How to Export Turmeric from India: Compliance, Packaging & Buyer Markets

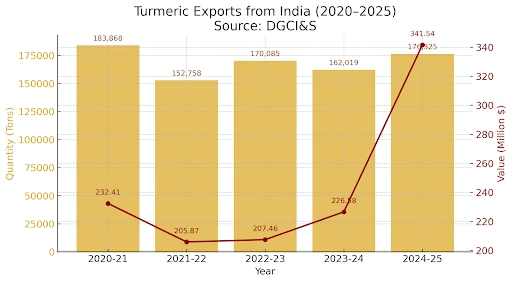

India is undeniably a global leader when it comes to turmeric exports. In 2023-24, India exported 162,019 tons of turmeric globally. Despite India being a global leader, it is imperative to understand that to export turmeric in bulk from India demands more than agronomic excellence. Rather, it requires mastery over compliance protocols, smart packaging strategies, and precise targeting of buyer markets.

The following framework serves as an operational map for traders to sell turmeric in bulk . It will give you all the vital information in detail if you are planning to start from scratch. So, let us get started.

Export Compliance: The Regulatory Foundations

Registration & Licensing

First things first. Every exporter must hold a valid Import Export Code (IEC) under DGFT. This code is not confined to agricultural commodities, but any commodity that you seek to export from India. Additionally, turmeric exports are closely monitored and governed by the Spices Board of India. A government body, which requires registration with its Schemes Division for export eligibility.

Quality & Safety Certifications

Quality certifications are the key to global agriculture exports, and turmeric is no different as a commodity. Global turmeric importers place significant emphasis on safety and quality compliance. Most importing nations enforce strict regulations regarding pesticide residues, heavy metal contamination, and microbiological safety. This makes internal quality assurance and robust testing frameworks non-negotiable for exporters. In fact, certifications and inspections are a critical part of export compliance.

International buyers commonly require certifications such as ISO 22000, HACCP, or FSSC 22000 to validate food safety management systems. For value-added spice products like powders, oleoresins, and blends, traceability and identity preservation throughout the supply chain are often mandatory contract conditions. These standards not only build importer confidence but also help spice exporters strengthen credibility and access premium global markets.

Phytosanitary / Health Certificates

Importers typically demand a phytosanitary certificate confirming absence of pests, and a health certificate attesting compliance with microbial and chemical norms. These are issued by APEDA / Spices Board authorities as per destination country requirements.

Documentation & Testing Packages

A complete export packet should include:

- Certificate of Origin

- COA (Certificate of Analysis) showing residue, heavy metal, moisture data

- Packing list, invoice, insurance, Bill of Lading

- Retained sample certificates, and laboratory accreditation proof (ISO/IEC 17025 labs preferred)

Strategic Packaging & Logistics

Effective packaging serves dual roles: protecting quality and assuring buyers of product integrity.

Mechanical & Structural Differences

- Primary & secondary packaging : Use food-grade inner liners (poly, foil) with outer woven jute / PP bags or cartons designed to resist moisture, light, and contaminants

- Batch labeling : Clear markings should include lot number, net weight, origin, curcumin content (if applicable), harvest date, shelf life, and exporter/importer details.

- Traceability codes : Embedding QR or barcode schemes linking back to farm / batch origin enhances buyer confidence and regulatory compliance

- Container / loading protocols : Export consignments may require fumigated containers, clean-room loading, and humidity control.

- Cargo insurance & freight terms : Use CIF or CIF+ insurance models, and be explicit in contracts about responsibilities during transshipment.

Buyer Markets & Trade Flow Dynamics

India commands a dominant position in global turmeric exports—export value and volume numbers illustrate this scale. In 2023-24, India exported over 16,692 shipments to 138 countries, handled by more than 2,000 exporters and reaching more than 4,300 buyers. Between 2020 and 2024, India's share of global turmeric exports held between 58 % and 66 % , with 2024 export value peaking at USD 333.25 million.

Major destination markets include the United States, United Arab Emirates, Bangladesh, Malaysia, and Morocco.For exporters and spice traders, aligning product grades, curcumin profiles, certification schemes, and packaging norms with region-specific buyer expectations is non-negotiable. For example, buyers in the EU may demand stricter pesticide thresholds and audit rights than buyers in Asia.

Operational Best Practices for Exporters

- Buyer qualification & pre-assessment : Vet the importer's regulatory profile, payment terms, and audit expectations before locking deals.

- Flexible grading & blend design : Offer a menu of curcumin grades, finger/root splits, and processed vs. raw turmeric to match buyer needs.

- Laboratory alliances : Tie up with accredited labs for faster COA turnaround and re-testing protocols.

- Continuous monitoring : Use in-line moisture, contaminant, and residue checks in processing lines to catch deviations early.

- After-sales audit support : Offer remote / on-site support to buyers in case of cargo quality complaints or regulatory audits.

Closing Reflections

Exporting turmeric is not a commodity play — it's a logistics, compliance, and relationships business. To export turmeric in bulk, the success lies in meeting exacting regulatory benchmarks, deploying smart packaging that preserves value, and targeting buyer markets with disciplined alignment. As India continues to hold a lion’s share in global turmeric trade, the next wave of export success will belong to those who can operationalize compliance, consistency, and buyer trust at scale.