Key Highlights:

India’s Global Leadership: India continues to dominate the global basmati rice market, exporting over 6 million MT in FY 2024–25, with major demand from Saudi Arabia, Iraq, Iran, UAE, and the US, which together account for nearly 80% of total exports.

Price-Driven Trade Dynamics: Bulk basmati rice pricing in 2025 ranges between USD 900–1,200 per MT, influenced by freight and currency fluctuations. Institutional buyers now prioritize price transparency, documentation efficiency, and shipment reliability over mere certification.

Evolving Buyer Expectations: Certifications like FSSAI, ISO 22000, and HACCP are now standard; differentiation lies in timely delivery, customized packaging, branding support, and consistent quality parameters such as moisture and elongation.

Compliance Essentials: Exporters must ensure APEDA registration, FSSAI licensing, phytosanitary certification, certificate of origin, and inspection clearance to meet international import regulations and maintain credibility in global trade.

Emerging Buyer Markets: While the Middle East accounts for 60% of shipments, Africa and Europe are witnessing rapid growth driven by diaspora demand and sustainability trends like eco-friendly packaging and traceable sourcing.

B2B Edge Through Reliability: Success in the bulk basmati trade depends on competitive CIF pricing, prompt documentation, and transparent communication, helping exporters secure repeat orders and long-term buyer trust.

Intro:

There is no doubt that India is an undisputed leader when it comes to Global Basmati Rice Exports. In fact, it is one of the most magnificent region-specific grains that enjoys the geographical indication tag.

India’s basmati rice export story unequivocally continues to dominate global agri trade headlines. In the financial year 2024–25, India exported approximately 6.065 million metric tonnes (MT) of basmati rice, which is a testament to its global stature in the basmati rice trade.

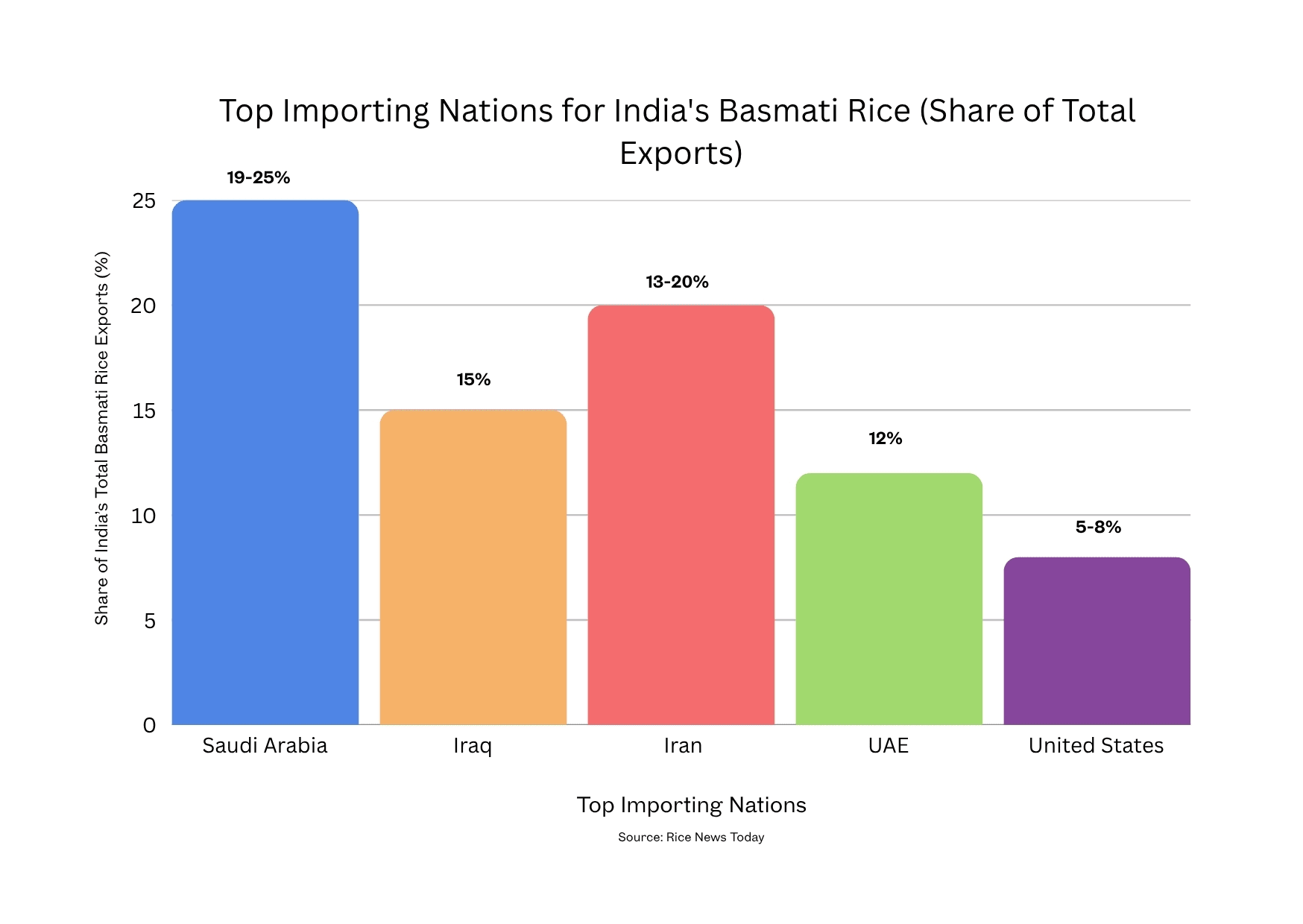

The top importing nations — Saudi Arabia (19–25%), Iraq (15%), Iran (13–20%), UAE (12%), and the United States (5–8%) — collectively account for nearly 75–85% of India’s total basmati exports.

These numbers now just reaffirm India’s stronghold in the premium aromatic rice segment, but a testament that countries like Pakistan are only the secondary global rice supplier after India. India as a country, holds a clear dominance in the B2B export space demands much more than having quality produce and standard certifications. Today’s global rice buyers are sharper, faster, and deeply analytical about pricing, documentation, and consistency.

1. The Real Market Dynamics

Price competitiveness remains the biggest lever in the global basmati rice trade. Most institutional importers and bulk buyers no longer negotiate purely on grade or certification. In fact, they closely compare FOB pricing, shipping terms, lead times and many other things that make a good procurement experience.

The typical bulk export price for Indian basmati rice (depending on the variety such as 1121 Sella or Pusa Basmati) has hovered between USD 900–1,200 per MT in 2025, but prices fluctuate widely with international freight and currency variations.

For Basmati Rice Exporters, the non-trade bulk price — when purchased directly from rice mills or through registered export agencies — is significantly lower. Many buyers prefer this channel since it helps reduce overall procurement and construction-linked input costs, a key factor for large institutional purchases.

Buyers today expect instant quotations, transparent shipment updates, and quick turnaround on documentation such as bill of lading, FSSAI compliance, and phytosanitary certification. Any delay can mean losing a tender or seasonal procurement window.

2. Beyond Certification: Delivering Buyer Experience

If you are a legacy Basmati Rice exporter, you might know that in the early 2010s, a valid FSSAI, ISO 22000, or HACCP certification was enough to attract global basmati rice buyers. That’s no longer the differentiator in today's trade scenario; it’s the baseline.

The global basmati market has reached certification saturation — nearly every credible exporter complies with these mandates. Therefore, importers evaluate other key parameters:

Reliability in fulfilling bulk orders within stipulated timelines.

Packaging flexibility — from 5 kg to 50 kg jute, PP, or vacuum-sealed bags.

Customized branding for private label buyers in the Middle East and North America.

Consistency in moisture content (usually between 12–13%) and grain elongation.

Portfolio of past buyers — a visible track record of successfully handled shipments.

Most leading buyers now request rice samples before contract finalization — not just for quality verification but also to evaluate cooking consistency, aroma, and texture uniformity.

3. Compliance & Documentation Essentials

Exporting basmati rice in bulk requires seamless coordination between millers, Basmati Rice Exporters, and logistics partners. Key compliance requirements include:

- APEDA Registration: Mandatory for all agricultural exports under ITC (HS) Code 1006.

- FSSAI License: Ensures compliance with India’s domestic food safety standards.

- Phytosanitary Certificate: Certifies the rice is free from pests and meets the quarantine standards of importing countries.

- Certificate of Origin: Establishes geographical authenticity — essential for basmati shipments.

- Inspection Certificate: Issued by the Export Inspection Council (EIC) or authorized agencies such as SGS or Bureau Veritas for quality assurance.

Recent DGFT guidelines also relaxed inspection requirements for shipments to certain European destinations, simplifying trade for exporters and reducing turnaround time.

4. Buyer Markets and Trade Shifts

It won’t be a hyperbole to say that Indian basmati rice exports exist, because the middle east exists. The Middle East remains India’s largest basmati rice buyer bloc, accounting for over 60% of total shipments, led by Saudi Arabia, Iran, and the UAE. However, exporters are also witnessing growing institutional demand from African markets (Nigeria, Senegal, Ghana) and Europe, particularly the UK, Germany, and Netherlands, where the Indian diaspora drives consumption. And it's none other than Saudi Arabia that remained as the largest importer of Indian basmati rice, purchasing around 11.73 LMT, followed by Iraq with 9.05 LMT and Iran with 8.55 LMT.

Exporters are also adapting to evolving demand for eco-friendly packaging and traceable sourcing, reflecting Europe’s shift towards sustainable agri imports.

5. Pricing Strategy: Where B2B Negotiation Matters

Bulk basmati rice buyers prioritize landed cost predictability, factoring in freight, handling, and port charges. Competitive exporters usually offer CIF-based quotations to simplify buyer decision-making.

Price parity, however, is not the only factor. Buyers want dependability, quick documentation, standardized grain size, and stable moisture levels. Exporters who maintain transparent trade practices, timely communication, and visible quality consistency tend to receive repeat orders and long-term contracts.

Conclusion

India’s basmati rice export ecosystem is no longer driven by quantity but by operational discipline, supply chain agility, and trust. In a market where every exporter holds the same certifications, it’s the experience, transparency, and professionalism that set a seller apart.

With more than USD 6 billion in annual exports and increasing penetration into non-traditional markets, basmati rice remains India’s strongest agricultural export pillar — and the exporters who blend compliance with commercial acumen are the ones writing the next chapter of India’s global grain story.

.webp)

.webp)