India’s rice exports didn’t surge in 2025 because demand suddenly appeared. Demand was already there. What changed was access.

Once New Delhi lifted the remaining export curbs earlier this year, shipments didn’t creep back into the market; they rushed in. The world’s largest rice exporter simply reclaimed the space it had temporarily stepped away from, and the effect was immediate across prices, volumes, and competitor behaviour.

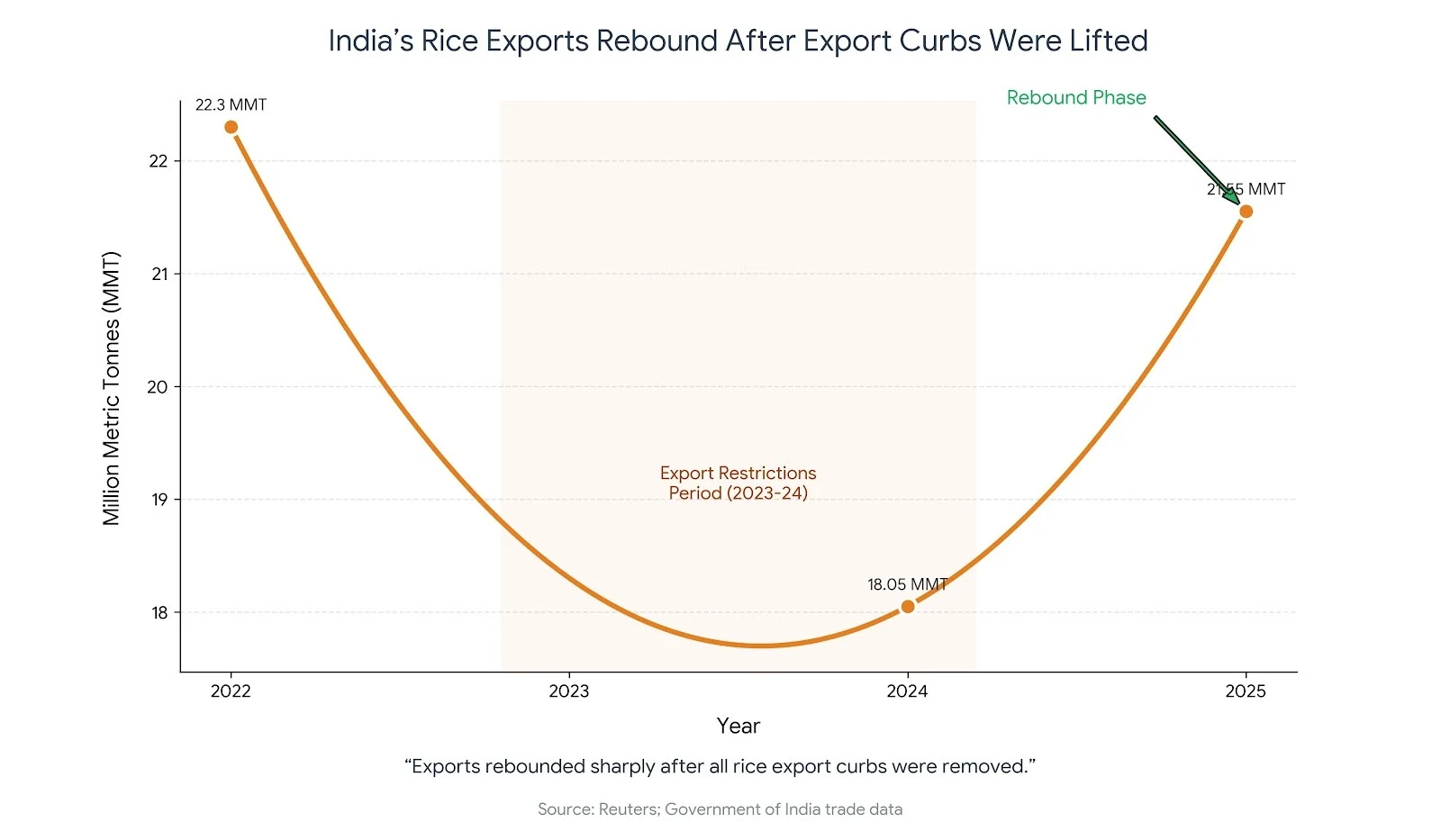

Exports rose to 21.55 million metric tonnes in 2025, up from 18.05 million tonnes in 2024, coming close to the 2022 record of 22.3 million tonnes. That rebound alone explains why Asian rice prices slid to their lowest levels in nearly a decade — and why buyers across Africa suddenly found relief. This wasn’t a policy tweak. It was a release valve and opened new opportunities for the Indian rice exporters.

Non-Basmati Rice Did the Heavy Lifting

If basmati brought value, non-basmati brought volume.

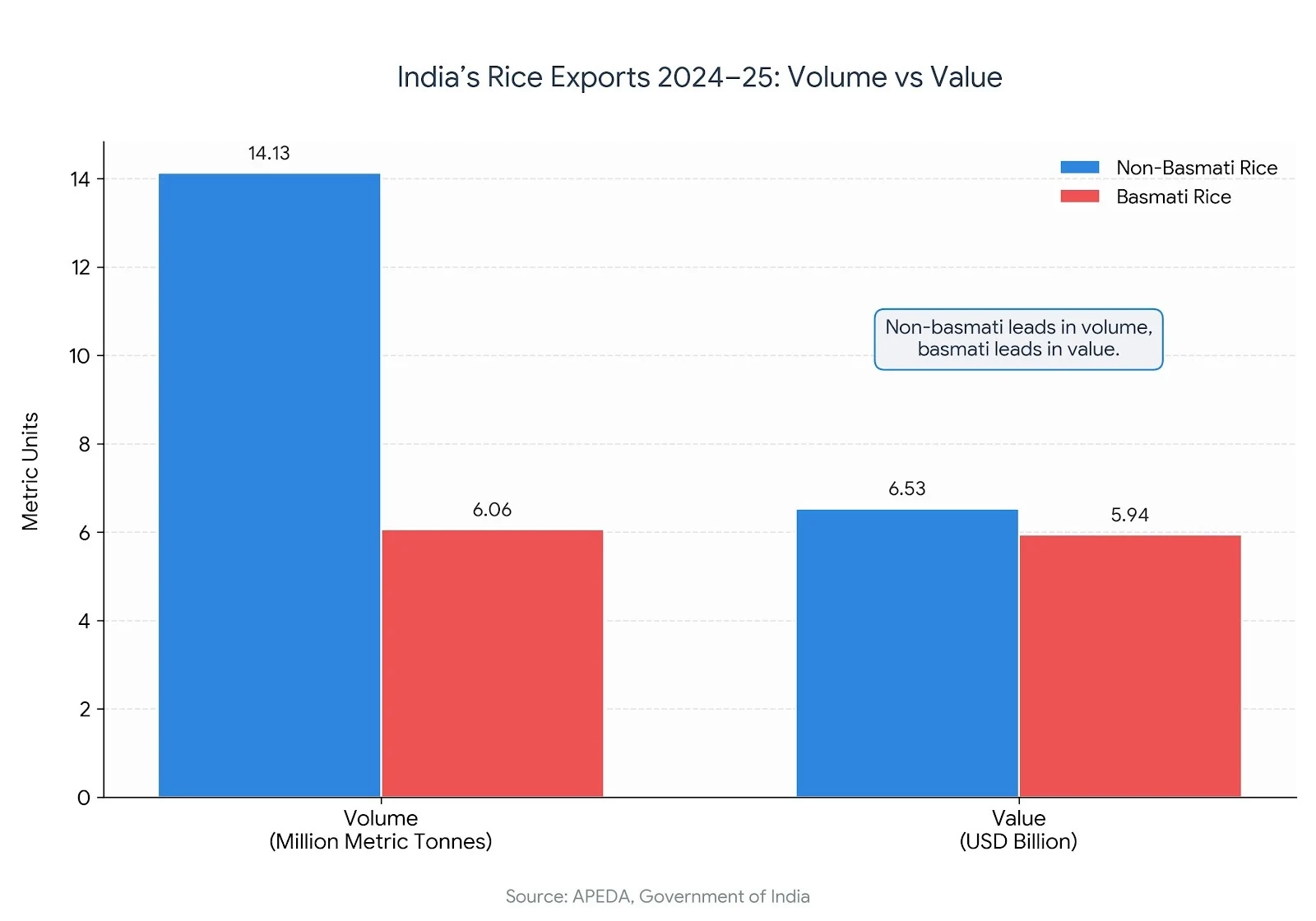

In 2024–25, India exported 14.13 million tonnes of non-basmati rice, valued at USD 6.53 billion, reinforcing its position as the most dependable supplier in this segment. Once the restrictions were lifted, non-basmati shipments jumped 25%, reaching 15.15 million tonnes.

The destinations tell their own story. Shipments rose sharply to Bangladesh, Benin, Cameroon, Ivory Coast, and Djibouti — markets where price stability matters more than branding and where Indian supply fits cleanly into food security systems.

This is where India’s scale shows. Non-basmati rice from India isn’t trying to be premium. It’s trying to be present — consistently, predictably, and in volume. That’s exactly what these markets needed once prices eased.

Basmati Exports Hit a Record — Quietly

Non-basmati rice moved the bulk, but basmati did what it usually does — it carried the value.

Exports climbed 8% in 2025, touching a new high of 6.4 million tonnes. The demand wasn’t loud or speculative. Buyers in Iran, the UAE, and the UK stayed steady, focused less on price swings and more on getting the grain right — length, aroma, and consistency batch after batch.

APEDA data puts India’s basmati exports at 6.06 million tonnes in 2024–25, worth roughly USD 5.94 billion. What’s easy to miss is how structured this trade has become. With over 43,000 RCACs issued to exporters, basmati now moves through a system that’s tightly tracked, highly compliant, and built for repeat business rather than one-off deals.

Where Basmati Is Actually Grown — and Why It Matters

Basmati cultivation remains firmly anchored in northern India. The BEDF survey for 2024–25 places production across Punjab, Haryana, Uttar Pradesh, Uttarakhand, Himachal Pradesh, Jammu & Kashmir, and Delhi — regions that together form India’s traditional basmati belt.

That concentration matters. Buyers aren’t just purchasing rice; they’re purchasing origin integrity from platforms like Tradologie. And despite rising volumes, basmati hasn’t drifted away from its geographical core — which is exactly why it continues to command a premium even as global prices soften.

Why Competitors Felt the Impact Immediately

India’s return didn’t just increase supply. It reset the market.

Improved availability from India curbed shipments from Thailand and Vietnam, pushing Asian prices down and forcing competitors to recalibrate. For import-dependent regions, particularly in Africa, this translated directly into lower food costs — a reminder of how central India’s role has become in global rice balance.

This wasn’t aggressive undercutting. It was gravity. When the largest exporter resumes full flow, the market adjusts around it.

The Bigger Picture: This Was About Timing, Not Luck

The 2025 surge wasn’t accidental, and it wasn’t purely demand-led. It was the result of record production, policy clarity, and a supply chain that was already in position, waiting.

India didn’t need to find new buyers. It needed to remove friction.

What the past year shows is simple: when restrictions ease, Indian rice doesn’t trickle into global markets — it re-establishes dominance. For buyers, that means availability and price relief. For exporters, it confirms something they already knew — scale, compliance, and consistency still win this trade.

And for the global rice market, it’s a reminder that India doesn’t just participate in price discovery. It often sets the tone.

Want to export or import rice globally? Visit www.tradologie.com today.

.webp)