Understanding Sona Masoori Rice:Origins, Qualities, and Market Positioning

Key Highlights:

- Sona Masoori rice: Medium-grain, lightweight, fragrant, non-sticky; grown in South India.

- Popular in South Indian cuisine & HORECA sector; cooks faster than Basmati.

- Price positioning: Slightly cheaper than Basmati, higher quality than IR-64 strong mid-tier appeal.

- Key demand centers: Middle East (UAE, Saudi Arabia, Qatar), USA (54% share), UK, Canada, Australia.

- Global rice market size: $323.5B (2024) → $432.1B (2033), CAGR 2.8%.

- Logistics: Containerized shipments (20-25 MT) most common; bulk vessels for 1000+ MT orders.

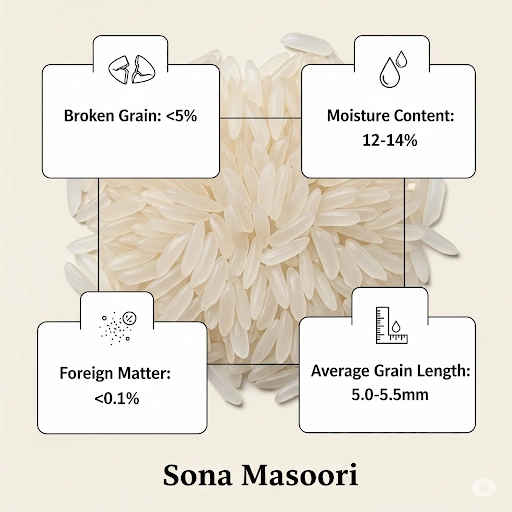

- Quality standards: < 5% broken, 12-14% moisture, < 0.1% foreign matter.

- Regulatory compliance: Phytosanitary certificates, FDA/EU/FSSAI standards, proper labeling.

- Pros: Affordable, high yield-to-price ratio, diaspora demand, short cooking time, growing markets.

- Business fit: Ideal for bulk importers targeting ethnic retail, mid-tier restaurants, and institutional buyers.

Title & Introduction :

India is the world's top rice exporter, exporting 22 million metric tons as of 2024/2025. Rice varieties like Soona Masoori rice play key roles in international business to business (B2B) trade areas. Among the country's rice exports, Sona Masoori is a cost effective rice that is of high quality. Sona Masoori rice is a rice that sits between premium Basmati rice and commodity grade.

Armed with the knowledge of Masoori rice's demand trend, profit potential, and challenges associated with sourcing, as well as fit in a portfolio in price-sensitive markets will help Sona Masoori rice exporters gain strategic advantage in commodity markets filled with both opportunities and uncertainty.

Understanding Masoori Rice (Expertise)

Sona masoori (IET No. 7244, BPT 3291; also spelt sona masoori or sona mahsuri) is lightweight, fragrant, medium-grain rice that came to be by hybridizing sona and masoori rice. Sona masoori is grown primarily in India's states of Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu. Sona masoori is typical in South Indian cuisine.

This medium-grain variety of rice features, it is known for its mild flavor, light texture, non-sticky cooking, the versatility to be used for traditional South India meals (i.e., dosas and idlis), and in contemporary restaurant meals. Masoori cooks faster than long-grained Basmati rice and the rice is often softer, which is a great quality in kitchens doing high volume and catering work.

The rice occupies a space between high quality, aromatic varieties and cheap non-basmati rice. Sona masoori is a high quality rice that is also exported to many countries, but its mid-backed price point means it retains an appeal on the pricing scale for both domestic and international markets by Sona Masoori rice exporters, where quality and price are prioritized.

Global Demand & Trade Trends (Authoritativeness)

India's rice exporting industry has seen massive instability over the past years. Global rice trade is expected to decrease in 2023 and 2024 following India's, the largest rice exporter, additional restrictions on the exportation of rice in July and August 2023. In 2022 India represented over 40 percent of the global share of exports. This set off supply chain impacts and raised prices to decade high prices, fundamentally restructuring international patterns of demand.

Rice export prices highest in over a decade as India restricts trade is defined by its impacts on import-dependent areas across Sub-Saharan Africa, particularly in Benin, Senegal, and Côte d'Ivoire. Now recovery is occurring as restrictions loosen and alternate sourcing develops.

Key demand centers for Masoori rice include:

- Middle East: The demand for Sona Masoori rice is significant in Middle Eastern countries, particularly in the United Arab Emirates, Saudi Arabia, and Qatar

- North America: United States is the leading importer, comprising 54% of the total with 200 shipments

- Diaspora Markets: Strong demand in UK, Canada, and Australia driven by South Asian communities

Pricing & ROI for Bulk Imports (Trustworthiness)

The global rice market demonstrates steady growth potential, with the global rice market size valued at USD 323.5 billion in 2024 and is projected to grow from USD 339.8 billion in 2025 to USD 432.1 billion by 2033, growing at a CAGR of 2.8%.

For B2B importers, several factors influence ROI calculations:

Cost Benefits: Masoori rice usually sells at 15-25% lower prices than Basmati, but at a better quality than IR-64 and other commodity grades of rice. This means you can win competitive margins in price sensitive markets.

Volume Economics: When bulk importers consider economies of scale banner, a containerized shipment of 20-25MT is way less expensive per unit than a smaller order. The current ocean freight rates are somewhat volatile, due to global shipping restrictions, but represent freight costs of around 8-12% on delivered costs depending on the destination.

Currency & Regulatory Influencers: The currency fluctuations of the INR against the major currencies constantly cause price volatility, while variable import duties and costs for compliance with phytosanitary regulations in destination markets, hinder transparency. For instance, current duty rates range from 0-15% across the major importing countries.

Quality & Sourcing Considerations (Trustworthiness)

Quality consistency remains paramount in B2B rice sourcing. Key parameters include:

Physical Specifications:

- Broken grain percentage: < 5% for premium grades

- Moisture content: 12-14% for optimal storage

- Foreign matter: < 0.1%

Sourcing Risk Mitigation:

- Supplier Verification

- Quality Assurance

- Documentation

- Storage Management

Logistics & Regulatory Factors (Experience)

Shipping Considerations:

- Containerized Options: 20ft containers (18-19 MT) and 40ft containers (24-25 MT) provide optimal protection for premium grades

- Bulk Vessels: Cost-effective for orders exceeding 1000 MT, though requiring enhanced quality protection measures

Regulatory Compliance:

- Phytosanitary Requirements: Mandatory fumigation certificates for most destinations

- Food Safety Standards: Compliance with destination country requirements (FDA, FSSAI, EU regulations)

- Labeling & Documentation: Proper origin marking, nutritional information, and organic certifications where applicable

Pros & Cons Summary Table

| Pros | Cons |

|---|---|

| Affordable vs premium rice varieties | Less global brand recognition compared to Basmati |

| High yield-to-price ratio for importers | Seasonal price volatility due to monsoon dependence |

| Favoured by diaspora and HORECA segments | Quality may vary by supplier and region |

| Shorter cooking time reduces energy costs | Limited shelf-life compared to aged varieties |

| Growing demand in emerging markets | Export restriction sensitivity |

Conclusion & Business Recommendation

Masoori rice is a tremendous opportunity for B2B importers, especially in price-sensitive or volume-driven markets. Demand for the variety is robust globally and increasing from diaspora growth and intrinsic appreciation for Indian cuisine - creating a sustainable market opportunity. While there are risks due to quality variability and potential pricing based on seasonality (but manageable through source protocols), the profit margins and level of acceptance are considerable enough to warrant inclusion in different import portfolios.

Strategic Recommendation: Masoori rice is a great fit for bulk importers whose target buyers are institutional and ethnic retail or mid-tier restaurant buyers.

However, companies focused on premium retail branding may find limited differentiation opportunities compared to more established aromatic varieties.

.webp)

.webp)