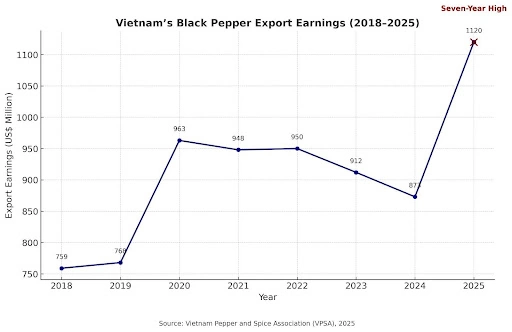

Vietnam has once again reaffirmed its position as the world's preeminent source of black pepper, with export earnings crossing US$1.12 billion in the first eight months of 2025—a seven-year high. For black pepper suppliers, this performance is not merely a statistical milestone but a commercial signal of how Vietnam's pepper industry is shaping the dynamics of global spice trade.

This informative piece of article/newsletter will provide you with the latest development and in-depth analysis on Vietnam's black pepper export industry.

The Commercial Significance of Vietnam in Global Black Pepper Trade

Vietnam accounts for a substantial share of the world's pepper exports, with 166,510 tons shipped between January and August 2025, of which 142,627 tons were black pepper. While export volumes registered a 9.4% decline year-on-year, elevated global prices ensured that value surged.

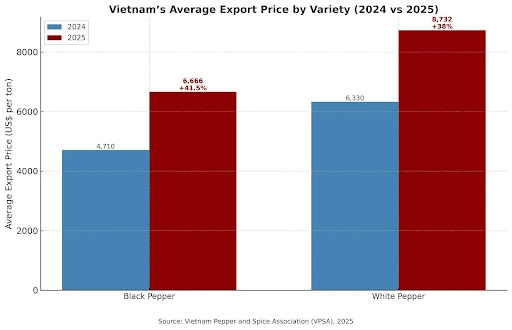

The average export price of black pepper stood at US$6,666 per ton, marking a 41.5% increase compared with last year. This divergence of volume and value highlights the resilience of Vietnam's role as a supplier—not merely dependent on output, but on its strategic positioning as a bulk black pepper trade hub.

For international buyers sourcing at scale, Vietnam's black pepper market offers not just volume but reliability. This is why black pepper manufacturers in Vietnam continue to dominate long-term supply contracts across North America, Europe, and Asia despite fluctuations in harvest sizes.

Demand Dynamics and Market Reach

The U.S. remained the largest buyer, accounting for 21.4% of Vietnam's pepper export value, though shipments declined by 31%. On the other hand, exports to China surged by 58%, with the UAE and India also showing notable growth. This diversification of buyer markets is significant for black pepper suppliers, who must navigate not only pricing but also trade policies and buyer expectations.

The ability of Vietnamese firms to supply to both developed markets like the U.S. and emerging markets such as India underscores the country's agility in adapting to shifting trade currents. For merchant black pepper exporters engaged in bulk black pepper contracts, this flexibility ensures Vietnam remains a strategic sourcing point even when regional demand fluctuates.

The Role of Black Pepper Processors and Manufacturers

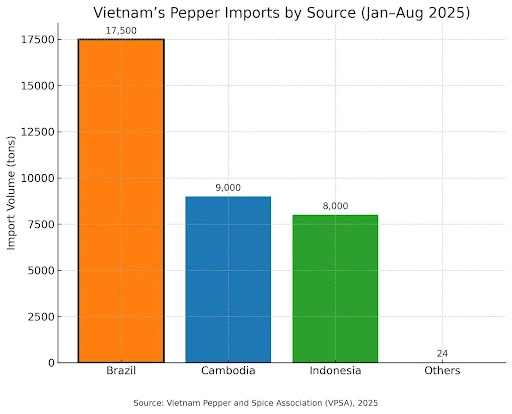

Vietnam's competitive advantage does not lie in farming alone but in its strong network of black pepper processors and manufacturers. By importing raw pepper—over 34,524 tons in the January-August 2025 period from Brazil, Cambodia, and Indonesia—Vietnam is able to blend, process, and re-export at higher commercial value. However, rising reciprocal tariffs, particularly from the U.S., may influence future strategies as firms reconsider transshipment volumes.

This processing-led model gives Vietnam the ability to balance domestic supply shortages with imports, while also meeting international buyers' specifications for quality, grading, and safety standards. For bulk black pepper importers, this translates into fewer disruptions and a steady pipeline of products that meets international compliance requirements.

Domestic Pricing Pressures and Global Implications

Farm-gate prices in Vietnam surged from VND142,000-143,000 per kilogram in late August to VND154,000-155,000 in early September, stabilizing slightly thereafter. For merchant exporters and black pepper suppliers, such fluctuations in the domestic market signal tight raw material availability. As on-farm stocks dwindle, export prices are likely to remain firm in the near term, reinforcing Vietnam's ability to command value in the global market.

In practical terms, this trend creates a pricing floor. Bulk black pepper importers cannot expect the kinds of depressed prices seen in earlier cycles; instead, they must adapt procurement strategies toward locking in supply contracts and engaging with established black pepper manufacturers and processors to secure continuity.

Strategic Considerations for B2B Buyers

For B2B buyers, the Vietnamese black pepper trade offers both opportunities and challenges. On one hand, elevated prices reflect strong market fundamentals—limited supply amid consistent global demand. On the other, Vietnam's vast processing and exporting infrastructure ensures that even in tight markets, buyers can secure bulk black pepper shipments with professional reliability.

In the near term, firms sourcing pepper should prepare for sustained high prices, but also recognize the value proposition that Vietnam brings: scale, consistency, and processing expertise. Strategic relationships with black pepper suppliers in Vietnam are thus less about opportunistic buying and more about building dependable trade pipelines.

Conclusion

Vietnam's pepper industry is no longer just a story of agricultural abundance—it is a case study in how a commodity can be transformed into a structured, globally competitive B2B trade ecosystem. For black pepper importers, Vietnam remains at the core of the global supply chain.

With exports exceeding US$1.12 billion in eight months, and with a deliberate balance between domestic production and imports for reprocessing, Vietnam has consolidated its role as the world's most strategic bulk black pepper hub. For global buyers, the message is clear: in the evolving spice trade, Vietnam is not simply a supplier; it is the cornerstone of commercial reliability.