entry hasn’t taken demand away. What it’s done is raise the bar.

India still sits in the strongest position globally when it comes to red chillies. But that position isn’t automatic anymore. It increasingly depends on how quickly exporters adjust to a market that’s sharper, better informed, and far less sentimental about tradition.

The next phase of the red chilli trade won’t be decided by who grows the most. It will be shaped by who understands buyers well enough to stay relevant when conditions change.