Plant-Based Protein Boom: Why Pulse Exports Are Skyrocketing

Key Highlights:

- Global Shift Toward Pulses: Rising demand for plant-based protein, climate-resilient crops, and food security concerns is making them reliable commodities for importers and exporters alike.

- Strategic Advantages: Pulses offer long shelf life, easy bulk transport, and minimal cold chain needs, making them reliable commodities for importers and exporters alike.

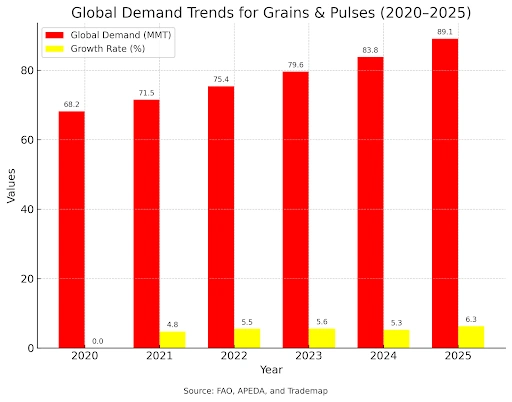

- Measured Growth: From 2020 to 2025, global demand for Indian grains and pulses expanded at a CAGR of 6.2%, confirming their role as drivers of agricultural trade.

- Export Portfolio Strength:

- Basmati rice dominates with over 70% global trade share.

- Wheat, maize, sorghum, and millets address mass consumption and health-focused demand

- Chickpeas, lentils, pigeon peas, black gram, and green gram power diverse international cuisines.

- Specialty grains like amaranth and horse gram tap into premium and vegan markets.

- Institutional Support: APEDA and other agencies provide certification, incentives, and trade facilitation to ensure global compliance and buyer confidence.

- 2025 OutlookClimate disruption and regional shortages are increasing reliance on India as a stable and dependable supplier of bulk pulses. Importers are shifting toward long-term, strategic contracts.

- Pro Tip: Platforms like Tradologie.com connect verified suppliers with global buyers, enabling secure, transparent, and efficient bulk pulse trade.

Introduction:

The pulse trade has entered a phase where numbers tell a sharper story than adjectives. Exports of cereals and pulses are not simply “rising” in 2025; they are expanding in measurable ways that confirm their centrality to global food systems. For Indian Pulses Traders, producers, and agri-enterprises, this is not a passing wave but a structural shift that places pulses at the very heart of plant-based protein demand.

Why Pulses Are Commanding Attention

Global consumers are recalibrating diets, guided less by fads and more by structural forces—food security concerns, the pursuit of climate-resilient crops, and a definitive shift toward protein alternatives. For importers in North America, Europe, and Asia, pulses have become a cornerstone ingredient in vegan and clean-label product portfolios.

Unlike perishable goods, pulses carry strategic trade advantages. They are easy to store, resilient in bulk transport, and require minimal cold chain infrastructure. For bulk pulses exporters, this means the ability to guarantee steady volumes without disproportionate logistical risk. For importing nations, it translates into confidence that shipments will not collapse under climate or transit disruptions.

Data That Anchors the Trend

The momentum is quantifiable. Between 2020 and 2025, reports from FAO, APEDA, and Trademap show that global demand for Indian grains and pulses has expanded at a compound annual growth rate (CAGR) of 6.2%. Such figures validate what traders already sense on the ground—pulses are no longer niche commodities but strategic drivers of global agricultural trade.

Commodities That Lead the Export Charge

The breadth of India's commodity portfolio allows exporters to address multiple layers of demand, from high-margin niches to mass-volume staples.

- Basmati Rice remains the flagship, with India controlling more than 70% of global trade. Iran, Saudi Arabia, the UAE, and the USA remain anchor buyers.

- Wheat varieties such as Lokwan, Sharbati, and Durum find steady demand in Bangladesh, Sri Lanka, and Afghanistan.

- Maize (corn) is channeled into animal feed and starch industries in Malaysia, Vietnam, and Indonesia.

- Sorghum (jowar), prized for drought resistance, secures markets in Nigeria, Sudan, and Kenya.

- Millets (bajra, ragi, foxtail), backed by the UN's “International Year of Millets,” are gaining traction in health-focused markets like the USA, Germany, the UK, and Japan.

- Chickpeas (Kabuli and Desi) fuel hummus, snacks, and vegan meals across Pakistan, UAE, Turkey, and Algeria.

- Lentils (masoor) move into Canada, Egypt, and Bangladesh on the back of their protein-dense profile.

- Pigeon Peas (tur/arhar) form part of the trade link with Mozambique, Caribbean islands, and Kenya.

- Black Gram (urad) finds culinary uses in Fiji, Sri Lanka, and Mauritius.

- Green Gram (moong) caters to Vietnam, UAE, and Malaysia, serving soups, salads, and specialty foods.

- Barley continues to be a dual-use commodity for beer and feed in Iran and Saudi Arabia.

- Amaranth Grain, with its superfood appeal, targets the USA, Canada, and Germany.

- Horse Gram—once obscure—has entered niche vegan markets in North America and Europe due to its iron and protein density.

For bulk pulses suppliers, this diversification means no single market shock derails the export trajectory; for buyers looking to import pulses in bulk, it means choice aligned with both taste and nutrition trends.

Institutional and Policy Support

India's export architecture is not left to market forces alone. Bodies such as APEDA are actively pushing cereals and pulses into international markets through incentives, certification programs, and trade agreements. Their role ensures that Indian shipments do not face rejection in premium destinations due to safety or quality issues.

Such institutional scaffolding gives bulk pulses sellers confidence that the regulatory ground beneath them is firm, and it signals to buyers that compliance with global standards is embedded in the trade ecosystem.

Why 2025 Represents a Structural Opportunity

The global pivot toward pulses is not accidental. Climate disruption has reduced local production in several importing regions, from drought-hit Africa to geopolitically strained Eastern Europe. As availability contracts, import reliance grows. That reliance is increasingly directed at India, whose production capacity and established export routes make it a dependable anchor in unstable times.

This is why bulk pulses exporters are seeing not just an uptick in orders but a change in how buyers approach contracts—longer-term, forward-looking, and increasingly strategic.

Want to export or import pulses in bulk? Visit www.tradologie.com