How Bulk Grain Buyers Reduce Risk in International Trade

Key Highlights

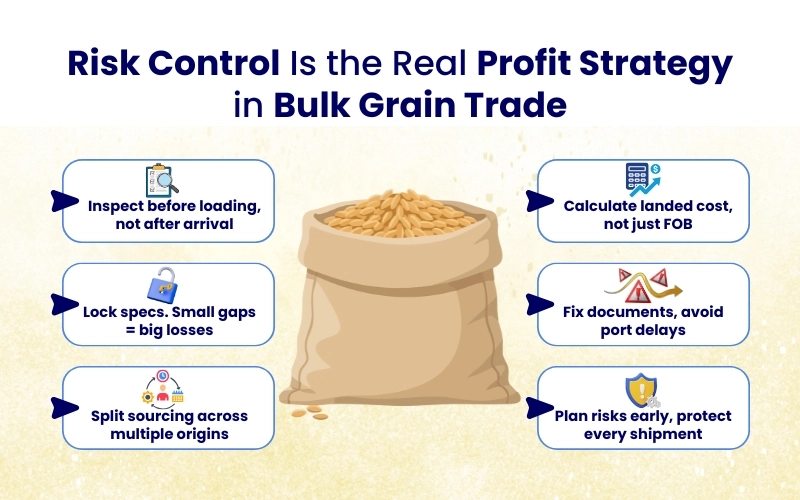

- In grain trade, price alone never tells the full story. Buyers evaluate the landed cost alongside quality risk, because a discounted cargo that fails specs often ends up costing more in claims and delays.

- Sampling happens early and from different stacks — separately, sometimes randomly — because one good-looking bag never tells the full story.

- Moisture, protein, and cleanliness quietly decide profitability. Small variations can change milling yield more than price ever will.

- Smart importers rarely depend on a single origin. If one crop fails or policy changes overnight, they already have a second supplier lined up.

- Containers, paperwork, and timing matter just as much as grain quality. A wet box or delayed clearance can do more damage than market volatility.

- The correct HS codes form the heart of trade and keep cargo moving - 1001 for wheat, 1005 for maize, 1006 for rice, 1003 for barley, 1004 for oats. Wrong codes slow everything down.

Introduction

In bulk grain trade, profit is rarely made on brilliance. It's made on discipline.

A few dollars saved on freight. A slightly tighter moisture range. One less rejected container. These small decisions compound quietly over hundreds of shipments. And over time, they separate the bulk grain buyers who survive cycles from those who blame the market.

Because grain trading, at its core, isn't about chasing upside. It's about managing what can go wrong.

International bulk grain importers understand this early. Weather shifts, port delays, policy changes, quality disputes — none of these are rare events. They are routine. The real skill lies not in avoiding risk altogether, but in reducing its impact before the vessel even sails.

That mindset shapes how serious buyers operate and buy grain in bulk.

Risk Starts at Origin, Not at Destination

Experienced international grain buyers don't wait for cargo to arrive before assessing quality. It's already too late by then.

Risk management begins right from the warehouse and sometimes even at the farm gate. Teams diligently focus on sampling, testing, and verifying that the grain behaves the way the specification says it should, even before the contracts are finalized.

It's less about trust and more about predictability.

- Pre-shipment sampling across multiple stacks, not a single lot

- Moisture, protein, and foreign matter tested separately

- Random checks to avoid “top-layer bias”

- Third-party inspection agencies involved before loading

Once grain is stuffed into containers, negotiation power drops sharply. So smart buyers settle arguments early, not at discharge.

Specifications Are Written Like Contracts, Not Suggestions

In retail food, quality can be subjective. In bulk grain trade, it can't.

A half-percent change in moisture or protein might look trivial on paper. In milling or processing, it isn’t. It affects yield, shelf life, and downstream costs. Multiply that across thousands of tonnes and margins begin to erode.

That's why b2b buyers who buy grain in bulk treat specifications like financial clauses.

- Clear limits on moisture and test weight

- Defined tolerance for broken or damaged kernels

- Penalties or discounts tied to deviations

- Lab methods standardized across both parties

The goal isn't perfection. It's consistent. Processors would rather receive the same average grain every month than an occasional “excellent” lot followed by a problematic one.

Predictability keeps factories running. Surprises shut them down.

Diversification Is Insurance, Not Strategy

Relying on one origin may look efficient in good years. It becomes expensive in bad ones.

A weak monsoon, a port strike, or a sudden export restriction can disrupt supply overnight. Buyers who depend on a single country find themselves scrambling. Those with alternatives simply switch contracts.

Diversification isn't about preference. It's about optionality.

- Multiple approved origins for the same grade

- Parallel supplier relationships maintained year-round

- Split contracts across regions

- Freight routes diversified to reduce congestion risk

It costs a little more to manage several suppliers. It costs far more to have none when one fails.

In grain trade, redundancy is often cheaper than urgency.

Freight and Timing Matter as Much as Price

Many new bulk grain importers focus only on FOB price. Seasoned ones look at landed cost.

A cheaper cargo that arrives late or deteriorates in transit is no bargain. Grain is sensitive — moisture, temperature, and time all leave their mark. Containers sitting at sea or stuck at ports quietly lose quality.

So logistics become part of risk control.

- Shipment schedules aligned with production cycles

- Transit time considered during bulk grain sourcing

- Containers checked for dryness and ventilation

- Desiccants or liners used for longer routes

It's not glamorous work. But it prevents claims, disputes, and rejected cargo — the kinds of losses that wipe out margins faster than price fluctuations ever could.

Documentation Reduces Financial Risk

Trade doesn't only fail because of grain. Sometimes it fails because of paperwork.

Missing phytosanitary certificates, incorrect HS codes, or incomplete inspection reports can hold cargo at ports for days. Storage fees mount. Buyers lose selling windows. Quality slowly declines while documents are sorted.

So documentation becomes operational risk management.

- Pre-cleared certificates before shipment

- Accurate HS codes for faster customs processing

- Insurance coverage aligned with cargo value

- Payment terms tied to verified inspection reports

Smooth paperwork doesn't generate profit. But bad paperwork certainly creates losses.

Experienced buyers sourcing grain in bulk know the difference.

Market Intelligence Is Quiet Protection

The best risk mitigation tool isn't physical. It's informational.

Watching crop reports, export policies, and currency movements helps buyers act early rather than react late. Grain markets move on fundamentals — harvest estimates, stock levels, government interventions. Those signals are visible if you pay attention.

Waiting for prices to move before responding usually means paying more.

- Monitoring crop conditions in key producing countries

- Tracking policy shifts and export restrictions

- Following stock-to-use ratios and trade flows

- Locking contracts before peak volatility

In this business, foresight often beats negotiation skill.

Consistency Beats Opportunism

Interestingly, the most successful bulk grain buyers aren't always chasing the lowest spot price. They focus on long-term stability.

Repeat suppliers. Known quality. Predictable logistics.

That approach may not win every tender, but it reduces friction — fewer disputes, fewer surprises, fewer emergency purchases at inflated rates.

Over time, those savings add up.

- Long-term contracts smooth price cycles

- Trusted suppliers reduce inspection risk

- Stable quality lowers processing losses

- Fewer disputes mean faster turnover

The math is simple: fewer shocks equal steadier margins.

The Quiet Discipline Behind Every Shipment

Bulk grain trade rarely rewards bold moves. It rewards careful ones.

Sampling separately. Checking containers. Splitting origins. Reviewing paperwork. Watching crop reports. None of it feels dramatic. Yet these small habits quietly protect millions of dollars in cargo every year.

Because once a vessel leaves port, control fades.

At that point, preparation is the only safety net you have.

And in international grain trade, the bulk grain buyers who plan for problems rarely have to deal with them.

.webp)