UltraTech Cement Bulk Purchase: How to Get the Best OPC 43 and PPC Rates

Key Highlights:

- UltraTech leads India's cement market with a 28.5% share, crucial for large-scale infrastructure and institutional buyers aiming for cost-efficient procurement.

- OPC 43 is ideal for high-strength structures, while PPC suits mass concreting and masonry, with UltraTech's quality meeting IS standards for both.

- Non-trade cement (bulk direct purchase) offers better rates for institutional buyers compared to retail channels, aiding in cost control.

- Bulk rates depend on plant coordination and reputable third-party agents, helping buyers negotiate better prices for UltraTech OPC 43 and PPC cement.

- Staying updated on regional prices, freight, and input costs is vital for institutional buyers to secure the best UltraTech cement rates for large projects.

Introduction:

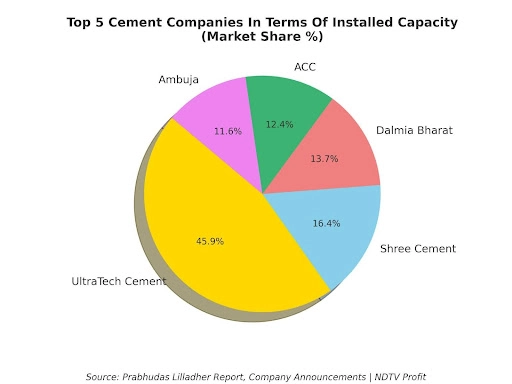

India's construction sector remains one of the strongest pillars of the national economy, driving demand for core commodities like cement year after year. Within this landscape, UltraTech Cement holds a commanding position with an installed capacity of 149.2 MTPA, translating to a substantial 28.5% market share — far ahead of peers like Shree Cement, Dalmia Bharat, ACC, and Ambuja. For infrastructure developers, institutional buyers, and large-scale contractors, managing the procurement of bulk cement at competitive rates is non-negotiable for cost control and project viability and the reason they seek UltraTech Cement bulk purchase price.

OPC 43 and PPC Cement Rates and Fluctuations

When it comes to Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC), buyers in North India — especially Delhi-NCR — closely monitor daily price fluctuations. Currently, the UltraTech OPC 43 cement price in Delhi-NCR typically ranges between ₹300 and ₹350 per bag, while the UltraTech PPC cement price stays slightly lower, often in the ₹300 to ₹330 range. However, these price points remain subject to routine market adjustments influenced by input costs, seasonal demand, and regional dispatch constraints. Kindly consider the date on which the blog has been published and get in touch with the authentic third-party agents for latest prices.

Understanding OPC and PPC: Application-Based Selection

Both OPC 43 and PPC cement grades have clear-cut applications in India's construction spectrum. OPC 43 is a preferred choice for structural concrete works requiring higher early strength, like high-rise residential towers, flyovers, and heavy foundation projects. On the other hand, PPC, due to its superior workability, durability, and resistance to chemical attacks, is widely adopted in mass concreting jobs, plastering, and masonry work, making it a staple for large housing developments and irrigation structures.

Notably, UltraTech's production of both OPC and PPC cements meets stringent IS specifications, making it the benchmark for quality among bulk buyers. Contractors and project owners often maintain a split procurement strategy to align cement grades with engineering requirements while keeping the landed cost optimized.

What Is Non-Trade Cement?

For corporate buyers, understanding the distinction between 'trade' and 'non-trade' cement is critical for procurement strategy. Trade cement is routed through retail dealer channels and hardware outlets — suitable for individual buyers and small contractors but carrying higher retail premiums. Non-trade cement, meanwhile, is supplied directly by the manufacturer or through authorized bulk distributors for institutional use. Rates for non-trade UltraTech OPC 43 and PPC cement are negotiated based on bulk volume, contract tenure, and logistical arrangements, often resulting in better price realization for large buyers.

How to Access Best Rates: Plants, Dealers, or Agents?

Large-volume buyers typically face two procurement pathways. First, the conventional retail channel — visiting local dealer shops and godowns. However, these rates reflect retail mark-ups and may not align with the pricing expectations of institutional buyers aiming for competitive cost per bag.

For serious bulk procurement, tapping into non-trade channels is essential. This can be executed by coordinating directly with UltraTech’s regional plants or engaging reputable third-party procurement agents who specialize in bridging buyers with manufacturers. These agents streamline paperwork, credit terms, dispatch schedules, and freight cost management. Importantly, working through these channels opens avenues for negotiating UltraTech OPC 43 cement wholesale price and bulk PPC cement price with better commercial terms than what's available on the open market.

Cement Market Snapshot: Installed Capacity and Market Share

UltraTech Cement's dominance is underscored by installed capacity figures that dwarf other players — Shree Cement follows with 53.4 MTPA and a 10.2% share, Dalmia Bharat with 44.6 MTPA, ACC at 40.4 MTPA, and Ambuja at 37.6 MTPA. Together, these top five firms control over 62% of India’s cement manufacturing capacity. For institutional buyers, this means procurement discussions are primarily with these major brands, with UltraTech as the prime supplier for flagship projects across highways, metro corridors, airports, and smart city developments.

Price Points and Cost Dynamics

Price realization for cement grades like OPC 53, OPC 43, and PPC remains sensitive to input factors — coal linkage, fuel cost, clinker capacity, and dispatch logistics. For bulk buyers, staying updated on the OPC 53 cement price, regional dispatch rates, and local dealer premiums is critical for planning large lifts. Moreover, when buyers look to buy PPC cement in bulk or negotiate OPC PPC cement distributors' rates, leveraging real-time market data provides a strategic edge.

Role of PPC Cement Suppliers and Distributors

An efficient network of PPC cement suppliers and OPC PPC cement distributors forms the backbone of the supply chain for bulk institutional procurement. Large contractors typically maintain standing arrangements with multiple distributors to mitigate supply risk during peak construction months. For developers operating in NCR and Northern India, aligning with trusted supply partners ensures consistency in site deliveries and cost predictability.

Final Considerations for Institutional Buyers

UltraTech Cement bulk purchase price negotiations should factor in freight equalization, local levies, unloading points, and payment terms. Direct procurement from plants or vetted non-trade agents generally yields better rates than retail dealers. As input costs and demand cycles shift, institutional buyers must stay agile, monitoring UltraTech OPC 43 cement price movements alongside bulk PPC cement price trends to maintain optimal landed costs.

Conclusion:

For India's infrastructure players, cement procurement is not a retail purchase — it's a critical cost head with long-term impact on project viability. Understanding the nuances of non-trade channels, grade-specific applications, and current regional rates is vital. When aligned with trusted suppliers and transparent negotiation, securing the best UltraTech OPC 43 and PPC cement prices remains achievable and integral to project cost efficiency.

.webp)

.webp)