The Indian government's announcement of a 20% export duty on parboiled rice has shaken the international rice market, particularly for West African and Asian purchasers who depend intensively on Indian non-basmati rice. The initiative to stabilize domestic supply and combat inflation is causing immediate trade adjustments and might draw attention to possible alternative sources.

Short-term Effect: Price Spikes and Contracts Revised

In the short term, the 20% export duty has resulted in higher price revisions both in repeat and fresh deals. B2B purchasers, particularly those involved in bulk procurement, are observing higher FOB (Free on Board) and CIF (Cost, Insurance, and Freight) prices from Indian exporters. Existing deals inked prior to the introduction of the tax are now in the process of renegotiation or facing slightly delayed shipments, as exporters do not wish to bear the additional expense.

This dramatic increase in trade expenses has led many importers to pursue what can be best termed as a “wait and watch” strategy. The cost of export duty is being shifted to the importer or resulting in lower shipment sizes per contract.

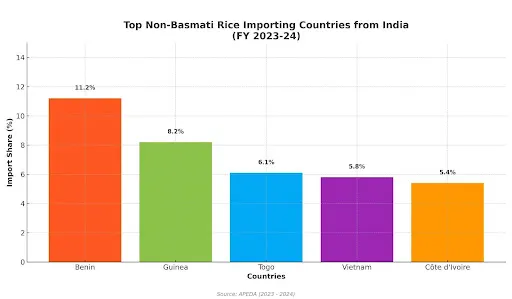

West Africans like Benin, Guinea, and Togo, who are large importers of Indian non-basmati parboiled rice are significantly affected. The countries depend heavily on imports of Indian rice because of its price and quantum availability, and the imposition of the new duty is testing their procurement plan.

As revised downwards or renegotiated at higher prices, government and private importers in these countries might be compelled to find substitute sources of supply or subsidise imports to keep domestic prices stable.

West Africa's Heavy Reliance on Indian Parboiled Rice Is Tested

West and Central Africans, where parboiled rice is a staple in diets, are particularly sensitive to India's export duty. Among them, Benin, Guinea, and Togo import significant amounts of India's non-basmati rice, including parboiled rice, and rely on low-cost, large-volume imports to keep their markets afloat.

Importers and government purchasing authorities in these countries can now expect to pay higher costs or have to wait to receive their shipments. Existing deals that were in discussions are now rewritten with increased costs and existing delivery schedules revised to include the additional fee. The drastic policy shift means tighter margins and harder procurement choices for private-sector importers and food retailers in these countries.

Thailand: The Most Likely Alternative, Though With Limitations

With India's stricting export policies, Thailand might gain increasing attention as an alternate source of parboiled rice supply. The second-largest rice-exporting country in the world, in 2023, shipped out $5.3 billion worth of rice to major markets like Indonesia, the U.S., South Africa, Iraq, and China.

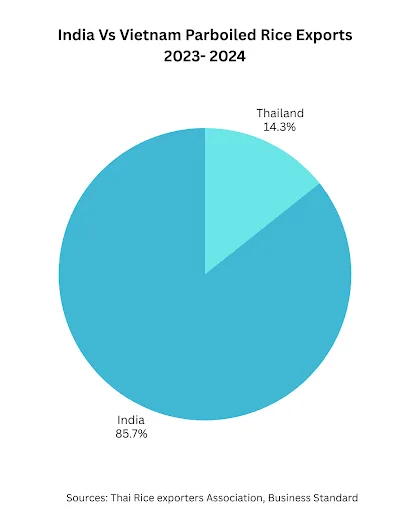

Yet, at present, the parboiled rice export of Thailand amounts to 1.26 million metric tonnes (2024)—much less than India's 7.57 million metric tonnes of the same year. This difference emphasizes that whereas Thailand is unlikely to be positioned to substitute India, it can increase production in steps to capture emerging trade opportunities resulting due to this supply shortfall. Thai rice can potentially function as a secondary source of supply to India's policy-challenged buyers in the future, as long as it improves its parboiled rice production base and keeps its policies stable.

Strategic Implications of B2B Procurement

Key to Diversification: Importers will be required to diversify beyond India to secure sustained food supplies, potentially adopting mixed sourcing with Thailand, Vietnam, and some producers in Africa.

Contract Flexibility: Trade agreements can be integrated with dynamic price models to cover policy-driven duties or trade barriers.

Storage and Forward Purchasing: Regional warehousing and stockpiling initiatives can be used as cushions to counteract unexpected disruptions in trade.

Tracking Production Patterns: Importers need to closely watch Thailand's parboiled rice production path since any growth in quantity would influence global supply and prices.

Digital Procurement and Trade Platforms: The scenario reiterates the merits of transparent procurement platforms like Tradologie.com where buyers can explore several other alternative rice options that match the parboiled rice.

Conclusion:

India’s parboiled rice export duty is a significant development for world rice trade, and especially for emerging economies' bulk purchasers. The market is adjusting accordingly, and purchasers are now at wait and watch situations and facing higher prices immediately.

The status of Thailand as a reliable, though presently constrained, supplier earns it a watch list status—not to replace now, but to diversify in due time. Agility, diversification, and strategic vision will be critical to both current disruption and future trade trends facing B2B rice purchasers and commodity traders.