Red Pulses Trade Insights: What Makes India a Top Export Hub

Just like any other agro commodity, the global trade in pulses has always been influenced by dietary shifts, price competitiveness, and regional production strengths. Red lentils (Masoor dal) occupy a commanding position due to their versatility in consumption, nutritional density, and ease of processing within this category. For businesses that import red pulse, India definitely emerges as a decisive player, both in production and exports.

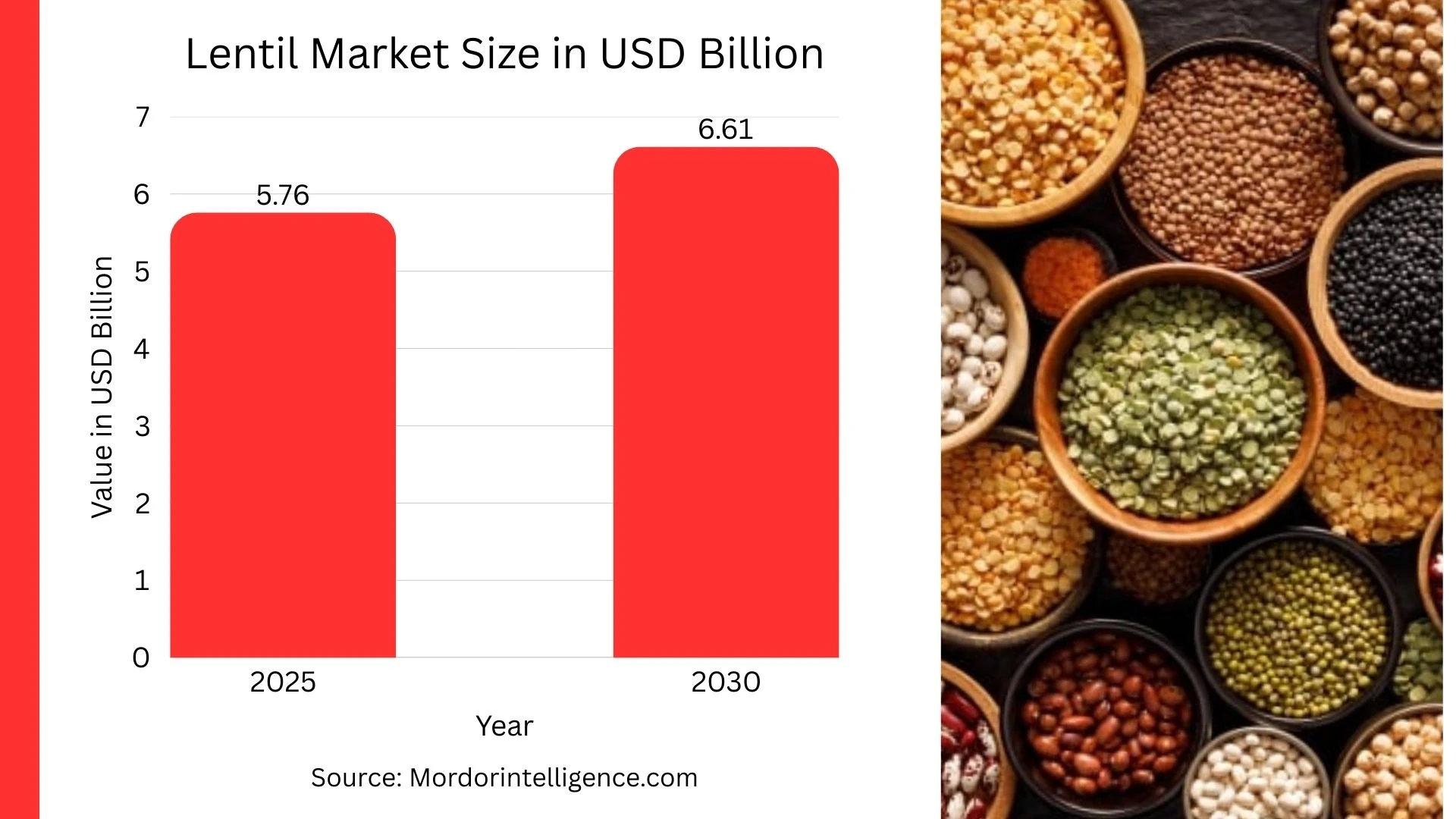

According to market projections, the lentil market size is estimated at USD 5.76 billion in 2025 and is expected to grow to USD 6.61 billion by 2030, registering a CAGR of 2.8%. This steady expansion is on account of rising protein demand in South Asia, the Middle East, and Western markets and also alongside a steady momentum in processed food industries that majorly rely on lentil flour and value-added pulse derivatives.

The Relevance of Red Lentils in Global Food Trade

Red lentils represent a staple in global trade, which can be attributed to their short cooking time, high protein-to-price ratio, and adaptability in multiple cuisines. Unlike green or black lentils, red lentils break down faster during cooking, which makes them an important ingredient in soups, stews, and ready-to-eat food categories. This positions them as a key commodity for food processors, institutional buyers, and bulk red pulse sellers who seek to diversify their export portfolio into pulses

From a B2B standpoint, red lentils offer flexibility in contract negotiations because of the availability of multiple grades (FAQ, SQ), each certified by quality grading systems based on moisture content %, impurity levels %, and broken percentage. Trade is also governed by documentation standards such as HS Code classification, SGS inspection, fumigation certificates, and phyto-sanitary certifications—all of which add layers of assurance for international buyers.

India's Position as a Key Exporter

India's role in red lentil exports is both strategic and supply-driven. As per Volza's India Export Data, between June 2024 and May 2025, India shipped 2,473 consignments of red lentils to global destinations. These shipments came from 231 Indian red lentil exporters catering to 379 international buyers, reflecting the strength of India's fragmented yet resilient export ecosystem.

However, this period recorded a -24% decline in exports compared to the previous twelve months. Despite this dip, in May 2025 alone, India shipped 179 consignments, maintaining a stable year-on-year growth of 0%. This indicates resilience even amid fluctuating production and tariff considerations.

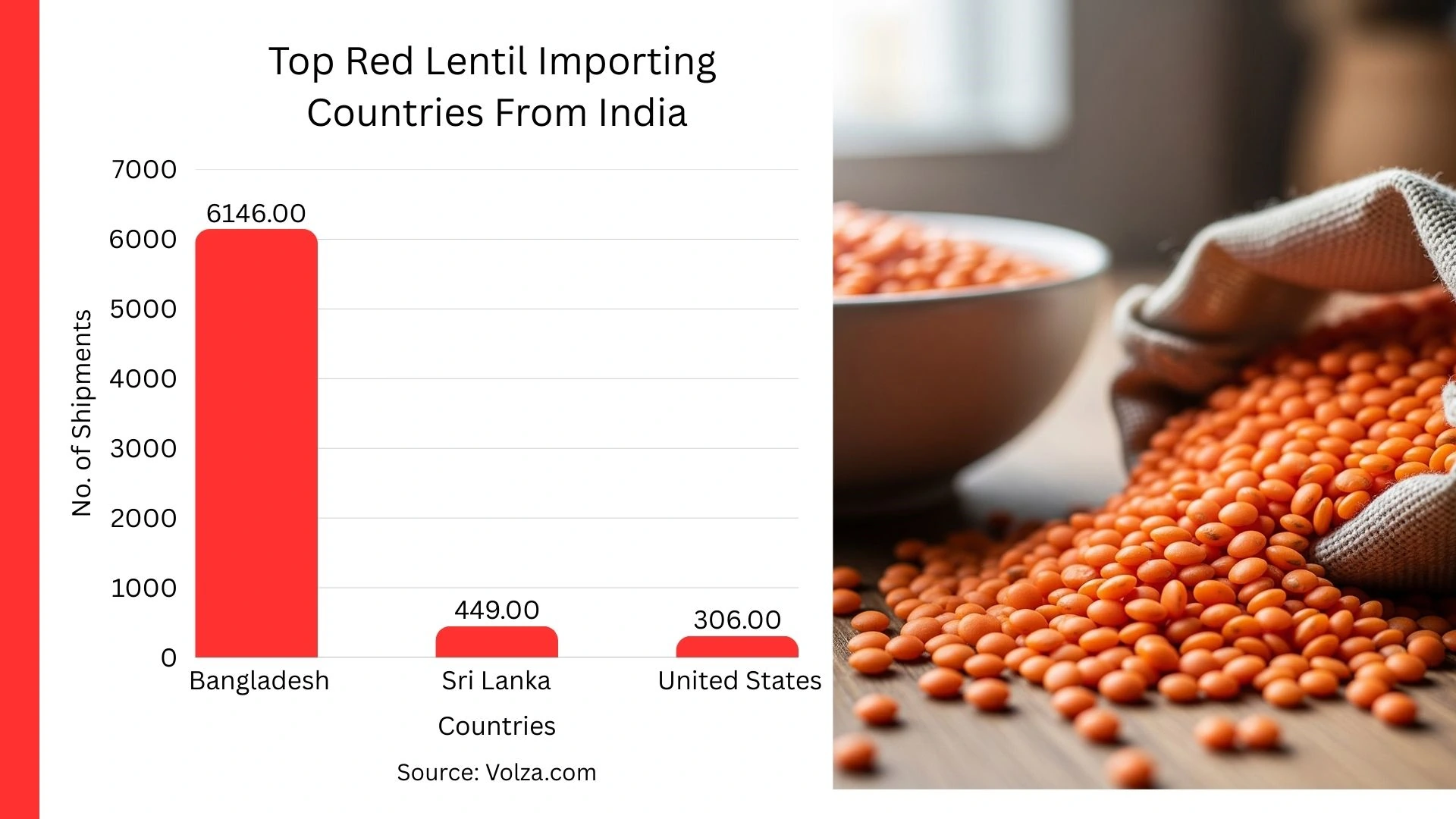

India's primary export destinations include Bangladesh, Sri Lanka, and the United States, where Indian pulses are entrenched in both wholesale and retail supply chains. For buyers who import red pulse, India remains an irreplaceable origin point due to its xBangladesh, Sri Lanka, and the United States.

Key Producing States in India

Red lentils in India are primarily grown in the central and eastern states. Major contributors include:

Top Red Lentil (Masur) Producing States in India

- Uttar Pradesh - Contributes the largest share (~36%) to India's red lentil output, with vast cultivation areas spread across the eastern and central zones of the state.

- Madhya Pradesh - Accounts for ~34-35% of production, largely concentrated in rain-fed belts, making it a key hub for bulk supply.

- West Bengal - Holds around ~10% share, with red lentil integrated into diverse crop rotations, supporting steady output.

- Bihar - Produces ~8-9% of the national volume, backed by fertile Gangetic plains known for pulse cultivation.

- Jharkhand - Contributes ~4-5%, with increasing acreage and improving productivity boosting its role in India's lentil economy.

These regional clusters underpin India's ability to sustain export commitments despite weather uncertainties or input cost volatility.

Comparative Position in Global Exports

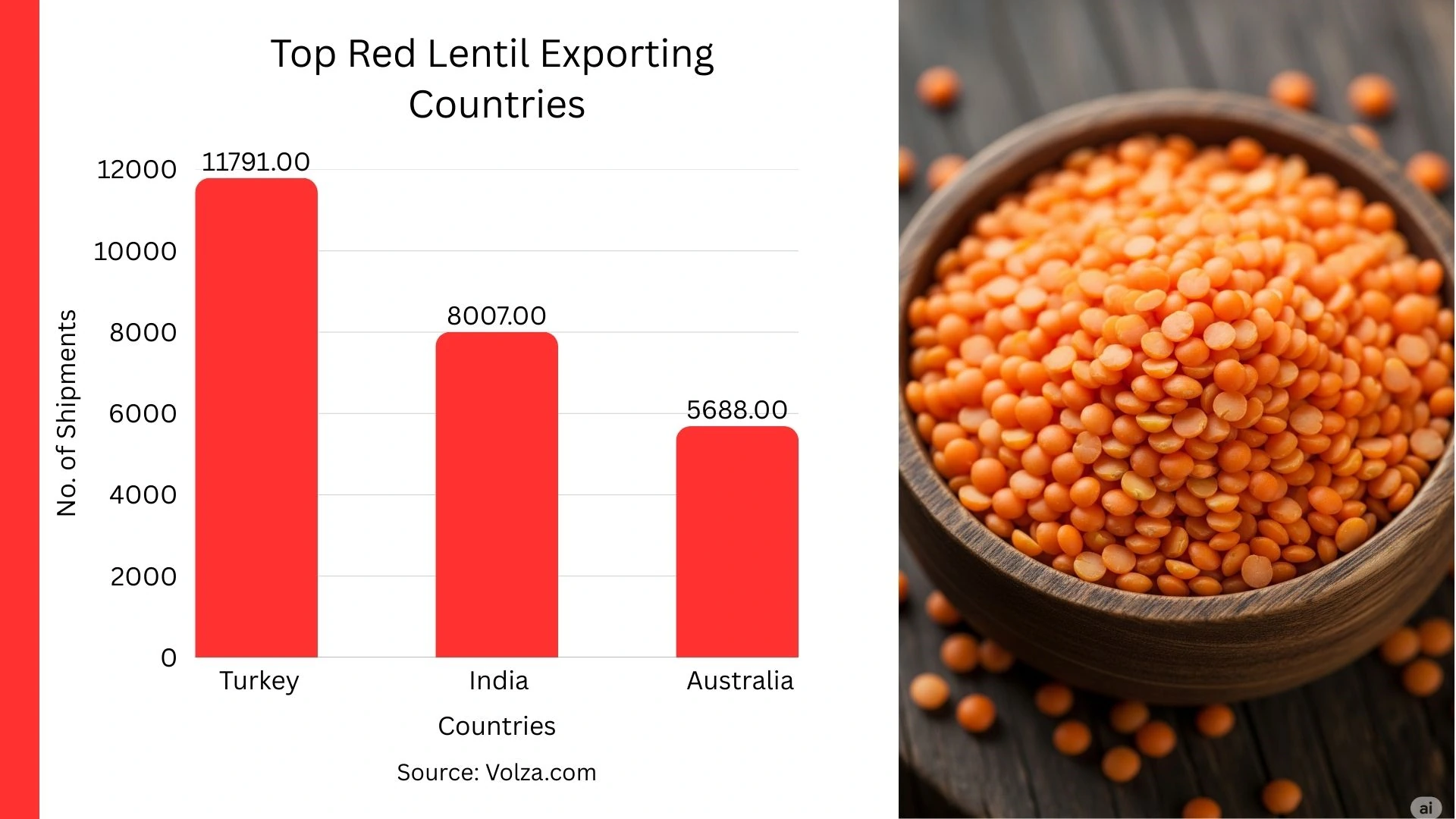

Globally, Turkey, India, and Australia are the top three red lentil exporters. According to shipment statistics:

This pecking order underscores how India consistently retains the second position, outpaced only by Turkey, while comfortably ahead of Australia in total consignments.

B2C Commercial Value Differentiation

For businesses looking for sourcing origins, the B2C pricing of red lentils highlights interesting disparities.

| Country | B2C Commercial Value (avg retail/wholesale) | Market Position | Key Differentiator |

|---|---|---|---|

| Turkey | High - premium positioning in Middle East & EU | Market leader | Quality perception, premium packaging |

| India | Moderate - competitive in South Asia, Africa, US | Value-driven | Price efficiency, volume flexibility, variety of bulk grades |

| Australia | Higher than India, lower than Turkey | Mid-premium | Consistency, clean grading, niche buyers |

This cost differential makes India particularly attractive for red lentil suppliers looking to integrate pulses into their contract portfolios. Buyers often find Indian red lentil exporters consignments advantageous when negotiating FOB contracts, particularly under bulk bag (25kg/50kg PP bag) packaging formats

Compliance and Trade Standards

Another factor that cements India's status as a reliable hub is its adherence to global compliance protocols. Export shipments routinely include:

- HS Code references for customs valuation.

- Phyto-sanitary certificates to meet plant health requirements.

- SGS inspections and fumigation certificates to assure buyers of quality.

- Grading reports certifying FAQ and SQ standards.

These frameworks minimize disputes, protect importer interests, and ensure Indian exporters retain credibility in competitive tenders.

Outlook for Red Lentil Trade

Looking ahead, India's role as a red lentil exporter will be defined by three converging dynamics:

- Regional Demand Pull: Bangladesh, Sri Lanka, and Middle Eastern buyers will continue to absorb Indian supply due to freight proximity and lower landed cost.

- Policy Adjustments: Tariff negotiations and minimum support price (MSP) adjustments could either spur higher export volumes or restrain outward trade.

- Festive & Institutional Demand: Seasonal spikes in both domestic and export demand will require red lentil suppliers to maintain flexible inventory systems.

Despite a 24% year-on-year decline, India's stature in red pulses remains secure, buoyed by competitive pricing, diverse grower networks, and compliance-backed shipments. For global buyers seeking to import red pulse or buy red pulse in bulk, India offers not just supply but also a trusted trade ecosystem anchored in decades of market resilience.

Conclusion

India may not be the largest red lentil exporter, but it sits at the strategic confluence of scale, price competitiveness, and trade compliance. With Turkey leading on premium positioning and Australia catering to niche buyers, India's sweet spot lies in servicing mass-volume buyers with competitive terms. For importers navigating global pulse supply chains, India remains not just an option—but a cornerstone.