Global Corn Trade Analysis: How China's Imports and U.S. Exports Shape the Market

Key Highlights:

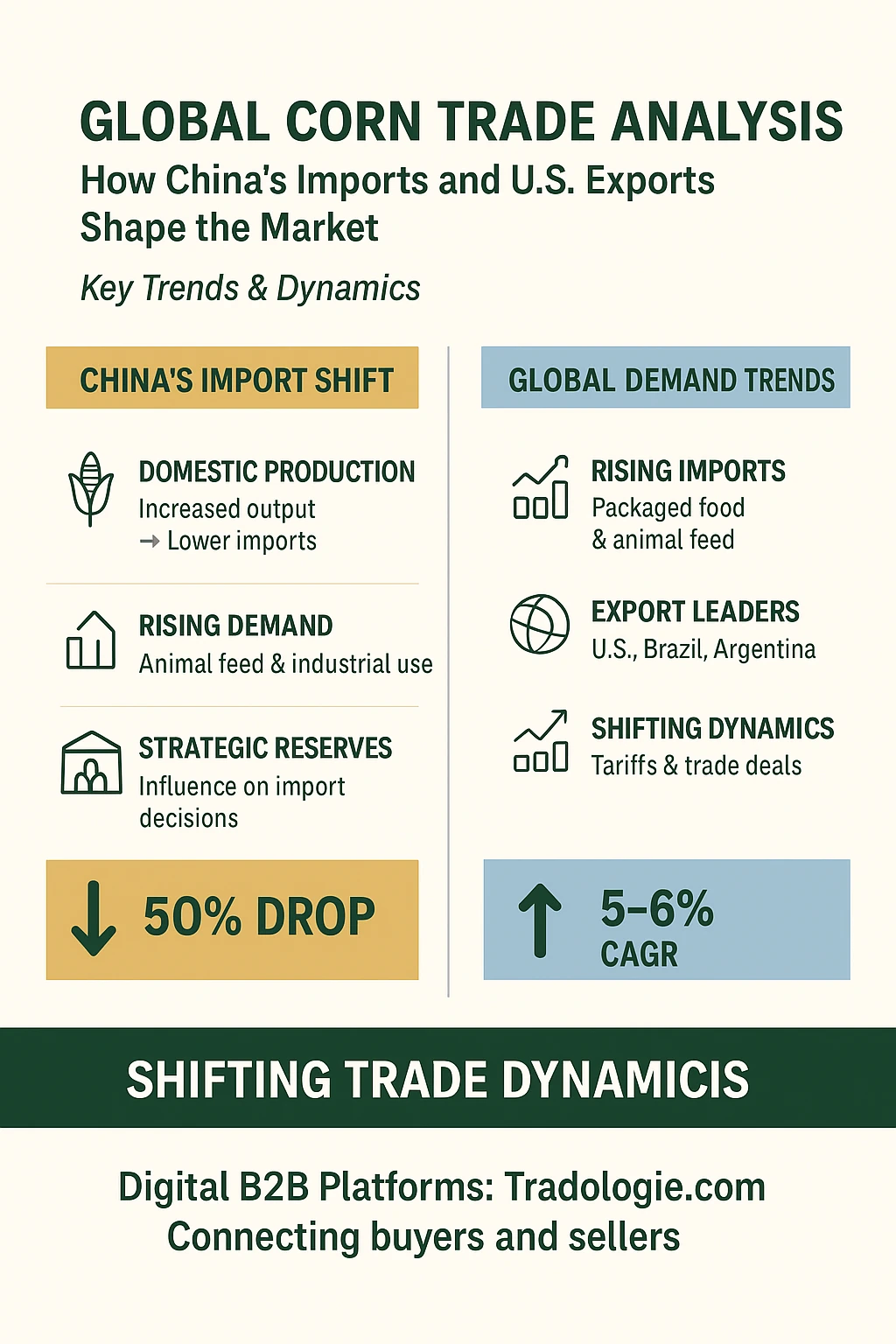

- China's Import Shift : Corn imports in China were first expected to be very high, but as domestic production increased, imports dropped sharply, showing China is becoming more self-reliant.

- U.S. Export Role : The U.S. continues to be a major corn supplier, though export volumes change depending on market conditions and political factors.

- Shifting Trade Dynamics : Global corn trade keeps changing because of tariffs, trade deals, and shifting demand. Digital B2B Platforms Tradologie help buyers and sellers adjust and trade more efficiently.

Key Highlights:

Corn is highly popular in both the US and China, with the US being the largest producer and China traditionally the biggest importer. In both economies, corn is mainly used for animal feed and industrial processing. Historically, the US has been a leading exporter of corn to China, which remains the most significant destination for this globally traded commodity.

For corn exporters seeking reliable buyers, especially in these markets, understanding key trends is essential. Let's explore them. This article examines China's corn import patterns, the US's export role, and implications for global trade.

China's Role in the Global Corn Market

China, once a net exporter, has transformed into the largest corn importer. This shift is driven by:

- Domestic Production Constraints : Even though China is one of the top Corn producers, its yields face challenges from environmental issues and land use changes. Bad weather, rising input costs, and water shortages in key farming regions have created more pressure on output.

- Rising Demand : The growing use of corn in livestock feed and industries has gone beyond what domestic production can cover. Corn is vital for pork production, which is a major part of China's food culture. Demand has also risen sharply from the starch, ethanol, and bio-chemical sectors, putting more strain on supply.

- Strategic Reserves : China keeps large corn reserves that play a big role in import decisions and price stability. At times, the government releases these reserves to cover shortages and control inflation in local markets.

In the 2024/25 marketing year, China's corn imports were initially estimated at 27.1 million metric tons, but increased domestic production cut imports by almost half, to approximately 13 MMT. This sharp decline underscores China’s growing reliance on local corn production.

Major Corn Exporters to China

China sources corn from several countries:

- Brazil : Brazil has become an important corn supplier to China, with exports rising as demand grows. It gains from competitive pricing, big harvests, and favorable trade deals that have expanded its market share in recent years.

- Ukraine : Ukraine has long been a key corn exporter, but its share has shifted because of geopolitical tensions and regional conflicts. Even with these issues, Ukraine still supplies a good amount when production remains steady.

- United States : U.S. exports to China have gone up and down, but it still holds a strong role in the import market. Reliable quality, efficient logistics, and long-standing trade links keep the U.S. competitive.

- Others : Countries such as Argentina and Russia also supply corn to China, though in smaller amounts. They often step in when major suppliers face disruptions or when they offer better prices.

U.S. Corn Exports to China

The US remains a key global corn exporter, though trade with China has varied:

- 2024/25 Exports : U.S. exported around 2.75 billion bushels of corn worldwide, with some going to China. These exports are vital for American farmers, especially when domestic stocks are high and need balancing.

- Trade Agreements : The Phase One trade deal of early 2020 boosted corn sales to China, but political factors continue to affect this relationship. Any trade dispute or tension has a direct impact on corn movement.

- Recent Trends : In 2024, U.S. exporters faced hurdles as China cut import volumes and imposed tariffs on farm goods. Currency shifts and rising freight charges also played a role in shaping overall trade levels.

Despite challenges, the U.S. continues as a reliable supplier thanks to infrastructure, quality standards, and the ability to meet large-scale demand.

Global Corn Trade Dynamics

The global corn market is influenced by multiple factors:

- Export Leaders : The U.S., Brazil, and Argentina remain top corn exporters, with Brazil's share rising in recent years. Expanded farmland and better technology have further improved Brazil's position in the export market.

- Import Trends : China continues to lead in corn imports, but countries like Mexico and Japan also play strong roles. Many Southeast Asian nations are importing more corn too, mainly to support their growing livestock industries.

- Market Shifts : Policies, tariffs, and trade agreements keep changing the global corn trade. For instance, issues in the Black Sea region or updates in U.S. farm policy often create ripple effects in worldwide corn prices.

Conclusion

China's reduced corn imports in 2024/25 show a pivot toward domestic production, altering global trade flows. The U.S. continues as a key exporter, and understanding these trends is crucial for stakeholders. Platforms like Tradologie enable direct, transparent trade, connecting buyers and sellers efficiently.