Key highlights:

- Herbal exports don’t spike overnight. Demand builds slowly, mostly because the same ingredients keep getting reused across pharma, food, and personal care.

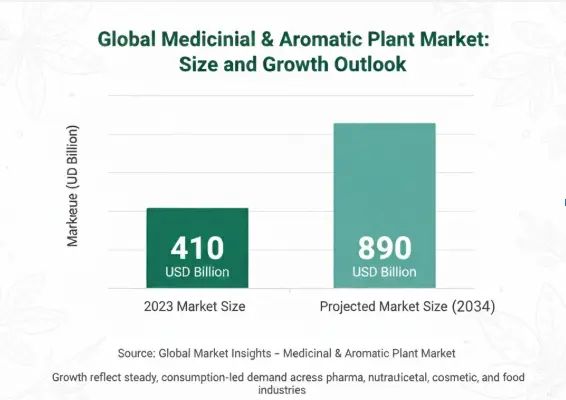

- The medicinal and aromatic plant market is already massive — well into the hundreds of billions of dollars — and it’s no longer operating on the margins of global trade.

- Herbs like turmeric, ashwagandha, ginger, tulsi, and senna keep moving because buyers come back for them, not because someone is chasing a trend.

- In real buying conversations, specs and lab reports usually matter more than stories, branding, or fancy packaging.

- Demand isn’t sitting in one place either. Europe, North America, Southeast Asia, and the Middle East all pull volume in different ways, which spreads risk for exporters.

Introduction to Herbal Commodity Market:

Herbal commodities don’t suddenly become “trending.” They build quietly. Demand grows in pockets, and a formulation changes here, a regulation shift there. While by the time exporters notice, buyers are already locking in supply. That’s where the herbal export story is headed as we move into 2026.

Global demand for medicinal and aromatic plants is no longer niche or seasonal. It’s structural. According to industry estimates, the broader medicinal and aromatic plant market was valued at over USD 400 billion in the mid-2020s and is projected to almost double over the next decade. That scale matters. It signals that herbal trade is moving out of cottage-industry territory and into mainstream global supply chains.

For exporters, the real question isn’t whether demand exists, it’s which herbs are seeing repeat, contract-driven demand, and why.

Why Herbal Export Demand Is Becoming More Predictable

Herbal commodities used to be driven largely by traditional medicine and regional consumption. That’s changed. Today, demand is coming from multiple directions at once:

- Pharmaceutical companies sourcing plant-based actives

- Nutraceutical brands reformulating with natural ingredients

- Cosmetic manufacturers replacing synthetic compounds

- Food and beverage companies leaning into “clean label” claims

This diversification has one effect exporters care about: stability. When the same raw material feeds three or four industries, demand doesn’t vanish with one regulatory tweak or consumer trend.

That’s why many herbal commodities are now traded with longer planning cycles and more formal procurement processes, not spot buying.

Key Herbal Commodities Likely to Stay in Demand Through 2026

Turmeric (Curcuma longa)

Turmeric remains one of the most consistently traded herbal commodities globally. Its demand isn’t just cultural anymore. Curcumin extraction for supplements and functional foods continues to expand, particularly in North America and Europe.

What keeps turmeric relevant in export markets is not novelty, but standardisation. Buyers now look for defined curcumin content, controlled moisture, and traceability back to origin. Exporters who can supply consistent lots rather than mixed-quality volumes are the ones seeing repeat business.

Ashwagandha

Ashwagandha has crossed an important line: it’s no longer just an “alternative” ingredient. It’s now a regular input in stress, sleep, and adaptogen formulations globally.

Demand growth is strong, but uneven. Buyers increasingly differentiate between root powder, extracts, and standardised withanolide content. This means exporters who understand spec-based selling, not just raw material supply, are better positioned.

Ginger

Ginger sits at the intersection of food and health products, which gives it resilience. It moves as a spice, a herbal ingredient, and a processed extract.

Export demand tends to spike during health cycles, but baseline consumption remains high across Asia, Europe, and the Middle East. Dried ginger, sliced ginger, and ginger powder each have distinct buyer segments — treating them as separate export products matters more than most sellers realise.

Tulsi (Holy Basil)

Tulsi doesn’t make noise in export markets, but it keeps moving. It shows up quietly in herbal teas, immunity mixes, and personal care products, and demand tends to build slowly rather than spike overnight.

Where things usually get stuck isn’t demand — it’s uniformity. Buyers often run into variation in leaf size, colour, or oil strength. Exporters who get drying and sorting right, and can deliver the same quality batch after batch, are the ones who stay in the loop.

Senna Leaves and Pods

Senna is less about branding and more about rules. It moves because it fits cleanly into pharmaceutical and nutraceutical formulations, especially where compliance matters more than presentation.

Buyers look closely at residue levels, moisture, and pharmacopoeia alignment. Volumes don’t jump dramatically year to year, but once contracts are in place, they tend to repeat — which is exactly why senna remains a steady export commodity rather than a trendy one.

What Global Buyers Are Actually Looking For

Across herbal commodities, one pattern is clear: b2b buyers are becoming less flexible on specifications and more flexible on origin.

- They want:

- Defined active content

- Clean lab reports

- Traceability and harvest data

- Consistent processing methods

They are less concerned about:

- Storytelling

- Packaging aesthetics

- Small visual variations

This is good news for exporters who operate at scale and understand documentation. Herbal trade is moving closer to agro-industrial norms than artisanal ones.

Regional Demand Patterns to Watch

Europe and North America continue to anchor demand for extracts, standardised powders, and certified organic herbs. Compliance matters more than price here.

Southeast Asia is emerging as a processing hub, importing raw herbs for value addition before re-export.

The Middle East remains a steady buyer of whole herbs and powders, particularly those linked to traditional remedies.

Africa is still a smaller herbal import market, but demand for basic medicinal plants is slowly rising alongside healthcare access.

Where Exporters Often Get It Wrong

Many herbal exporters still approach the market like a spot trade — selling what they have, when they have it. That works less and less.

The herbal product exporters gaining ground are the ones who:

- Plan procurement against buyer demand

- Segment products by use, not just name

- Treat documentation as part of the product

- Invest in grading and storage

Herbal commodities reward patience and process more than aggressive pricing.

Looking Ahead to 2026

Herbal exports are not headed for a speculative boom. They’re settling into something more valuable: predictable, consumption-led growth.

As global industries continue to replace synthetic inputs with plant-based alternatives, demand will spread across more herbs — but it will also become more selective.

For exporters, the opportunity in 2026 isn’t chasing every new “super herb.” It’s understanding which commodities already sit inside global supply systems — and learning how to supply them properly.

That’s where the real export growth will come from.

-(2).webp)