How Coffee Bean Origin Affects Export Pricing

Key Highlights : How Coffee Bean Origin Shapes Export Pricing (HS Code 0901)

- Under HS Code 0901, coffee prices don't really move on headlines alone. They move on basics — how much a country can ship, how reliably it ships, and how often buyers give big orders.

- Arabica origins like Colombian Milds don't earn higher prices because of storytelling. They earn them because supply is tight and buyers know what they'll get, shipment after shipment.

- Brazil sets the tone for volume trade. Scale and currency swings give it room to price aggressively, but that same scale keeps a lid on how far premiums can stretch.

- Robusta exporters play a different game altogether — cost control, steady output, and contracts that feed blends, instant coffee, and foodservice at scale.

- When stocks are low and currencies move, origin differences stop being theoretical. They show up directly in price gaps — and that's where buyers and exporters feel it fastest.

Introduction:

In the global coffee trade, price is rarely just a number. It is a signal—of origin, of reliability, of risk, and of reputation. While futures markets and short-term supply shocks influence daily movements, coffee bean origin remains one of the most powerful long-term determinants of export pricing.

For global coffee exporters, importers, and institutional buyers alike, understanding how origin shapes price is no longer optional—it is strategic.

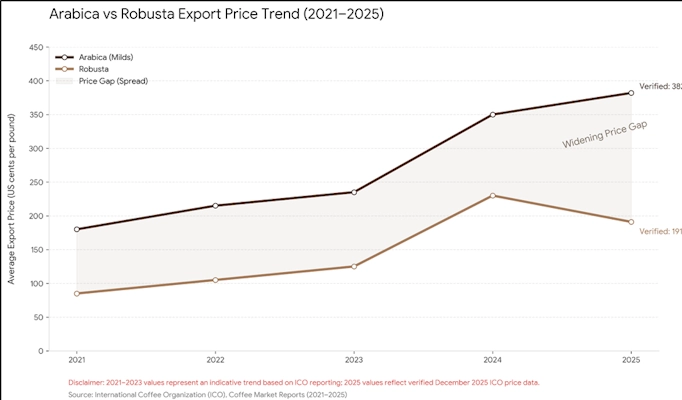

Over the last five years, global coffee trade has made one thing increasingly clear: coffee is not priced equally, because coffee is not produced equally.

Origin Is Not Geography—It Is Economics

At a surface level, origin simply refers to where coffee is grown. In trade reality, origin represents a bundle of economic attributes: production cost structures, quality consistency, supply discipline, currency exposure, infrastructure maturity, and buyer trust.

This is why coffee from Colombia, Brazil, Vietnam, or Uganda does not merely differ in taste—it differs in export pricing logic.

The International Coffee Organization's classification into Colombian Milds, Other Milds, Brazilian Naturals, and Robustas is not arbitrary. These categories reflect how the market prices origin-based risk and value.

Origin Is a Pricing Signal, Not a Label

Coffee origin is not just geography. In export markets, origin represents a bundle of economic realities: production scale, cost structures, quality consistency, currency exposure, and supply discipline.

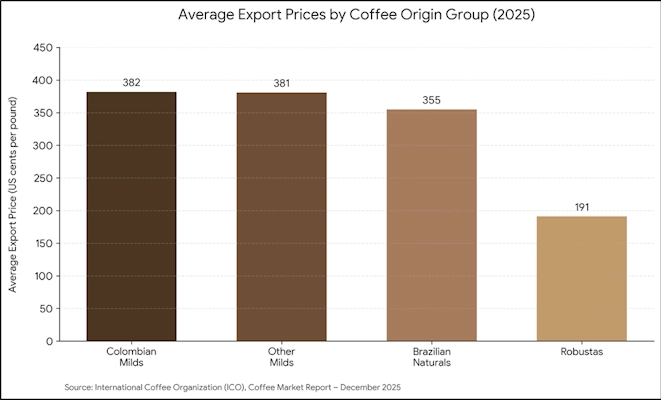

These groups reflect how the market prices risk, reliability, and reputation. In December 2025 alone, average export prices across these origins showed stark differences:

- Colombian Milds: ~382 US cents/lb

- Other Milds: ~381 US cents/lb

- Brazilian Naturals: ~355 US cents/lb

- Robustas: ~191 US cents/lb

These gaps are not temporary distortions. They are structural price tiers.

Why Arabica Origins Command Structural Premiums

Arabica-producing origins—particularly Colombian Milds and Other Milds—have consistently traded at a premium over other coffee groups. This premium is not speculative; it is structural.

Colombian Milds, for example, represent more than washed Arabica beans. They represent:

- A long-standing reputation for quality

- Stable export protocols

- Tight supply discipline

- Limited capacity for aggressive volume expansion

In recent years, Colombian exports have approached operational ceilings, meaning additional demand cannot be easily met with additional supply. From a pricing perspective, this creates inelastic supply, which naturally sustains higher export prices.

Other Milds — from places like Peru, Honduras, or Ethiopia — often trade close to Colombian prices, but they don't always move as steadily. Harvests can swing from year to year, weather plays its part, and logistics aren't always predictable.

So prices tend to wobble a bit, even when the cup quality stays strong.

For global coffee exporters, the lesson is pretty straightforward. Buyers dont pay premiums on taste alone. They pay for reliability — knowing the same quality will arrive, on time, shipment after shipment.

Brazilian Naturals: Scale Creates Price Power—But Caps Premiums

Brazil occupies a unique position in global coffee pricing. Brazil benefits from scale, logistics efficiency, and diversified production across regions as the world's largest producer. This allows Brazilian coffee exporters to price competitively. And this is more for even high-volume contracts.

However, scale is a double-edged sword.

Brazilian Naturals typically trade at a discount to Colombian and Other Milds—not because of inferior quality, but because:

- Large production volumes reduce scarcity premiums

- Cyclical “on-year/off-year” harvests introduce supply swings

- Currency movements (especially Brazilian real depreciation) allow exporters to lower USD prices without hurting local margins

In effect, Brazil trades pricing flexibility for premium ceilings. It dominates volume-driven trade but rarely captures the highest per-unit export values.

For bulk buyers, Brazilian origin often becomes the benchmark for value pricing in Arabica.

Robusta Origins and the Economics of Cost Leadership

Robusta-producing origins such as Vietnam, Uganda, and Indonesia operate on a fundamentally different pricing model. Here, the export price is less about brand or cup profile and more about cost efficiency and reliability.

Robusta exports have grown aggressively in recent years, supported by:

- Higher yields per hectare

- Lower production costs

- Strong demand from instant coffee, foodservice, and blended products

Vietnam's exports have found their rhythm again. In this trend, Uganda keeps quietly adding capacity, and Indonesia just continues doing what it has always done and it steady, dependable output. Put together, it tells you something simple: Robusta isn’t priced on image or prestige. It moves on demand.

When Arabica prices started climbing too high for comfort, many importers didn't debate for long. They simply adjusted their blends and leaned more heavily on Robusta. Volumes followed naturally. Even when prices cooled, shipments didn’t.

For Robusta exporters, the edge rarely comes from charging a premium. It comes from showing up season after season with the same quality, the same reliability, and the ability to ship at scale without surprises.

Supply Cycles and Why Some Origins Are More Volatile

Not all origins respond equally to market shocks.

Origins with:

- Cyclical harvests

- Weather-dependent yields

- Concentrated production zones

tend to exhibit sharper price volatility.

Brazil's Arabica cycles, Peru's biennial output, and Ethiopia's weather sensitivity all translate into export price swings. In contrast, origins with more stable production systems and controlled growth show greater price resilience.

Low Inventories Amplify Origin-Based Pricing

The global inventories have tightened dramatically over the last 5 years.

- European consumer stocks fell from ~15 million bags (2022/23) to ~7.9 million bags by late 2025

- ICE-certified Arabica stocks in the US declined to ~0.48 million bags

Low inventories make markets hypersensitive to origin-specific news—weather in Brazil, flooding in Indonesia, or export disruptions in Africa.

In such conditions, origin matters more, not less.

Price Differentials Are Signals, Not Arbitrage Gaps

The persistent price gaps between origins—often exceeding 150-190 US cents per pound between Arabica Milds and Robustas—are sometimes misinterpreted as market inefficiencies.

In reality, these differentials signal:

- Risk premiums

- Quality expectations

- Contract reliability

- Long-term supply confidence

They are not short-term anomalies. They are structural expressions of origin economics.

What This Means for Exporters

Exporters must recognize the lane they operate in.

Premium-origin exporters should focus on:

- Quality assurance

- Traceability

- Long-term buyer relationships

- Defending price integrity

Volume-origin exporters should focus on:

- Cost optimization

- Logistics efficiency

- Consistency

- Scale-driven contracts

Trying to compete outside one's structural advantage often leads to margin erosion.

What This Means for Importers

For importers and roasters, origin-based pricing is a strategic lever.

Understanding origin economics allows buyers to:

- Optimize blend formulations

- Hedge price risk

- Balance margin and quality

- Secure long-term supply stability

In an increasingly volatile global commodity environment, origin intelligence is pricing intelligence.

Final Thought: Origin Is the Market's Memory

Coffee markets move daily, but origin remembers.

Prices fluctuate, futures swing, and headlines change—but the economic DNA of an origin shapes export pricing year after year. In the global coffee trade, origin is not just where coffee comes from. It is why it is priced the way it is.

And for those who understand that distinction, pricing becomes strategy—not speculation.