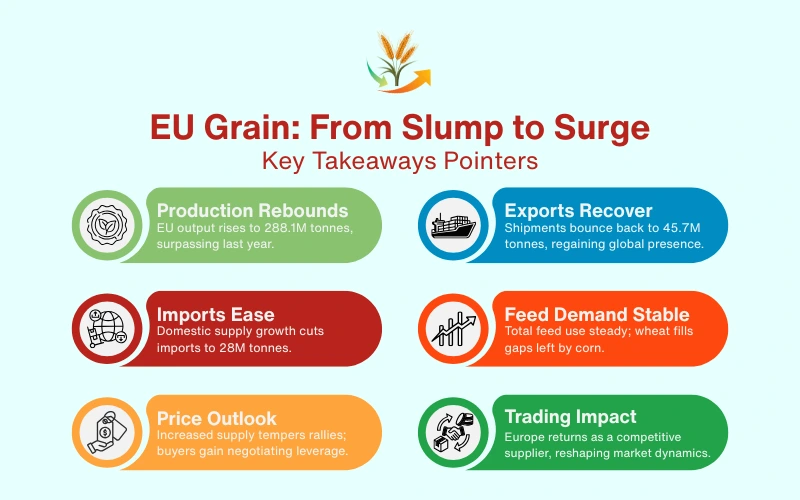

After a bruising season that left EU grain exports limping, the bloc is back on its feet—and then some. The latest projections for the 2025–26 season suggest that Europe’s grain story has taken a sharp turn for the better. With production climbing to 288.1 million tonnes and exports expected to recover to 45.7 million tonnes, the EU is once again stepping back into the global grain spotlight, sleeves rolled up and ready to trade.

For grain traders, millers, feed buyers, and procurement teams, this is not just an industry update. This is the kind of development that quietly reshuffles price expectations and redraws supply maps.

From Lean Harvests to Laden Silos

Last season was a hard slog for EU grain, the kind that drains patience and margins in equal measure. Production limped along at roughly 257.7 million tonnes, skies refused to cooperate, and export flows sputtered like an engine running on fumes. Momentum never quite clicked into gear. This year, though, the wind has shifted. Kind summer weather across northern and western Europe has quietly done the spadework, lifting yields and nudging production comfortably past earlier expectations, and putting the market back on steadier ground.

France, Germany, and Poland have led the charge, delivering yields that exceeded cautious expectations. The outcome is simple: fuller silos, better domestic coverage, and enough surplus to look outward again. In trading terms, the EU has moved from playing defense to being at forefront.

Grain Exports Back in the Game

Grain exports are expected to stage a measured rebound to about 45.7 million tonnes, up from 37 million tonnes last year. This isn’t just a statistical bounce; it points to EU grain finding its way back into the mix in key importing regions after a subdued run.

North Africa and the Middle East are likely to lead the charge. These markets are familiar ground for European grain, and when supply opens up, EU origins tend to line up well on price, reliability, and freight. Expect wheat and barley from the region to reappear in tenders with more competitive pricing and a steadier footing than last season.

For competing grain exporters, this is where the gloves come off. More EU grain on the water means stiffer competition, tighter spreads, and fewer easy wins.

Import Demand Cools as Supply Builds at Home

As production climbs, the EU’s appetite for imports is beginning to cool. Grain imports are projected to ease from 30.6 million tonnes to around 28 million tonnes. On paper, the dip looks manageable. In reality, it quietly pulls a meaningful slice of demand out of the global equation.

Grain exporters shipping corn and feed grains into Europe are likely to feel the pressure first, especially those already operating on thin margins. When a heavyweight buyer eases off the throttle, the grain price ripples tend to travel well beyond its own backyard.

Feed Demand Holds Firm, With a Twist

Feed consumption in the EU remains strong at 161.9 million tonnes, despite ongoing animal disease challenges and mounting regulatory pressure. What’s changing is the composition of feed rations.

Corn production is slipping to 57.5 million tonnes, largely due to reduced planted area in major producing countries. Add to that limited availability from Ukraine, and wheat is stepping into the gap. Feed wheat is quietly doing more work behind the scenes, absorbing part of the supply increase and keeping export availability from swelling too aggressively.

It’s a subtle shift, but one that matters for grain price formation.

Price Outlook: A Ceiling, Not a Collapse

From a pricing perspective, the EU rebound puts a lid on overly bullish sentiment. Greater export availability has a way of taking the heat out of rallies, particularly in wheat and barley. This isn’t a market in free fall, but one where upward momentum is starting to meet resistance.

Buyers may find a little more room to manoeuvre at the negotiating table, while sellers will need to stay agile. Banking on prices to lift on their own could turn into a waiting game.

What This Means for B2B Players

From a pricing angle, the EU rebound puts a cap on excessive bullishness. Increased export availability tends to cool price rallies, especially in wheat and barley. This is not a market in retreat, but one where upward momentum is beginning to run into resistance.

Buyers may see a bit more flexibility at the negotiating table, while sellers will have to stay responsive. Relying on prices to rise on their own could test patience.

The Bigger Trade Picture

In a global market grappling with weather risks, geopolitical noise, and constantly shifting trade routes, the EU’s production rebound brings a welcome sense of balance. It doesn’t upend the playbook, but it does alter who has leverage.

Europe is back at the table with supply to offer, and this time, it looks prepared to play its hand.