India’s rice export landscape is entering a renewed phase of expansion—one that exporters, global buyers, procurement houses, and international food brands cannot afford to overlook. After a temporary dip caused by policy-led trade restrictions, India’s rice export engine is accelerating once again, reshaping global B2B rice flows and reinforcing the country’s dominance as the world’s largest rice supplier.

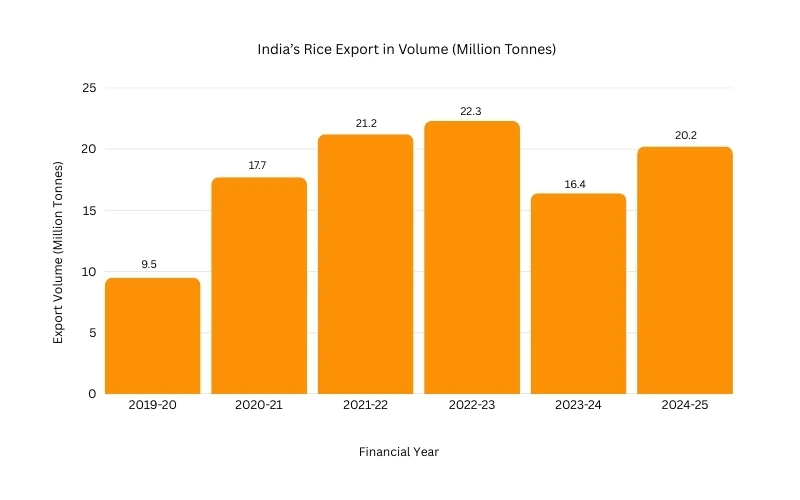

The latest export volumes, as seen in the data shared (2019–20 to 2024–25), reflect a resilient, upward-moving trajectory. India’s rice shipments, which dropped sharply to 16.35 million tonnes in 2023–24 due to the government’s export ban on select non-basmati varieties, have bounced back to 20.2 million tonnes in 2024–25, and are now projected to hit 23.5 million tonnes in 2025–26—a historic breakthrough driven by recovering demand and improved supply stability.

Record-Breaking Trajectory: A Market Reset That Favors Exporters

According to the Indian Rice Exporters Federation (IREF), India is not only returning to normal export levels but is on the verge of surpassing its earlier record of 22.35 million tonnes (2022–23). More importantly for B2B stakeholders, this renewed upward curve signals a stronger, more predictable export environment in the coming years—an essential factor for long-term supply contracts, annual procurement plans, and retail pipeline commitments.

The temporary export restrictions, which had momentarily reduced India’s share in the global rice trade, created supply gaps in Africa, Asia, and the Middle East. However, the resumption of exports in 2024–25 has allowed Indian exporters to reclaim those markets and negotiate fresh contracts at favourable terms. This reset is creating a strategic advantage for exporters who are now positioned to supply into markets recovering from shortfalls.

Non-Basmati: The Volume Driver for High-Growth Markets

With non-basmati rice accounting for nearly 70% of India’s total export volumes, the commodity continues to be the backbone of India’s rice trade. For B2B buyers in Africa and South Asia, non-basmati holds unmatched importance—largely because of its affordability, versatility, and alignment with regional consumption patterns.

The five largest non-basmati destinations—Benin, Guinea, Côte d’Ivoire, Togo, and Bangladesh—contribute 44% of export volumes. These structurally dependent markets rely heavily on India’s consistent supply, presenting exporters with long-term market security. As consumption in Africa continues to grow in double digits, the window for Indian suppliers to diversify product lines—parboiled, white, steamed—has never been wider.

For traders, millers, and exporters, this is the ideal period to maximize outreach, expand into second-tier African markets, and strengthen supply assurance through year-round contracting.

Basmati: Premium Growth Riding on Stable Middle Eastern Demand

While non-basmati brings scale, basmati brings profitability—an equation critical for exporters aiming to optimize margins. With 61.2% of basmati exports going to Saudi Arabia, Iraq, Iran, Yemen, and the UAE, the Middle East remains the epicenter of premium rice consumption.

Basmati’s aromatic profile, brand equity, and cultural relevance assure steady demand even during price fluctuations. With Europe and North America steadily increasing their basmati imports, Indian exporters are well-positioned to expand into high-value retail and private-label supply chains.

As global consumers shift toward premium staples, basmati exporters can leverage this demand to strengthen multi-country distribution networks and lock in higher-value supply agreements.

Exporters Eye the Next Big Milestone: 30 Million Tonnes by 2026–27

The optimism within the exporter community is not unfounded. The combination of record domestic production, improved logistics, stable policy outlook, and expanding global demand is expected to push India’s rice exports toward 30 million tonnes by 2026–27—a level not previously envisioned for the sector.

For B2B players, such scale represents:

- Larger procurement cycles

- Broader trade routes

- New buyers entering the market

- Higher containerized freight movement

- Stronger bargaining power with global distributors

Why This Export Momentum Matters for B2B Stakeholders

The sustained growth of India’s rice exports is more than just a statistical climb—it represents a strategic supply advantage for all players in the global rice value chain. The post-restriction recovery demonstrates India’s unmatched capacity to stabilize global markets when volatility hits.

For exporters, this means:

- Better negotiation leverage with global importers

- Higher predictability for long-term contracts

- Opportunities to penetrate under-served African, CIS, and Latin American markets

- Scope to build private-label relationships with global retailers

- Increased investor confidence in the rice export ecosystem

In a world where food security is becoming a policy priority for many nations, India’s reliability as a rice supplier positions its exporters as indispensable partners in global trade.

Conclusion: A Defining Moment for India’s Rice Exporters

The renewed surge in rice exports is more than a recovery—it is a structural transformation. With export volumes rising, global demand expanding, and new markets opening, Indian rice exporters are entering an era of unprecedented opportunity.

The coming years will reward those who invest in capacity, diversify product portfolios, and build stronger relationships with importers. India’s rice trade is not just rebounding—it is rewriting the rules of global commodity supply.

This is the moment for exporters, millers, traders, procurement agencies, and bulk buyers to scale with confidence and capture a larger share of the multibillion-dollar global rice market.

.webp)