- China cuts U.S. soybean imports in 2025 (down to 29% of U.S. exports).

- Brazil dominates with ~2.5 billion bushels shipped to China (Jan-Aug 2025).

- Reasons: Brazil's cost & logistics edge, China's diversification, and food security strategy.

- Impact on U.S.: Oversupply, falling prices, and urgent need for new export markets.

- Global effects: Latin America gains, smaller producers get openings, and other grains (corn, wheat, sorghum) also hit.

- B2B agro trade lesson: Exporters must diversify; buyers seek resilient supply chains and flexible contracts.

- Outlook: China's pivot looks permanent, signaling a structural shift in global agro trade.

Introduction

China's abrupt pullback from U.S. Soybean Imports in 2025 is sending shock waves through global agricultural trade. Once the anchor buyer for American soy, China's retreat is more than a bilateral shift—it signals a rebalancing of supply chains, trading alliances, and strategic risk. For exporters, importers, and B2B agro platforms, this development underscores the peril of overdependence on a single market. As China reorients its sourcing, the future contours of global agro trade are being redrawn.

Background: U.S.- China Soybean Trade

Soybeans have long formed the backbone of U.S.- China agricultural exchange. In 2024 , China purchased approximately 985 million bushels of U.S. soybeans, accounting for over half of U.S. soybean exports.Yet during January-August 2025, exports to China collapsed to 218 million bushels , with trade now constituting roughly 29 percent of U.S. exports. Meanwhile, China is importing record volumes overall, but from South American suppliers. Brazil alone shipped nearly 2.5 billion bushels of soybeans to China during that same period.

Soya is central to China's feedstock, edible oil, and protein supply chain—it catalyzes the livestock, aquaculture and edible oil sectors. The shift in import sourcing thus ripples through the broader global commodity system.

Why China Is Pulling Back

China's strategy is being recalibrated along several axes:

South America Steps Forward. Brazil's Soybean Exports to China have surged. In the January-August window, Brazil supplied about 2.5 billion bushels , eclipsing U.S. volumes. With scale, cost efficiencies, and better logistical alignment to Chinese demand, Brazil's competitiveness has widened the gap.

Geopolitical & Diversification Imperative. The pullback is consistent with China's longstanding aim to reduce vulnerability to U.S. sanctions or trade disruptions. A diversified supplier base lowers exposure to geopolitical swings.

Internal Policy & Food Security Motivation. China views food security as an existential priority. By sourcing from multiple nations, it can avoid overreliance on any one exporter and stabilize its domestic market buffers and strategic reserves.

Over time, these drivers have coalesced into a steady trend: even when U.S. soy remains competitively priced, China is opting for diversification.

Global Ripple Effects

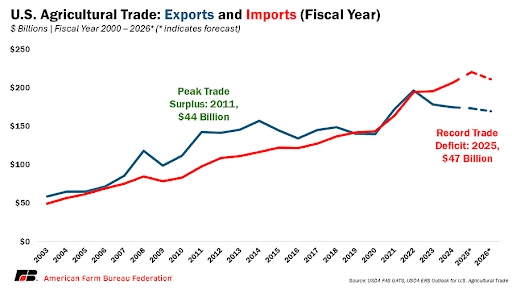

U.S. Farmers & Exporters Face Oversupply, Margin Pressure . With China largely absent from newer sales, U.S. producers confront inventory gluts and weaker pricing. Excess supply strains domestic margins and pushes exporters to seek new outlets.

Beneficiaries in Latin America & Beyond. Countries like Brazil and Argentina are absorbing volumes that historically went to the U.S. Smaller soybean producers may also see opportunities in niche or regional markets previously out of reach.

Intercommodity Effects. Soybeans' reallocation ripples into grains like corn and sorghum, as feed demand patterns shift. Moreover, crops such as cotton, wheat, and even pork are affected as feed and input flows reorganize. In the 2025 cycle, China has reportedly paused U.S. imports of corn, wheat, and sorghum altogether.

Volatility & Futures Dislocations. The disruption intensifies commodity futures dynamics. Market participants are revising risk premia, hedging strategies, and supply projections more aggressively as the prior U.S.- China linkage frays.

Implications for B2B Agro Trade

Diversify or Perish. Overdependence on one major buyer is now unforgiving. Agro exporters must develop multi-market capabilities and fallback channels to withstand demand shocks.

Buyers & Importers: Favor Reliable, Resilient Supply Chains. When choosing suppliers, buyers will emphasize stability, geographically diversified supply sources, and contract structures able to withstand sudden policy shifts.

Rise of Digital B2B Platforms. Platforms like Tradologie.com (or similar verified-buyer marketplaces) gain share by enabling exporters to reach new markets and mitigate reliance on legacy trade flows.

Contracting, Hedging, and Trade Finance Discipline. Forward contracts with flexibility, embedded price adjustment clauses, effective hedging, and robust trade finance tools will become prerequisites—not optional enhancements.

The Road Ahead: Diversification & Strategic Realignment

Exporters now must shift focus to emerging demand centers: Southeast Asia, Africa, the Middle East, and South Asia. Governments and trade promotion agencies should support this reorientation through intelligence, logistics support, and market-entry programs.

China's soybean pivot shows signs of permanence, not temporary retraction. The U.S.- China soybean axis is undergoing structural realignment. In this moment, the redrawing of global agro trade is underway—and the winners will be those who built flexibility, resilience, and multi-vector reach before the shift became evident.

Want to export or import soybean in bulk? Visit www.tradologie.com today!