TMT Saria Price Volatility: Tips for Long-Term Procurement Planning in India

Key Highlights:

- TMT Saria Price Volatility: Prices fluctuate due to raw material costs, energy prices, regional demand, government policies, and global steel trends.

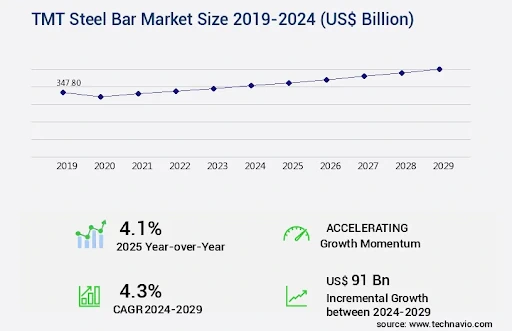

- Market Growth: India's TMT steel market is projected to grow by US $91 billion between 2024-2029, driven by urbanization and infrastructure demand.

- Top Procurement Channels: Buyers can source TMT bars directly from plants, distributors, online platforms, dealers, or government e-auctions.

- Supplier Relationships Matter: Long-term partnerships with trusted TMT Saria suppliers help mitigate price spikes and ensure consistent supply.

- Smart Buying Strategies: Diversify procurement channels, leverage online platforms, purchase in bulk during price dips, and monitor market forecasts.

- Focus on Quality: Ensure BIS-certified products and reliable supplier credibility to maintain safety standards despite price fluctuations.

Introduction :

TMT Saria (Thermo-Mechanically Treated steel bars) is the backbone of India's construction sector, used extensively in residential, commercial, and infrastructure projects. Given the country's rapid urbanization, the demand for TMT bars is expected to remain strong. However, buyers often face a significant challenge, price volatility. Fluctuations in raw material costs, energy prices, and global market conditions directly impact TMT Saria prices, making long-term procurement planning essential for contractors, builders, and institutional buyers.

The TMT steel bar market is expected to grow by $91 billion between 2024 and 2029, at an annual growth rate of 4.3%. To benefit from this growth, buyers must use smart strategies that reduce risks and ensure a steady supply.

Why Prices of TMT Saria Fluctuate

Just like any other industry, TMT bars as a commodity are susceptible to price fluctuations. Several factors contribute to this price volatility in the domestic market which are as follows.

- Raw Material Costs - Iron ore and coal are the primary inputs. Any disruption in supply or government policy changes impacts pricing.

- Energy & Fuel Costs - High dependence on electricity and coal-based furnaces means fluctuating energy prices directly affect TMT bar costs.

- Regional Demand-Supply Gaps - Construction booms in metro cities or infrastructure projects often drive local price spikes.

- Government Policies - Duties, GST changes, or e-auctions influence bulk procurement costs.

- Global Influence - Although TMT Saria is mostly a domestic product, international steel price trends still affect Indian rates.

Understanding these factors allows buyers to align their procurement strategy with market dynamics.

Market Size and Trends

- APAC Dominance - Asia-Pacific, led by India, accounted for nearly 77% of global market growth during the forecast period.

- Residential Demand - The residential segment was valued at US $164.10 billion in 2023, highlighting the massive scope for builders and housing developers.

- Grade Trends - Among different grades, Fe 415 TMT bars contributed the largest share in 2023 due to their affordability and wide application.

- Opportunities - With a market expansion potential of US $91 billion, long-term partnerships with trusted TMT Bar suppliers will be critical for meeting demand efficiently

Different Buying Options for TMT Bars

Indian buyers have multiple procurement channels, each with its pros and cons. Choosing the right one depends on volume requirements, budget, and supply consistency.

- Direct from Plant - Best suited for large-scale institutional buyers. Prices are lowest, but orders must be in bulk. Many TMT Saria suppliers work directly with plants to fulfill high-volume demand.

- Through Third Parties/Agents - Costs are almost equal to direct purchases but provide flexibility in negotiations. Builders often rely on these networks when direct plant contracts are not feasible.

- Distributors - Ideal for medium-scale buyers who require regular supply at reasonable pricing. Many distributors act as long-term procurement partners for small builders.

- Dealers/Retailers - The most common route for small-scale buyers. Quantity flexibility is high, but pricing is higher compared to wholesale options.

- Online Platforms - A growing trend in India. These platforms provide transparent pricing and access to multiple TMT Saria sellers, making them convenient for both wholesale and retail buyers.

- Stockyards & Local Markets - Quick availability and negotiable rates are the biggest advantages, though quality consistency may vary.

- Government E-Auctions - Institutional buyers and contractors working on government projects can procure bulk TMT Bars through e-auctions at competitive rates

Tips for Long-Term Procurement Planning

Long term procurement planning is paramount for running a successful construction business. Any delay in supply can result in a significant monetary loss. Here are some of the tips for the successful long term procurement strategy.

- Build Relationships with Trusted Suppliers - Forming strong partnerships with reliable TMT Bar suppliers ensures timely delivery and consistent pricing. Long-term contracts often protect buyers from sudden price spikes

- Diversify Procurement Channels - Avoid dependence on a single supplier or channel. Working with a mix of TMT Saria sellers — plants, distributors, and online platforms — spreads risk.

- Opt for Bulk Purchases During Price Dips - Steel markets are cyclical. Tracking price trends and purchasing in bulk during downward cycles helps lower costs in the long run.

- Leverage Technology and Online Platforms - Digital platforms provide real-time market updates, price transparency, and access to multiple TMT Saria suppliers, making procurement decisions faster and more data-driven.

- Focus on Quality Standards - Price fluctuations shouldn't compromise quality. Always verify BIS certification and supplier credibility before finalizing contracts. Reliable suppliers not only provide competitive rates but also ensure compliance with safety standards.

- Plan with Market Forecasts - With India's TMT steel bar market projected to grow steadily, incorporating long-term demand forecasts into procurement planning helps businesses stay ahead of rising costs.

Future Outlook

The domestic TMT Saria market is set to remain strong due to rising infrastructure spending, housing demand, and urban expansion. Buyers who align with credible TMT Saria suppliers and adopt flexible procurement models will be best positioned to manage volatility

For institutional buyers, strategic partnerships with leading TMT Bar suppliers, use of online platforms, and participation in bulk government e-auctions can deliver both cost efficiency and uninterrupted supply.

Conclusion

Price volatility in the TMT Saria market is inevitable, but smart procurement planning can help buyers navigate uncertainties. By diversifying suppliers, monitoring price trends, and entering long-term agreements with trusted TMT Saria sellers, businesses can secure steady supply while optimizing costs. With the market expected to add US $91 billion by 2029, those who focus on building sustainable procurement strategies today will have a significant competitive edge in the future.