Why the World Wants Indian Cumin: Unpacking Global Demand

Key Highlights: India's Strategic Role in the Global Cumin Market

- India's Dominance: Top exporter of cumin, backed by APEDA 2023-24 data; major share of global trade.

- Unique Edge: High essential oil content, uniform granule size, and compliance with ASTA & ISO standards make Indian cumin preferred for spice blends and FMCG processing.

- Strong Supply Chain: Gujarat & Rajasthan linked to ports (Mundra, Kandla) with robust warehousing and cold chain infrastructure → ensures timely, bulk shipments.

- Early Harvest Advantage: India's Feb-March harvest comes before Syria & Turkey (June-July), giving Indian exporters a first-mover edge in pricing and availability.

- Export Value Trends:

- Peak: USD 443.63M in FY 2020-21 (pandemic-driven demand).

- FY 2023-24: USD 264.99M (market correction, stable baseline).

- 5-year average > USD 340M , showing consistent global demand.

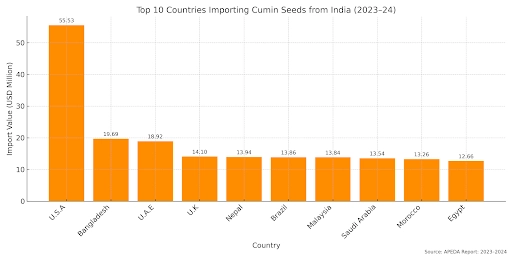

- Key Buyers: U.S. leads imports, driven by ethnic food processors, health brands, and bulk distributors.

- Compliance Factor: U.S. FDA and global food safety certifications are mandatory for smooth customs clearance and buyer trust.

- Opportunities:

- Price stability advantage during global supply disruptions (Turkey, Syria).

- Growing adoption in HORECA & food processing clusters across Asia, Africa, and Europe.

- Digital Procurement: Platforms like Tradologie.com enable:

- Live negotiations with verified suppliers.

- Transparent price discovery & competitive quotes.

- End-to-end trade support in native languages.

Takeaway for B2B Buyers & Exporters

Indian cumin offers quality, compliance, and supply resilience, making it indispensable for bulk buyers, FMCG processors, and ingredient manufacturers worldwide. Digitized trade ecosystems like Tradologie.com further simplify and secure sourcing.

Introduction: India's Strategic Role in the Global Cumin Market

In the global spice trade, cumin (Cuminum cyminum) is an important commodity with significant turnover across international wholesale and food manufacturing supply chains. India continues to dominate the market as a top cumin exporter, accounting for a major share of global trade volumes as per the data the APEDA’s 2023–24 report

Unique flavour profile, high essential oil content, and established export infrastructure, Indian cumin is increasingly favoured by FMCG conglomerates, ingredient manufacturers, and bulk food procurement agencies.

Indian Cumin's Competitive Edge in Global Trade

High Oil Content & Uniform Granule Size

What distinguishes Indian cumin in international trade is its consistent quality parameters, including a high volatile oil content, which enhances aroma retention—critical for industrial spice blends, ready-to-eat meals, and seasoning powders. Indian cumin is preferred in processed food segments due to its cleaning, grinding, and grading standards as per ASTA and ISO specifications, particularly in Gujarat and Rajasthan—the primary producing belts.

India's Strong Supply Chain and Logistics is an Advantage

India's cumin export capabilities are supported by a well-integrated supply chain, connecting key producing regions like Gujarat and Rajasthan to major ports such as Mundra and Kandla. The presence of organized agri-mandis, efficient warehousing, and cold chain infrastructure ensures smooth aggregation, handling, and movement of cumin for export.

For bulk buyers and importers, this directly translates into timely shipments, minimal transit losses, and consistent supply availability, making India a reliable origin for sustained, high-volume procurement.

Early Harvest Advantage: Strategic Market Entry

India's cumin crop is harvested between February and March. It is well ahead of other major producers like Syria and Turkey, whose harvests fall around June to July. This early harvesting window gives Indian exporters a first-mover advantage in global markets and expowers them to fulfill demand when international supply is still constrained.

This translates to early-season procurement, improved inventory planning, and a competitive edge in pricing and availability for bulk buyers and institutional importers, —well before supply from other origins comes online.

A Data-Driven Overview: Export Value Trends

India's cumin export performance reflects shifting dynamics in the global demand curve. According to the APEDA 2023-24 report:

- In FY 2020-21, cumin exports peaked at USD 443.63 million, driven by bulk buying from Middle Eastern and North American FMCG sectors during the pandemic.

- By FY 2023-24, the figure corrected to USD 264.99 million, highlighting a market recalibration, yet sustaining a robust baseline for cumin suppliers.

- The five-year average stands well above USD 340 million, signaling consistent institutional demand despite geo-economic fluctuations.

The United States, in particular, continues to lead global cumin procurement, driven by demand from ethnic food processors, health food manufacturers, and large-scale distributors.

Regulatory Compliance: Meeting Global Standards

Exporting cumin seeds to the U.S requires adherence to internationally recognized food safety regulations, such as those enforced by the U.S. FDA. Importers typically expect suppliers to maintain relevant certifications that ensure traceability, hygiene, and quality assurance across the supply chain.

This minimises the risk for buyers who source in bulk from compliant and certified facilities, minimizes regulatory risks and ensures smooth customs clearance, making compliance a critical factor in supplier selection.

Export Opportunities for B2B Buyers and Aggregators

Price Volatility Due to Climatic Disruptions

Given price volatility due to climatic disruptions and geopolitical trade bans (e.g., temporary restrictions by Turkey and Syria), Indian cumin suppliers are always a reliable options for importers globally. Most big cumin trading companies in the US rely on well-established India's top cumin exporters for their bulk supplies.

Integration with HORECA and Food Processing Clusters

Indian cumin enjoys growing traction in HORECA (Hotel, Restaurant, Catering) and ingredient sourcing hubs of Southeast Asia, Africa, and Eastern Europe. Its applications span from traditional spice blends to meat seasoning, pickling, and ready-meal kits—boosting its volume movement across global institutional channels.

Digitized Procurement: Tradologie.com's Role in Wholesale Cumin Sourcing

Tradologie.com, India's leading platform for agro-commodity trade, enables verified cumin suppliers to connect with genuine international buyers through a process of live ngotaion.For importers, the platform offers:

- 100% transparency in price discovery

- Most competitive quotes from Indian suppliers

- A dedicated trade manager in speaking native language

- A complete support till the delivery of goods

Tradologie's ecosystem is designed to eliminate middlemen margins, making it ideal for bulk spice buyers, private label manufacturers, and institutional food buyers across more than 100 countries.

Conclusion:

Indian cumin is indispensable in global culinary and food processing ecosystems. With stringent quality control, scalable production, and certified infrastructure, Indian cumin exporters are well-positioned to cater to wholesale buyers, FMCG processors, and ingredient aggregators worldwide.

For B2B entities looking to source cumin with assurance on volume, compliance, and cost-efficiency, India offers a resilient, premium-grade supply channel—amplified further by digitized platforms like Tradologie.com.

.webp)