India is set to return to the global sugar market. A senior official from the Department of Food and Public Distribution stated that the 2025/26 season, starting October 1, will leave enough surplus sugar after meeting domestic consumption and ethanol requirements. This surplus opens the way for Sugar Exports from India that could affect world price trends.

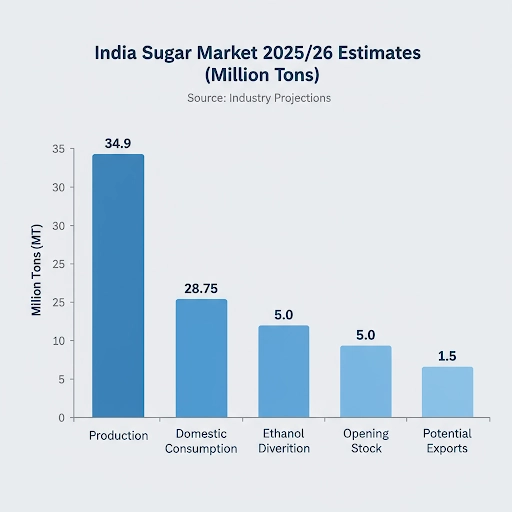

Industry estimates project India's sugar production at around 34.9 million metric tons for the season, with opening stocks near 5 million tons, alongside a record ethanol output expected.

COMMERCIAL SIGNIFICANCE FOR SUPPLIERS AND BUYERS

India is the world's and its re-entry matters for large scale buyers and mills worldwide. The government did not commit to a fixed export quota for the new season, though earlier in the current marketing year authorities allowed exports of 1 million tons. Industry bodies have pressed for larger permissions for 2025/26.

For global Bulk Sugar Buyers, India's move changes the sourcing calculus: it adds an accessible volume pool in Asia while also changing price dynamics in short order.

SUGAR PRODUCTION, STOCKS AND THE ETHANOL FACTOR

The production projection of 34.9 million tons is the most important baseline number for sugar traders and contract buyers. After accounting for domestic consumption, which ISMA estimates at about 28.5 to 29 million tons, and planned diversion of sugar into ethanol production, India is expected to carry roughly 5 million tons of opening stock into the season.

At the same time industry estimates point to a large ethanol programme and a record ethanol output figure, which will continue to divert some sugar away from exports and processing for food.

That balance between food and fuel use is the single biggest variable for how much commercial sugar will actually land on export markets.

LIKELY DESTINATIONS AND TRADE PATTERNS

Historically India's sugar has moved into neighbouring and regional markets in South Asia and the Middle East and into parts of Africa. Recent trade flows show sizeable sugar shipments to Sri Lanka, Bangladesh, Sudan and the United Arab Emirates, while bulk buyers in East Africa and some Southeast Asian markets have also sourced Indian sugar.

For buyers in these markets, proximity and attractive landing cost make India a natural sugar supplier. For traders elsewhere, sugar export volumes from India will be an additional competitive option, especially for raw and lower processed white sugar types.

GLOBAL PRICE IMPLICATIONS

How much sugar India will sell overseas matters more than the announcement itself. Global supply forecasts differ. The International Sugar Organization and USDA class reports show the world's sugar supply demand balance moving toward a much tighter configuration than a year ago but not uniformly across origins.

- Any incremental Indian sugar exports in the range of 1 to 2 million tons could exert downward pressure on nearby price benchmarks and relieve tightness in some import dependent regions.

That said Brazil remains the dominant swing supplier of bulk sugar and Brazilian crop and policy will still largely set the tone for the price cycle globally. In short, India's return will be price negative for sellers but will improve contract leverage and supply options for buyers.

REGIONAL IMPACTS

Neighbouring sugar importing countries from India such as Bangladesh, Sri Lanka and Nepal stand to benefit from easier access and likely improved freight economics. East African buyers that have relied on other origins may also see more competitive offers from Indian mills.

Conversely, for regional sugar exporters or processors who compete with Indian shipments, the added volume could pressure margins. For any buyer that sources regionally, the immediate effect will be on short term procurement windows and on negotiating power for supply contracts.

QUALITY, LOGISTICS AND POLICY RISKS

- Practical sourcing notes for B2B buyers : Indian sugar quality varies by type and grade and in recent trades buyers showed preference for Brazilian sugar when quality and specification mattered for industrial use.

- Logistics, including port capacities, vessel availability, and the timing of the season, will determine how quickly Indian offers are converted into delivered tonnage.

- Policy risks : Export permissions, subsidy programs, and ethanol diversion rules may change during the season and can significantly affect the volumes available for export. It is important to closely follow government notifications and industry association updates

STRATEGIC GUIDANCE FOR B2B BUYERS

For traders, processors and large buyers the immediate priorities are simple.

- Review existing procurement schedules and add options for October to December filling, when Indian sugar export offers will likely appear.

- Ethanol diversion into forward supply risk models.

- Test quality early and build graded specifications into contracts rather than rely only on price.

- Finally, use physical and OTC hedges to protect margins if you expect short term price swings as Indian volumes enter market desks.

CONCLUSION

India's return to sugar export is a structural development for 2025/26 supply chains. It will not instantly reset global pricing but it will add commercial liquidity, change near term negotiating dynamics and give buyers a credible alternative in Asia and Africa.

For bulk sugar buyers, the season opening on October 1 requires a prompt action: lock quality tested volumes where needed, watch ethanol diversion as a volume risk, and keep a close eye on official export permissions and subsidy developments.