Vietnamese Rice Exporters are navigating a period of heightened uncertainty following the Philippines’ decision to extend its suspension on regular and well-milled rice imports through 31 December 2025. Historically, the Philippines has been one of Vietnam’s largest buyers, absorbing more than 40% of the country’s rice shipments, particularly regular and well-milled grades, the backbone of Vietnam’s export portfolio.

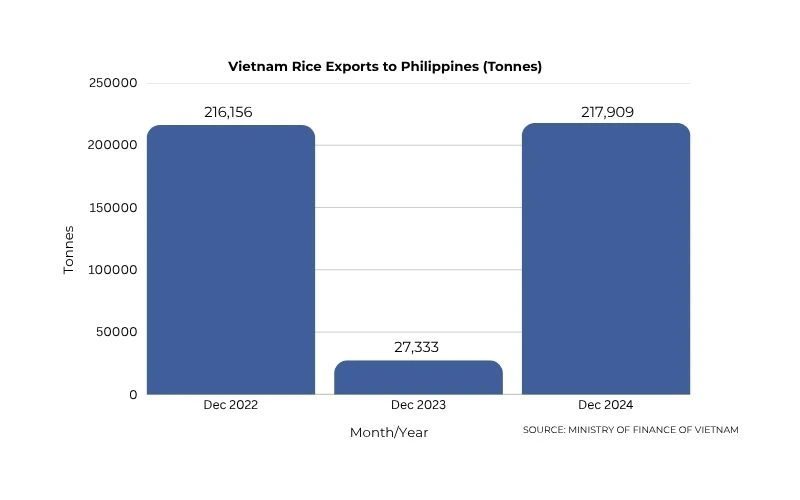

According to Vietnam’s General Department of Customs monthly export statistics , Vietnam exported 216,156 tonnes to the Philippines in December 2022, which fell to 27,333 tonnes in December 2023 before recovering to 217,909 tonnes in December 2024. The extended ban therefore represents a significant disruption to a critical market.

Manila’s Policy Rationale: Protecting Domestic Supply

The executive order by President Ferdinand Marcos Jr. reflects Manila’s broader objective of stabilizing domestic rice markets. By prolonging the import suspension, the authorities aim to protect local palay growers, secure buffer stocks, and stabilize prices. While specialty rice types such as basmati, black, and Japanese rice are exempt from the ban, regular and well-milled varieties—which constitute the bulk of Vietnam’s export volumes—remain restricted. Complementary measures, such as the expansion of storage capacities under the National Food Authority and considerations of higher import tariffs, reinforce Manila’s strategy to shield domestic producers.

Immediate Impact on Vietnamese Exports

From a trade perspective, the extension directly affects Vietnam’s core export operations. With its primary market for regular and well-milled rice partially closed, exporters face the challenge of absorbing new-crop volumes without undermining pricing. This comes at a sensitive moment: the winter-spring harvest is underway, and mills are operating at peak capacity. In the first ten months of 2025, Vietnam exported roughly 7.2 million tonnes of rice, valued at around US$3.7 billion, reflecting a 6.5% decline in volume and a 23.8% fall in export value year-on-year. Average export prices decreased to approximately $511 per tonne, indicating the pressure exerted by reduced demand and potential oversupply.

Vietnam’s dependence on the Philippine market is particularly evident in the 27% year-on-year decline in shipments to Manila between January and October 2025. With traditional buyers sidelined, exporters are increasingly redirecting shipments to African and Middle Eastern markets, where Ghana and Côte d’Ivoire now account for over 12% and 11% of Vietnam’s rice exports, respectively.

Strategic Response: Diversification and Product Differentiation

Vietnamese exporters are responding with a two-pronged approach: market diversification and product differentiation. Diversifying into African and Middle Eastern markets presents trade-viable alternatives for absorbing high-volume, well-milled rice at competitive prices. These regions not only provide immediate demand but also have established trade networks that facilitate logistics and market access.

Simultaneously, exporters are emphasizing higher-value and specialty rice lines. Low-emission rice, high-quality premium grades, and niche market varieties offer opportunities to offset the loss of volume in traditional markets. As Deputy Minister of Agriculture and Environment Phùng Công Thìn notes, maintaining a target of 8 million tonnes of rice exports for the year depends on expanding into new markets while enhancing product differentiation.

Navigating Trade Risks

Despite these strategic shifts, risks remain. Peak production periods coincide with constrained access to traditional buyers, raising the risk of oversupply and continued downward pressure on prices. Diplomatic and trade engagement also becomes critical. The Vietnam Food Association has suggested that the Trade Ministry explore mechanisms to negotiate exceptions for key rice grades or engage through formal trade frameworks to clarify conditions for future restrictions.

Outlook: Opportunities Amid Challenges

The extended Philippine ban underscores the vulnerabilities inherent in concentrated export markets. For Vietnam, the immediate priority is to balance supply pressures with emerging opportunities in alternative geographies. African and Middle Eastern markets provide near-term avenues, while Southeast Asian neighbors and specialty rice markets hold medium- to long-term potential.

Vietnamese exporters that leverage trade intelligence, recalibrate product portfolios, and pursue market diversification can mitigate the impact of the Philippine ban. While the loss of more than 40% of traditional demand is a major headwind, proactive strategies in market expansion and value-added products can reinforce Vietnam’s resilience and preserve its position as a leading global Rice Supplier.

.webp)

.webp)